Global Aerospace Insurance Market Size to worth USD 1281.17 Million by 2033

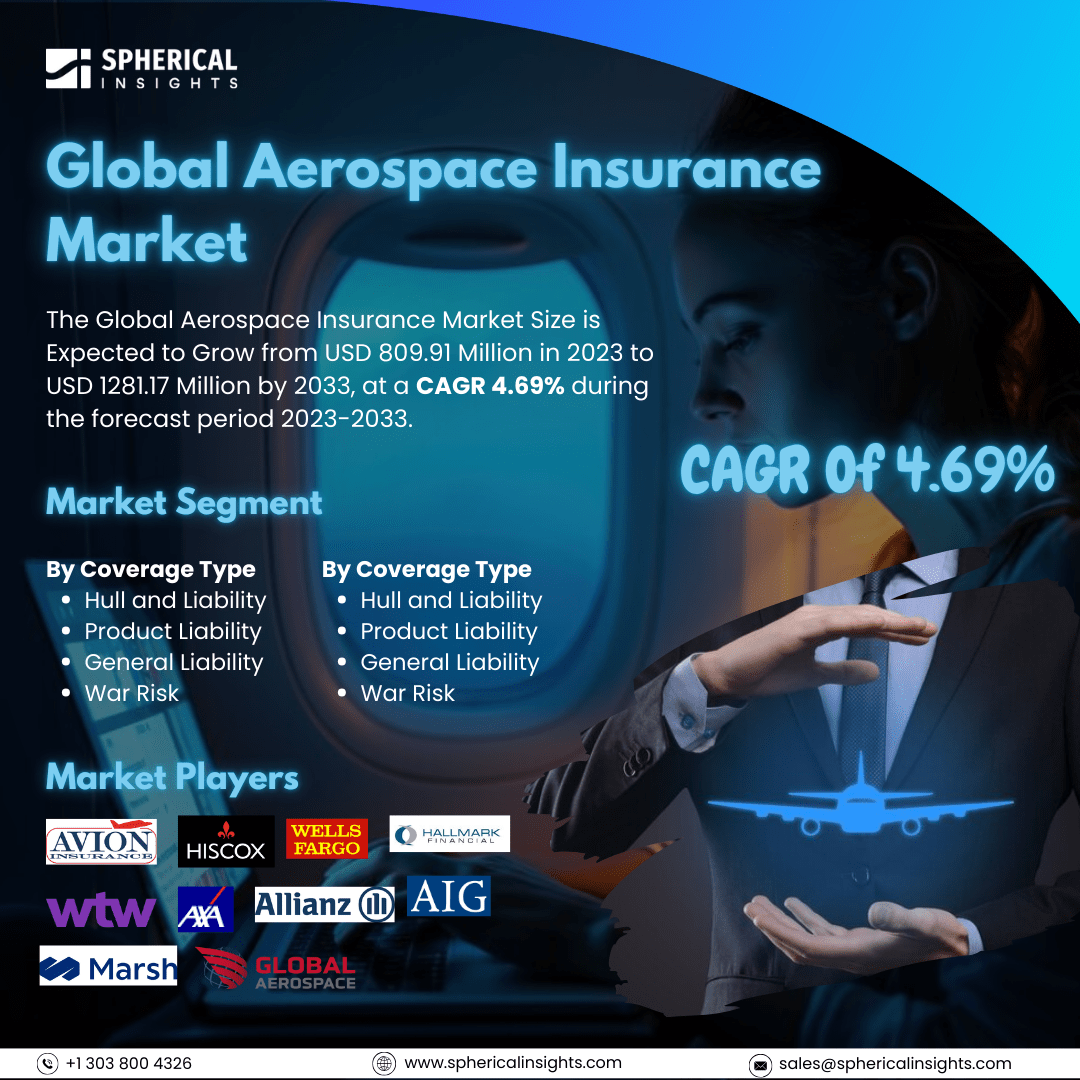

According to a research report published by Spherical Insights & Consulting, The Global Aerospace Insurance Market Size is Expected to Grow from USD 809.91 Million in 2023 to USD 1281.17 Million by 2033, at a CAGR 4.69% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Aerospace Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Hull and Liability, Product Liability, General Liability, and War Risk), By Aircraft Type (Fixed-Wing Aircraft, Rotary-Wing Aircraft, and Unmanned Aircraft Systems (UAS)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The aerospace insurance market refers to the segment of insurance that protects aircraft and other aerospace vehicles from risks associated with their operation. This includes risks such as property damage, cargo loss, and personal injury. Several key factors drive the demand in the aerospace insurance market, including the increasing size of the aircraft fleet, growing initiatives in space exploration, technological advancements in aviation, rising geopolitical tensions, inflation, and the need for effective risk management, particularly for high-value aircraft operations and complex space missions. One of the main driving factors is the continuous expansion of commercial airlines, private aviation, and cargo operations on a global scale, which leads to a higher demand for aircraft insurance to safeguard against potential accidents and damages. Additionally, increased investments in space exploration projects, including satellite launches and commercial space travel, create a need for specialized insurance coverage for risks related to space activities. New aircraft designs, advanced materials, and complex avionics systems can raise the cost of aircraft, further driving the need for comprehensive insurance policies. Unstable geopolitical situations can also heighten the risk of disruptions to flight operations, leading to potential claims and prompting insurers to adjust their pricing and coverage strategies accordingly. However, the aerospace insurance market faces several challenges. These include high claim costs due to the complexity of aircraft technology, volatile geopolitical situations that increase risk, limited availability of data for accurate risk assessment, stringent regulatory environments, and the cyclical nature of the aviation industry.

The hull and liability segment is predicted to hold the largest market share through the forecast period.

Based on the coverage type, the aerospace insurance market is classified into hull and liability, product liability, general liability, and war risk. Among these, the hull and liability segment is predicted to hold the largest market share through the forecast period. This is due to the high value of aircraft, there is a strong necessity for comprehensive coverage against various risks, which include damage or loss of the aircraft, third-party liability, and passenger liability. Additionally, the product liability segment is anticipated to experience significant growth, fueled by the rising number of product recalls and lawsuits in the aerospace industry.

The fixed-wing aircraft segment is anticipated to hold the highest market share during the projected timeframe.

Based on the aircraft type, the aerospace insurance market is divided into fixed-wing aircraft, rotary-wing aircraft, and unmanned aircraft systems (UAS). Among these, the fixed-wing aircraft segment is anticipated to hold the highest market share during the projected timeframe. The widespread application of fixed-wing aircraft in both commercial and military aviation is significant. These aircraft provide advantages such as efficiency in long-distance travel, higher payload capacities, and versatility across various operational roles, including cargo transport and passenger services. As global demand for air travel continues to rise, particularly in emerging economies, the fixed-wing segment is likely to benefit from increased investments in fleet expansion and modernization, which will further solidify its market position.

North America is estimated to hold the largest share of the aerospace insurance market over the forecast period.

North America is estimated to hold the largest share of the aerospace insurance market over the forecast period. North America's robust aerospace industry, which includes major manufacturers and operators of aircraft, drives this demand. The region enjoys significant defense spending and a well-established aviation infrastructure, contributing to a high need for comprehensive insurance coverage. Additionally, the presence of leading insurance providers and the increasing complexity of risks associated with aerospace operations enhance North America's dominance in this sector.

Europe is expected to grow the fastest during the forecast period. Growth can be attributed to several factors, including an expanding aviation sector and increasing regulatory requirements for insurance coverage. The region's commitment to improving safety standards and technological advancements in aircraft design and operations is encouraging airlines and operators to seek more comprehensive insurance solutions. Moreover, the emergence of innovative insurance products tailored to address new risks, such as cyber threats and environmental liabilities, positions Europe as a key player poised for rapid development in this market.

Company Profiling

Major key players in the aerospace insurance market include Avion Insurance, Hiscox London Market, Wells Fargo, Hallmark Financial Services Inc., Willis Towers Watson, AXA, Allianz SE, American International Group, Marsh Inc., Global Aerospace, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Worldlink Specialty, LLC, a provider of specialized insurance products for the aviation and aerospace industry, launched a new digital portal that offers easy access to its exclusive range of aviation insurance solutions. Brokers and their aviation clients can now enjoy a streamlined process for obtaining coverage, receiving quotes, and managing payment options with just a few clicks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the aerospace insurance market based on the below-mentioned segments:

Global Aerospace Insurance Market, By Coverage Type

- Hull and Liability

- Product Liability

- General Liability

- War Risk

Global Aerospace Insurance Market, By Aircraft Type

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aircraft Systems (UAS)

Global Aerospace Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa