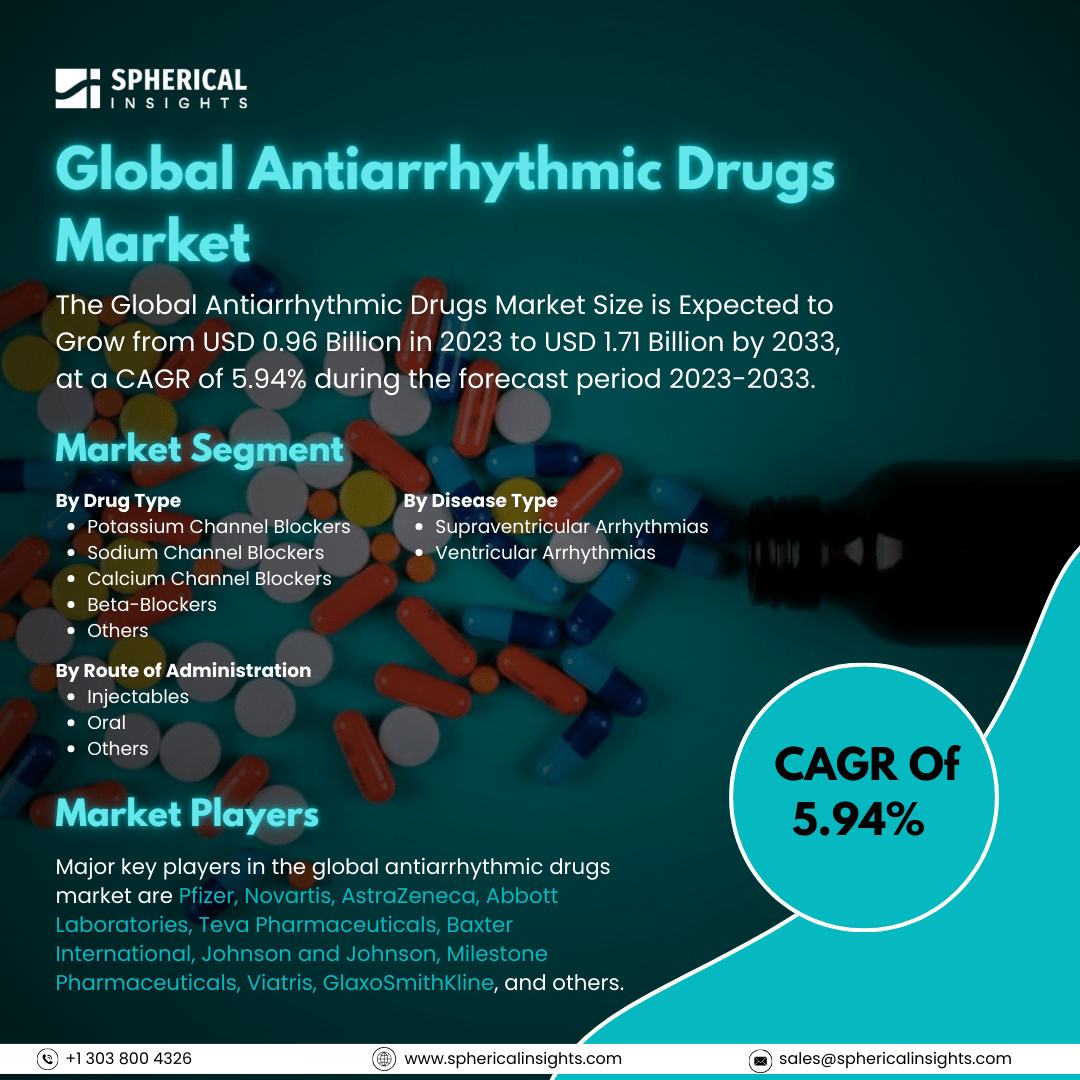

Global Antiarrhythmic Drugs Market Size to worth USD 1.71 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Antiarrhythmic Drugs Market Size is Expected to Grow from USD 0.96 Billion in 2023 to USD 1.71 Billion by 2033, at a CAGR of 5.94% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Antiarrhythmic Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Potassium Channel Blockers, Sodium Channel Blockers, Calcium Channel Blockers, Beta-Blockers, and Others), By Disease Type (Supraventricular Arrhythmias, Ventricular Arrhythmias, and Others), By Route of Administration (Injectable, Oral, and Others), By Distribution Channel (E-Commerce, Hospital Pharmacies, Retail Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The antiarrhythmic drugs market is the industry that develops, produces, and sells medications to treat irregular heart rhythms, including oral and intravenous drugs, for various applications including hospitals and clinics. Antiarrhythmic agents like digoxin, quinidine, and procainamide are safe and effective in treating symptomatic patients with life-threatening arrhythmias during pregnancy as first-line therapy. The market growth is fueled by factors such as the increasing prevalence of cardiovascular diseases, drug development innovations, and supportive regulatory frameworks. The market for antiarrhythmic drugs is expanding owing to developments in computational biology, personalized medicine, and drug discovery. The FDA expedites approvals, and precision medicine has emerged as more significant. Wearable technology and other digital health innovations give medical practitioners access to real-time data, which improves therapeutic strategies and patient outcomes. Various regulatory authorities' initiatives drive the demand for antiarrhythmic drugs. For instance, CDER established the Interdisciplinary Review Team (IRT) to provide expert review advice to sponsors and review divisions within the FDA on the design and interpretation of QT studies and investigate the potential for drugs to cause torsade de points using an integrated approach of non-clinical assays as described by the Comprehensive In-Vitro Proarrhythmic Assay (CiPA) initiative, and clinical ECG data. However, they may additionally cause adverse reactions such as immune-mediated responses and cardiovascular toxicity which may impede the market growth.

The beta blockers segment dominated the market with 31.05% of the share in 2023 and is predicted to grow at a significant CAGR during the projected timeframe.

Based on the drug type, the global antiarrhythmic drugs market is categorized as potassium channel blockers, sodium channel blockers, calcium channel blockers, beta-blockers, and others. Among these, the beta blockers segment dominated the market with 31.05% of the share in 2023 and is predicted to grow at a significant CAGR during the projected timeframe. The rise in hypertension, arrhythmias, and other cardiovascular diseases is driving demand for beta blockers for long-term management. These drugs are crucial in treating irregular heart rhythms, high blood pressure, and angina. Improved diagnostic techniques and increased heart health awareness contribute to early detection and intervention, sustaining the demand for beta blockers in the future.

The ventricular arrhythmias segment held the largest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the disease type, the global antiarrhythmic drugs market is categorized as supraventricular arrhythmias, ventricular arrhythmias, and others. Among these, the ventricular arrhythmias segment held the largest share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The segmental growth is attributed to the increasing prevalence of cardiovascular diseases, including ventricular arrhythmias, which is a global health concern, increasing demand for antiarrhythmic drugs, advancements in drug formulation and delivery systems, along new-generation drugs.

The oral segment accounted for the largest market share of 68.89% in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

Based on the route of administration, the global antiarrhythmic drugs market is categorized as injectable, oral, and others. Among these, the oral segment accounted for the largest market share of 68.89% in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. This is attributed to their enhanced bioavailability and fewer side effects. Advancements in drug formulations provide consistent blood levels and better patient outcomes. The shift towards outpatient care supports oral medication use for chronic conditions.

The hospital pharmacies segment held the largest market share of 62.33% in 2023 and is predicted to grow at a remarkable CAGR during the projected timeframe.

Based on the distribution channel, the global antiarrhythmic drugs market is categorized as e-commerce, hospital pharmacies, retail pharmacies, and others. Among these, the hospital pharmacies segment held the largest market share of 62.33% in 2023 and is predicted to grow at a remarkable CAGR during the projected timeframe. The market growth is attributed to the rise in cardiovascular patients hospitalized for conditions like atrial fibrillation and ventricular arrhythmias, increasing demand for antiarrhythmic drugs, modern cardiac care protocols, and advanced technologies.

North America is estimated to hold the largest share of the global antiarrhythmic drugs market over the predicted period.

North America is estimated to hold the largest share of the global antiarrhythmic drugs market over the predicted period. In North America, the antiarrhythmic drugs market is fueled by high cardiovascular disease prevalence and regulatory support from agencies like the FDA. The FDA has accelerated drug approvals, boosting market growth. The Affordable Care Act has improved healthcare access, increasing medication adherence and market growth.

Asia Pacific is predicted to hold the fastest-growing region of the global antiarrhythmic drugs market throughout the projection period. The Asia Pacific antiarrhythmic drug market is expanding due to rising cardiovascular disease incidence, healthcare expenditure, and middle-class growth, facilitated by regulatory modernized and public health initiatives. India's antiarrhythmic drug market is experiencing rapid growth owing to rising cardiovascular disease prevalence, government initiatives, and digital health technologies improving access, patient management, and treatment adherence.

Company Profiling

Major key players in the global antiarrhythmic drugs market are Pfizer, Novartis, AstraZeneca, Abbott Laboratories, Teva Pharmaceuticals, Baxter International, Johnson and Johnson, Milestone Pharmaceuticals, Viatris, GlaxoSmithKline, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Amrish Deshmukh MD and et.al reported that a clinical study of Dofetilide as an antiarrhythmic drug showed therapeutic activity against ventricular tachycardia. The study protocol was approved by the Institutional Review Board of the University of Michigan and informed consent was waived.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global antiarrhythmic drugs market based on the below-mentioned segments:

Global Antiarrhythmic Drugs Market, By Drug Type

- Potassium Channel Blockers

- Sodium Channel Blockers

- Calcium Channel Blockers

- Beta-Blockers

- Others

Global Antiarrhythmic Drugs Market, By Disease Type

- Supraventricular Arrhythmias

- Ventricular Arrhythmias

Global Antiarrhythmic Drugs Market, By Route of Administration

Global Antiarrhythmic Drugs Market, By Distribution Channel

- E-Commerce

- Hospital Pharmacies

- Retail Pharmacies

- Others

Global Antiarrhythmic Drugs Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa