Global Asset Liability Management Solutions Market Size to worth USD 2.89 Billion by 2033

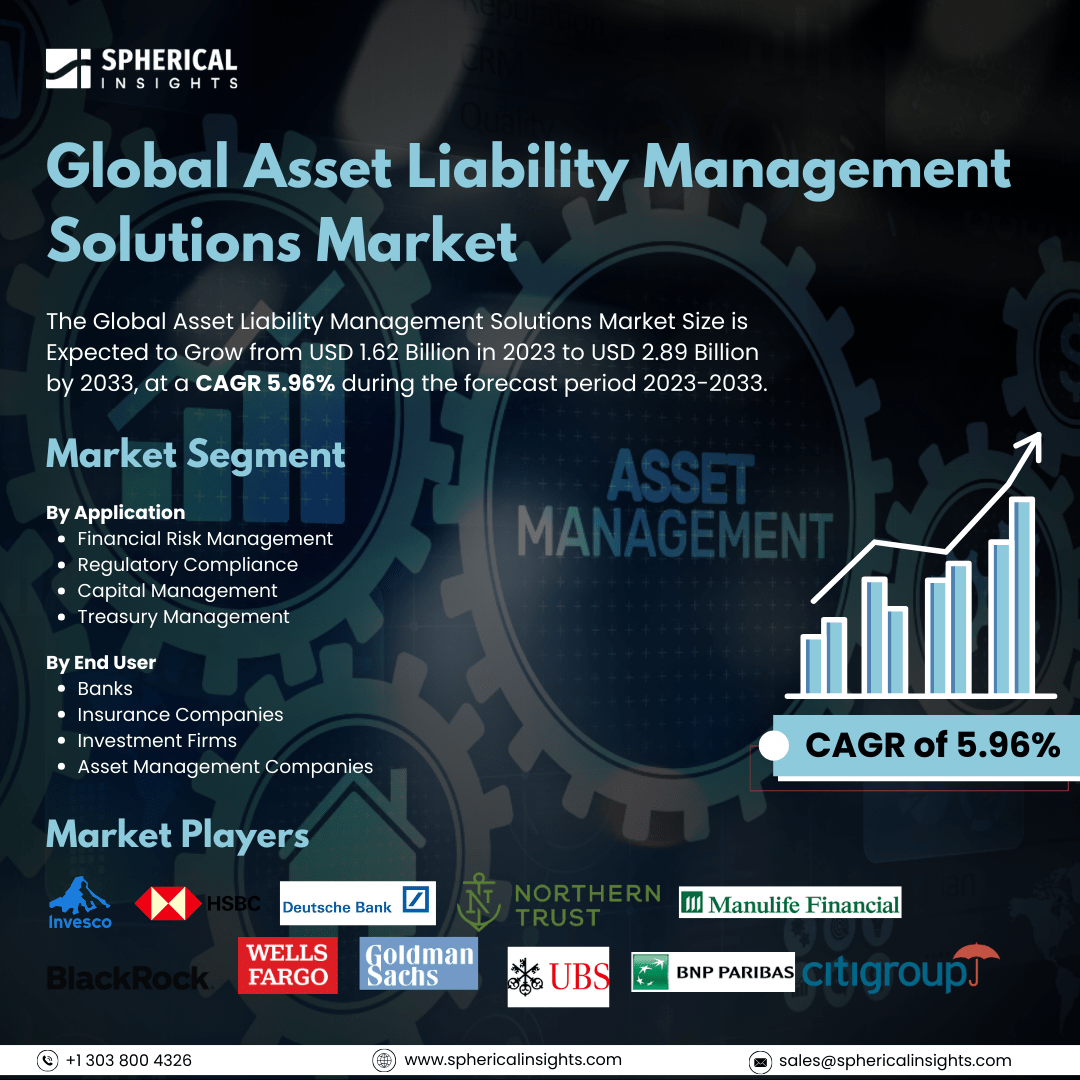

According to a research report published by Spherical Insights & Consulting, The Global Asset Liability Management Solutions Market Size is Expected to Grow from USD 1.62 Billion in 2023 to USD 2.89 Billion by 2033, at a CAGR 5.96% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Asset Liability Management Solutions Market Size, Share, and COVID-19 Impact Analysis, By Application (Financial Risk Management, Regulatory Compliance, Capital Management, and Treasury Management), By End User (Banks, Insurance Companies, Investment Firms, and Asset Management Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The asset liability management (ALM) solutions market focuses on products and services designed to assist financial institutions in managing their assets and liabilities. ALM solutions can help these institutions reduce risk, enhance profitability, and ensure liquidity. Key drivers of the ALM solutions market include increasing regulatory pressures, the need for robust risk management practices, the growing complexity of financial markets, and the demand for advanced analytics to effectively address asset-liability mismatches, particularly concerning interest rate risk and liquidity risk. These factors highlight the necessity for sophisticated ALM systems that optimize returns while minimizing potential losses. However, the ALM solutions market also faces several challenges. These include complex implementation processes, high initial costs, a shortage of skilled personnel to operate ALM systems, regulatory uncertainties, resistance to organizational change, and potential data quality issues. These challenges can particularly affect smaller institutions with limited resources and hinder the effectiveness of ALM analysis.

The financial risk management segment is predicted to hold the largest market share through the forecast period.

Based on the application, the asset liability management solutions market is classified into financial risk management, regulatory compliance, capital management, and treasury management. Among these, the financial risk management segment is predicted to hold the largest market share through the forecast period. The demand for robust risk management frameworks is increasing due to the growing complexity of financial instruments and regulatory requirements. Organizations are increasingly investing in advanced analytics and technology-driven solutions to assess and mitigate risks associated with market fluctuations, credit exposure, and operational uncertainties. As financial institutions strive to comply with stringent regulations while optimizing their risk-return profiles, the demand for sophisticated financial risk management tools is expected to rise significantly, solidifying this segment's leading position.

The banking segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end user, the asset liability management solutions market is divided into banks, insurance companies, investment firms, and asset management companies. Among these, the banks segment is anticipated to hold the highest market share during the projected timeframe. This is driven by the critical role banks play in the financial ecosystem and their need for effective asset-liability management solutions. As financial institutions face mounting pressure to enhance profitability while managing risks related to interest rate fluctuations and liquidity, banks are increasingly investing in advanced tools and technologies. Such investments not only help banks meet regulatory mandates but also enable them to optimize their balance sheets and improve overall financial performance, thereby strengthening their market dominance.

North America is estimated to hold the largest share of the asset liability management solutions market over the forecast period.

North America is estimated to hold the largest share of the asset liability management solutions market over the forecast period. The demand for comprehensive asset-liability management strategies is being fueled by the region's well-established financial infrastructure and the presence of leading financial institutions. The growing complexity of financial products and the need for strict regulatory compliance have prompted banks and other financial entities to adopt these strategies. Additionally, the region's strong emphasis on technological innovation and digital transformation in financial services is expected to drive the demand for advanced asset-liability management solutions, reinforcing its dominant market position.

Europe is expected to grow the fastest during the forecast period. Financial reforms and an increasing focus on risk management and regulatory compliance are stimulating market growth. As European financial institutions adapt to new regulations such as Basel III and Solvency II, there is a heightened demand for sophisticated asset-liability management solutions that can enhance decision-making and improve financial stability. Moreover, the rise of fintech companies and digital banking in Europe is further driving the growth of the market, as these entities seek innovative solutions to streamline operations and manage financial risks more effectively.

Company Profiling

Major key players in the asset liability management solutions market include Invesco, HSBC, Deutsche Bank, Northern Trust, Manulife Financial, BlackRock, Wells Fargo, Goldman Sachs, UBS, BNP Paribas, Citigroup, JPMorgan Chase, Charles Schwab, State Street, Morgan Stanley, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Global consulting and actuarial firm Milliman has launched Milliman Agile ALM, a software package designed to make asset/liability management (ALM) and stochastic valuation accessible for insurers, aiding them in complying with Solvency II, IFRS 17, and other regulatory requirements.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the asset liability management solutions market based on the below-mentioned segments:

Global Asset Liability Management Solutions Market, By Application

- Financial Risk Management

- Regulatory Compliance

- Capital Management

- Treasury Management

Global Asset Liability Management Solutions Market, By End User

- Banks

- Insurance Companies

- Investment Firms

- Asset Management Companies

Global Asset Liability Management Solutions Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa