Global Electromagnetic Weapons Market Size, Share, and COVID-19 Impact Analysis, By Product (Lethal Weapons, Non-Lethal Weapons), By platform (Land, Airborne, Naval), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Electromagnetic Weapons Market Insights Forecasts to 2033

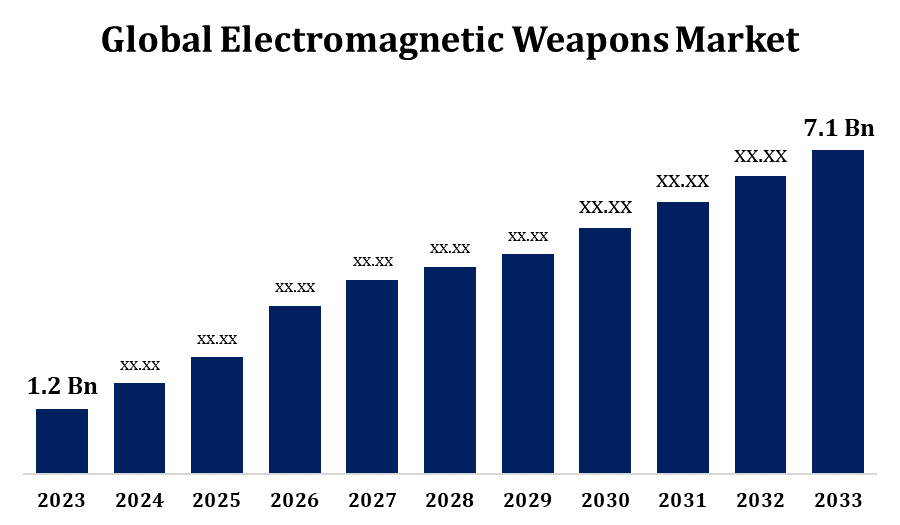

- The Electromagnetic Weapons Market Size was valued at USD 1.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 19.46% from 2023 to 2033.

- The Global Electromagnetic Weapons Market Size is expected to reach USD 7.1 Billion By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Electromagnetic Weapons Market Size is Expected to reach USD 7.1 Billion By 2033, at a CAGR of 19.46% during the forecast period 2023 to 2033.

The electromagnetic weapons market is experiencing significant growth, driven by advancements in military technology, increasing defense budgets, and rising geopolitical tensions. These weapons use electromagnetic energy to disable or destroy enemy targets, including electronic systems, drones, and communication networks. The demand for directed energy weapons (DEWs), such as high-power microwaves (HPM) and electromagnetic pulse (EMP) weapons, is rising due to their precision, cost-effectiveness, and ability to counter modern threats. North America leads the market, with the U.S. investing heavily in research and development. Key players include Lockheed Martin, Raytheon Technologies, and BAE Systems. Challenges include regulatory concerns and ethical considerations, but ongoing innovation in power sources and miniaturization is expected to drive future market expansion across military, law enforcement, and homeland security applications.

Electromagnetic Weapons Market Value Chain Analysis

The electromagnetic weapons market value chain consists of several key stages, from research and development (R&D) to end-user deployment. It begins with raw material suppliers providing components like semiconductors, high-power energy sources, and electromagnetic coils. Manufacturers and defense contractors, including companies like Lockheed Martin and Raytheon Technologies, integrate these components into directed energy weapons (DEWs) and electromagnetic pulse (EMP) systems. System integrators ensure compatibility with existing defense infrastructure, followed by rigorous testing and validation by military agencies and regulatory bodies. Distribution channels include direct government contracts, defense procurement agencies, and private security firms. End users include military forces, law enforcement, and homeland security agencies. Continuous R&D, advancements in power efficiency, and strategic collaborations drive innovation and market growth in this sector.

Electromagnetic Weapons Market Opportunity Analysis

The electromagnetic weapons market presents significant growth opportunities driven by rising defense spending, technological advancements, and evolving warfare strategies. The increasing adoption of directed energy weapons (DEWs) for counter-drone and missile defense applications creates demand for high-power microwave (HPM) and electromagnetic pulse (EMP) weapons. Emerging economies, particularly in Asia-Pacific and the Middle East, are investing in modern defense systems, expanding market potential. The integration of artificial intelligence (AI) and autonomous targeting further enhances weapon efficiency, attracting government and private sector investments. Additionally, the rising need for non-lethal crowd control and cybersecurity applications offers new commercial avenues. However, challenges such as regulatory constraints and ethical concerns remain.

Global Electromagnetic Weapons Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 19.46% |

| 2033 Value Projection: | USD 7.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 146 |

| Segments covered: | By Product, By platform, By Region |

| Companies covered:: | Thales Group, Northrop Grumman Corporation, Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE Systems, L3Harris Technologies, Inc., Rheinmetall AG, The Boeing Company, Honeywell International Inc, Rafael Advanced Defense Systems Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Electromagnetic Weapons Market Dynamics

Advancements in electromagnetic weapons technology

The electromagnetic weapons market is witnessing rapid technological advancements, enhancing weapon efficiency, range, and precision. Innovations in high-power microwave (HPM) and electromagnetic pulse (EMP) weapons are improving their ability to disable enemy electronics and communication systems. Breakthroughs in power generation, including compact energy storage solutions and directed energy systems, are making these weapons more portable and deployable. Artificial intelligence (AI) and automation are being integrated for real-time threat detection and targeting, increasing operational effectiveness. Additionally, advancements in solid-state electronics and pulse-forming networks are boosting energy efficiency and reducing system size. Countries like the U.S., China, and Russia are heavily investing in research and development to gain strategic advantages. As technology evolves, electromagnetic weapons are expected to play a critical role in modern defense and security strategies.

Restraints & Challenges

One major hurdle is the high cost of research, development, and deployment, limiting adoption to nations with substantial defense budgets. Technical challenges include power efficiency, miniaturization, and ensuring effectiveness in diverse combat scenarios. Regulatory and legal constraints, including international arms control agreements, restrict the use and proliferation of such weapons. Ethical concerns regarding their potential impact on civilian infrastructure and electronic systems further complicate market expansion. Additionally, shielding and countermeasures against electromagnetic attacks are being developed, reducing weapon effectiveness over time. The integration of electromagnetic weapons into existing defense systems also requires extensive testing and compatibility assessments.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Electromagnetic Weapons Market from 2023 to 2033. The United States leads in the development and deployment of directed energy weapons (DEWs), high-power microwave (HPM) systems, and electromagnetic pulse (EMP) technologies. The Department of Defense (DoD) and agencies like DARPA are investing heavily in next-generation electromagnetic weapons for military applications, including missile defense, anti-drone systems, and cybersecurity. Key players such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman are at the forefront of innovation. Canada also contributes through defense collaborations and technology development. The increasing focus on modern warfare, border security, and counterterrorism is fueling regional market growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China leads in research and development, integrating electromagnetic weapons into its naval and missile defense programs. India is expanding its defense capabilities through government-backed initiatives and partnerships with global defense firms. Japan and South Korea focus on counter-drone and cybersecurity applications. Regional conflicts and the need for advanced electronic warfare solutions are accelerating market growth. India is steadily expanding its electromagnetic weapons research through organizations like the Defense Research and Development Organization (DRDO). With increasing border tensions, India is focusing on developing EMP weapons and high-power microwave (HPM) systems to enhance its defense infrastructure. Strategic partnerships with the U.S., Israel, and European defense firms are further accelerating technological advancements in this field.

Segmentation Analysis

Insights by Platform

The naval segment accounted for the largest market share over the forecast period 2023 to 2033. Navies worldwide are integrating directed energy weapons (DEWs), electromagnetic railguns, and high-power microwave (HPM) systems to enhance ship defense capabilities against threats such as drones, missiles, and swarm attacks. The U.S. Navy leads in deploying electromagnetic railguns and laser-based weapons, with China and Russia also developing similar technologies for their naval fleets. These weapons offer advantages like precision targeting, cost-effective operation, and reduced ammunition dependency. Ongoing advancements in power generation, miniaturization, and shipboard integration are fueling market expansion. However, challenges such as high energy requirements and system durability in harsh marine environments remain key hurdles to widespread adoption.

Insights by Product

The non-lethal weapons segment accounted for the largest market share over the forecast period 2023 to 2033. High-power microwave (HPM) and directed energy weapons (DEWs) are being developed to disable electronic systems, disrupt communications, and incapacitate targets without causing permanent harm. Law enforcement agencies and military forces worldwide are investing in these technologies to manage riots, protect critical infrastructure, and conduct non-lethal warfare. The U.S., China, and European nations are leading in research and deployment of electromagnetic-based non-lethal weapons. Additionally, advancements in miniaturization and energy efficiency are expanding their applications.

Recent Market Developments

- In November 2024, BAE Systems has received a follow-on contract from the U.S. Army to upgrade its Multi-Class Soft Kill System (MCSKS) countermeasures, designed to protect ground combat vehicles from guided missiles and close-range threats.

Competitive Landscape

Major players in the market

- Thales Group

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- BAE Systems

- L3Harris Technologies, Inc.

- Rheinmetall AG

- The Boeing Company

- Honeywell International Inc

- Rafael Advanced Defense Systems Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Electromagnetic Weapons Market, Product Analysis

- Lethal Weapons

- Non-Lethal Weapons

Electromagnetic Weapons Market, Platform Analysis

- Land

- Airborne

- Naval

Electromagnetic Weapons Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Electromagnetic Weapons Market?The global Electromagnetic Weapons Market is expected to grow from USD 1.2 billion in 2023 to USD 7.1 billion by 2033, at a CAGR of 19.46% during the forecast period 2023-2033.

-

2. Who are the key market players of the Electromagnetic Weapons Market?Some of the key market players of the market are the Thales Group, Northrop Grumman Corporation, Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE Systems, L3Harris Technologies, Inc., Rheinmetall AG, The Boeing Company, Honeywell International Inc, and Rafael Advanced Defense Systems Ltd.

-

3. Which segment holds the largest market share?The naval segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?