世界の自動車用燃料タンク市場の規模、シェア、COVID-19の影響分析、容量別(45リットル未満、45〜70リットル、70リットル以上)、材質別(アルミニウム、プラスチック、スチール)、車種別(乗用車、小型商用車、大型商用車)、地域別(北米、ヨーロッパ、アジア太平洋、ラテンアメリカ、中東、アフリカ)、分析と予測2023年~2033年

業界: Automotive & Transportation世界の自動車燃料タンク市場規模は2033年までに299億3000万米ドルを超えると予測

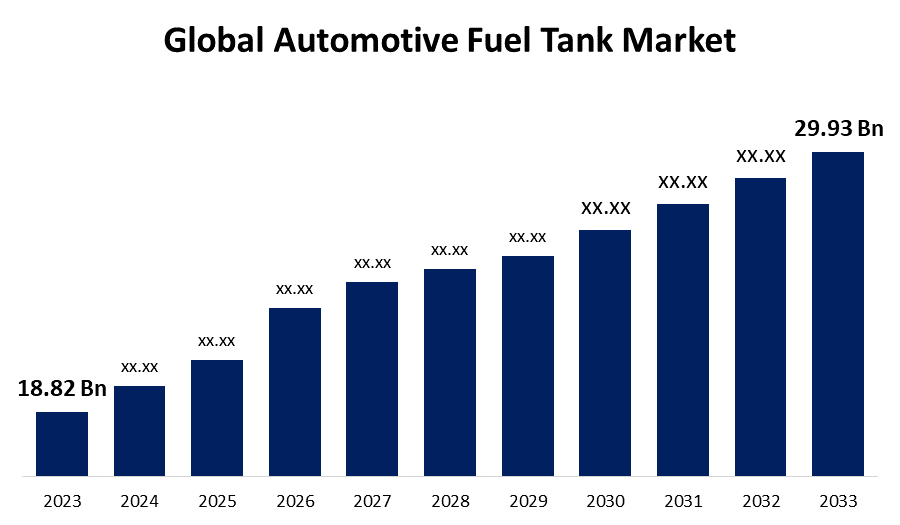

Spherical Insights & Consultingが発行した調査レポートによると、世界の自動車燃料タンク市場 規模は、予測期間中に年平均成長率(CAGR)4.75%で成長し、2023年の188.2億米ドルから2033年には299.3億米ドルに成長する見込みです。

このレポートの詳細については、こちらをご覧ください -

「世界の自動車用燃料タンク市場の規模、シェア、COVID-19の影響分析、容量別(45リットル未満、45〜70リットル、70リットル以上)、材質別(アルミニウム、プラスチック、スチール)、車種別(乗用車、小型商用車、大型商用車)、地域別(北米、ヨーロッパ、アジア太平洋、ラテンアメリカ、中東、アフリカ)、分析と予測2023〜2033年」の110の市場データ表と図表を含む200ページにわたる主要な業界の洞察を参照

The growing need for automobile gasoline tanks as global vehicle sales rise is creating a positive market picture. As a result, an increase in consumer demand for personal transportation options is driving market growth. Furthermore, individuals are looking for easy and efficient means to get from one place to another for business, pleasure, or entertainment. Aside from that, there is a growth in demand for upgraded automobile gasoline tanks. People prefer cleaner, more fuel-efficient vehicles. In addition, automotive OEMs invest a large amount of money in research to find and develop lightweight materials for manufacturing automotive components that reduce vehicle weight. Since recently, the automotive industry has shifted away from traditional metal tanks and toward plastic tanks. Plastic tanks have been the preferred option of car manufacturers due to their various inherent advantages over metal gasoline tanks, and they are gaining acceptance in the market. However, people's growing preference for zero-emission automobiles, combined with stringent government mandates to minimize fuel emissions and promote environmentally friendly vehicles, may limit market growth over the forecast period.

世界の自動車燃料タンク市場 レポートの対象範囲

| レポートの対象範囲 | Details |

|---|---|

| 基準年: | 2023 |

| の市場規模 2023: | 188.2億米ドル |

| 予測期間: | 2023 - 2033 |

| 2033 価値の投影: | 29.93米ドル |

| 過去のデータ: | 2019-2022 |

| ページ数: | 240 |

| 表、チャート、図: | 110 |

| 対象となるセグメント: | 容量別、材質別、車種別、地域別 |

| 対象企業:: | Magna International Inc., YAPP Automotive Parts Co. Ltd., SMA Serbatoi S.P.A., Yachiyo Industry Co., Continental AG, Kautex Textron GmbH & Co. KG, TI Automotive Inc., The Plastic Omnium Group, Martinrea International Inc., Unipres Corporation, and Others |

| 落とし穴と課題: | COVID-19の影響、課題、将来、成長、分析 |

このレポートの詳細については、こちらをご覧ください -

The less than 45 liters segment is expected to hold the largest share of the global automotive fuel tank market during the anticipation timeframe.

Based on the capacity, the global automotive fuel tank market is categorized into less than 45 liters, 45-70 liters, and above 70 liters. Among these, the less than 45 liters segment is expected to hold the largest share of the global automotive fuel tank market during the anticipation timeframe. The majority of passenger vehicles, including hatchbacks and sedans, have gasoline tank capacities of less than 45 liters. Passenger car sales and manufacturing are skyrocketing over the world due to urbanization, high population rates, improving living standards, and advances in automotive technology. The increase in disposable income is increasing people's desire to purchase a new car.

The plastic segment is expected to grow at the fastest CAGR during the anticipation timeframe.

Based on the material, the global automotive fuel tank market is categorized into aluminium, plastic, and steel. Among these, the plastic segment is expected to grow at the fastest CAGR during the anticipation timeframe. Most plastic gasoline tanks are composed of high-density polyethylene (HDPE). These tanks are lightweight and easily built to suit OEM specifications. Plastic gasoline tanks are in more demand than metal fuel tanks, resulting in increased demand for HDPE. Plastic gasoline tanks are utilized in almost every vehicle type, including passenger cars, light trucks, and big trucks.

The passenger car segment is expected to hold a significant share of the global automotive fuel tank market during the anticipation timeframe.

Based on the vehicle type, the global automotive fuel tank market is categorized into passenger car, light commercial vehicle, heavy commercial vehicle. Among these, the passenger car segment is expected to hold a significant share of the global automotive fuel tank market during the anticipation timeframe. Automobile makers prioritize the development of lightweight gasoline tank materials for passenger cars. For every 100 kilometres travelled, a reduction of up to 100 kg saves between 0.3 and 0.5 litres of gasoline. Lightweight vehicles enhance vehicle performance while reducing fuel emissions.

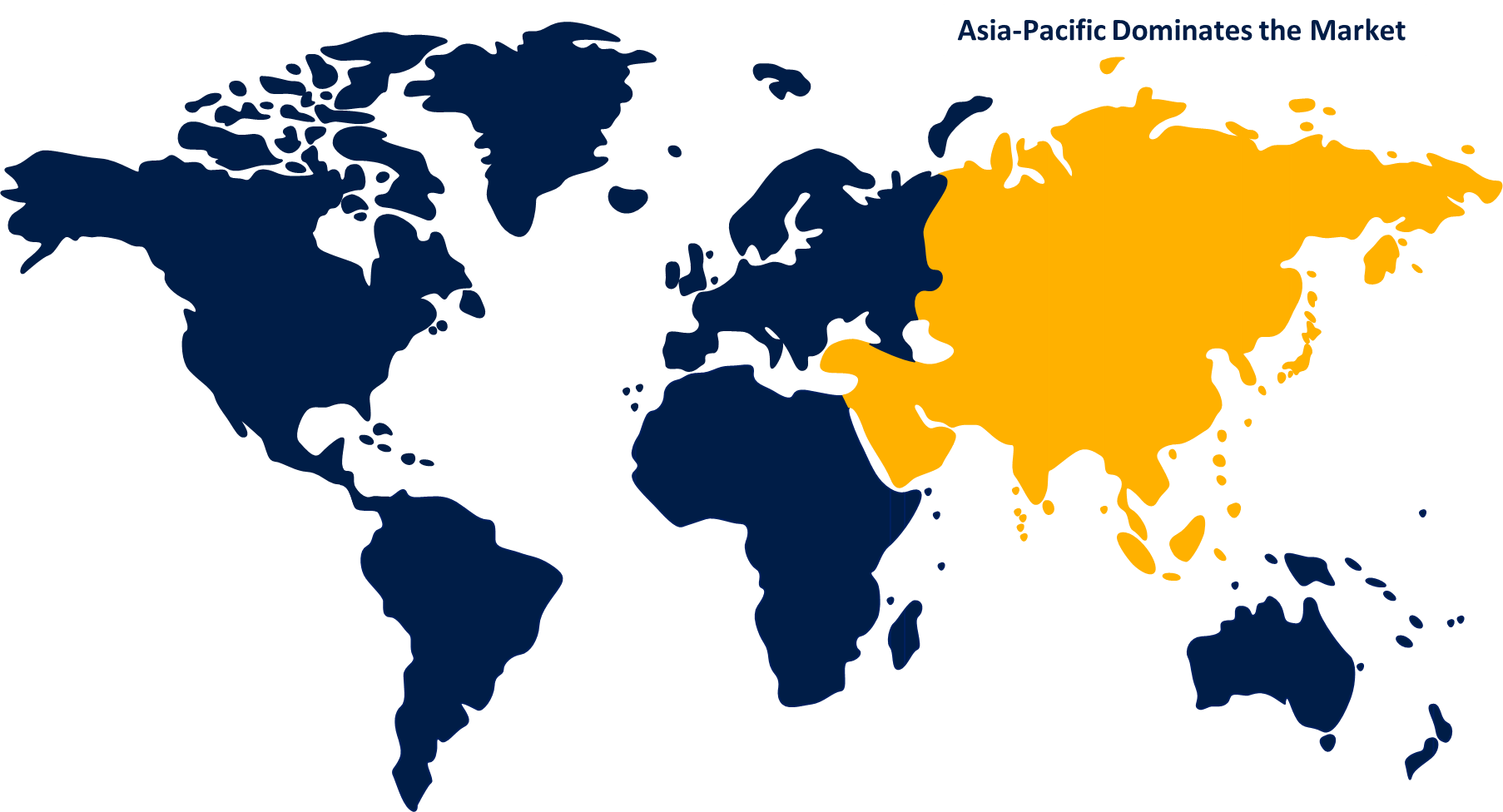

Asia Pacific is projected to hold the largest share of the global automotive fuel tank market over the anticipation timeframe.

このレポートの詳細については、こちらをご覧ください -

Asia Pacific is projected to hold the largest share of the global automotive fuel tank market over the anticipation timeframe. Growing industrialization and infrastructure development in Asia and Oceania are driving commercial vehicle growth. Furthermore, vehicle manufacturing and production are rapidly rising due to foreign direct investment in Thailand, Malaysia, and Vietnam. As vehicle production grows, so does the demand for automobile fuel tanks throughout Asia and Oceania.

North America is expected to grow at the fastest CAGR growth of the global automotive fuel tank market during the anticipation timeframe. The increased focus on creating specialised fuel storage solutions for hydrogen-powered cars. Furthermore, strict pollution regulations are fuelling industrial growth. Furthermore, increased public demand for larger cars, such as SUVs and pickup trucks, is propelling market growth.

Major vendors in the global automotive fuel tank market are Magna International Inc., YAPP Automotive Parts Co. Ltd., SMA Serbatoi S.P.A., Yachiyo Industry Co., Continental AG, Kautex Textron GmbH & Co. KG, TI Automotive Inc., The Plastic Omnium Group, Martinrea International Inc., Unipres Corporation, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Toyota Motor Corporation cooperated with UBE Corporation to develop a novel polyamide 6 resin named UBE NYLON 1218IU. This innovative resin is used as a plastic liner material in the high-pressure hydrogen tank of Toyota's new Crown fuel-cell vehicle. The nylon 6 resin passes stringent requirements for preventing hydrogen leaks in the FCV's high-pressure hydrogen tank.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive fuel tank market based on the below-mentioned segments:

Global Automotive Fuel Tank Market, By Capacity

- Less Than 45 Liters

- 45-70 Liters

- Above 70 Liters

Global Automotive Fuel Tank Market, By Material

- Aluminum

- Plastic

- Steel

Global Automotive Fuel Tank Market, By Vehicle Type

- 乗用車

- 小型商用車

- 大型商用車

地域別自動車燃料タンク市場

- 北米

- 私たち

- カナダ

- メキシコ

- ヨーロッパ

- ドイツ

- イギリス

- フランス

- イタリア

- スペイン

- ロシア

- その他のヨーロッパ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋地域

- 南アメリカ

- ブラジル

- アルゼンチン

- 南米のその他の地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- 南アフリカ

- その他の中東およびアフリカ

このレポートを購入するにはサポートが必要ですか?