Global Automotive Finance Market Size to Exceed USD 590.5 Billion by 2033

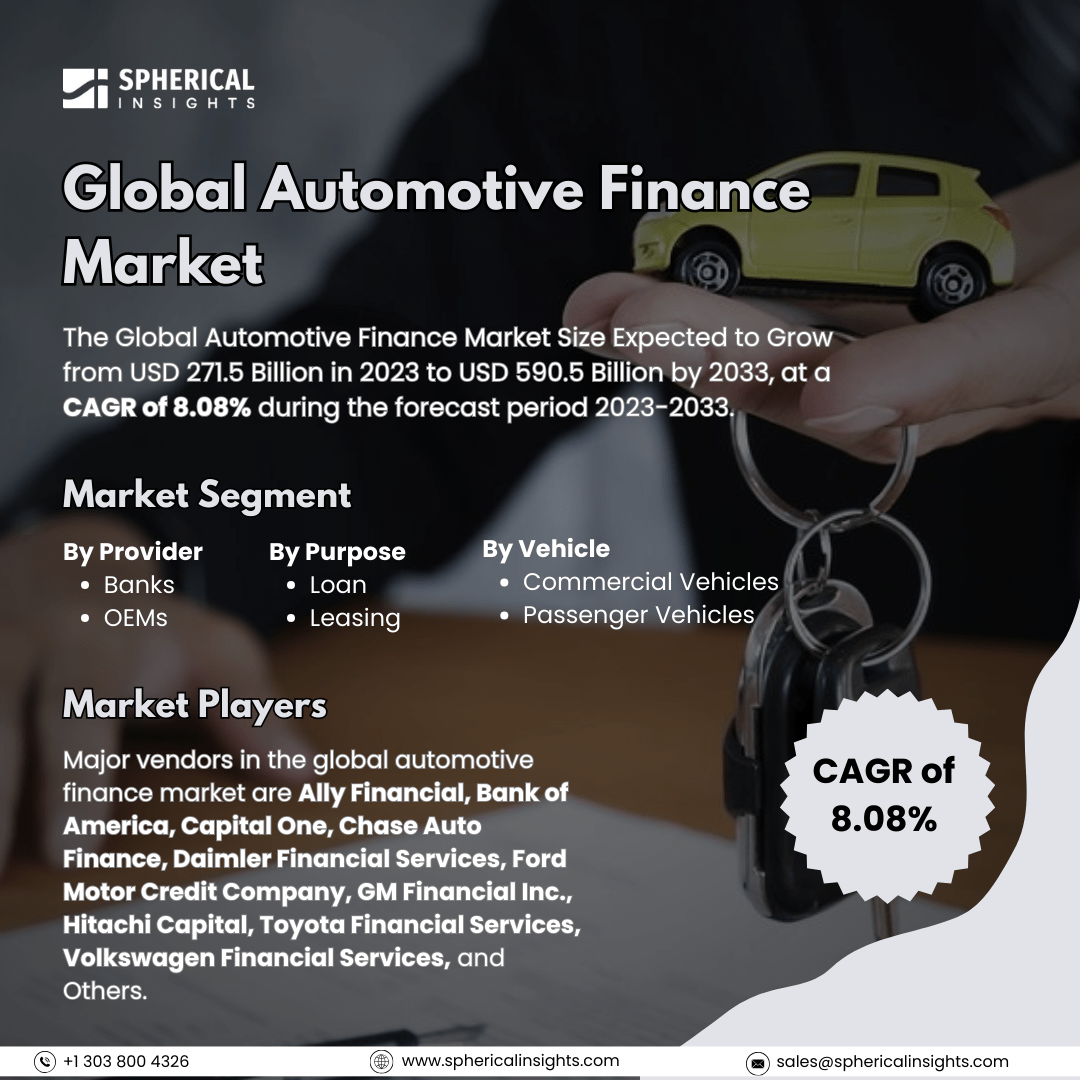

According to a research report published by Spherical Insights & Consulting, The Global Automotive Finance Market Size Expected to Grow from USD 271.5 Billion in 2023 to USD 590.5 Billion by 2033, at a CAGR of 8.08% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Automotive Finance Market Size, Share, and COVID-19 Impact Analysis, By Provider (Banks, OEMs), By Purpose (Loan, Leasing), By Vehicle (Commercial Vehicles, Passenger Vehicles), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The automotive finance market refers to the industry providing financial solutions to acquire or lease a vehicle, loans, leases, and credit options available from banks, credit unions, financial institutions, and automobile manufacturers. It assists individuals and companies in acquiring a vehicle through a structured payment plan that often involves interest rates and terms aligned with their credit profile. Moreover, rising vehicle prices, increasing demand for flexible financing options, and the growing adoption of electric vehicles are pushing the growth of the automotive finance market. Increased accessibility and efficiency are enhanced through growing digital lending platforms and AI-driven credit assessments. Government incentives for vehicle financing in general, coupled with incentives for EVs in particular, provide a further boost to the market's growth. Generally, improving economic conditions, urbanization, and rising disposable income drive demand for auto loans and leasing. Other market-expanding factors include collaboration between banks and car manufacturers as well as subscription-based models as a form of innovative financing. However, high interest rates for financing vehicles, strict criteria of loan authorization, economic uncertainties, increasing risks of defaulters, and regulatory challenges. Further, market saturation and growing competitiveness in leasing automobiles constrain growth.

The banks segment accounted for the largest share of the global automotive finance market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of provider, the global automotive finance market is divided into banks and OEMs. Among these, the banks segment accounted for the largest share global automotive finance market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Dominance is driven by its established customer base, competitive interest rates, and diverse loan offerings. Banks also offer flexible financing options, long-term loan structures, and partnerships with dealerships, making them the preferred choice for vehicle financing.

The leasing segment accounted for a significant share of the global automotive finance market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of purpose, the global automotive finance market is divided into loans and leasing. Among these, the leasing segment accounted for a significant share of the global automotive finance market in 2023 and is anticipated to grow at a rapid pace during the projected period. Increased vehicle prices, growing demand for lower monthly payments, and increased demand for electric vehicles drive the adoption of leasing. Furthermore, businesses and consumers prefer leasing for flexibility, tax benefits, and hassle-free vehicle upgrades.

The passenger vehicles segment accounted for the largest share of the global automotive finance market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of vehicles, the global automotive finance market is divided into commercial vehicles and passenger vehicles. Among these, the passenger vehicles segment accounted for the largest share of the global automotive finance market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The primary drivers of financing for personal vehicles are high consumer demand, increasing urbanization, and rising disposable incomes. Other factors that drive passenger vehicle financing dominance include attractive loan and leasing options and the growing adoption of electric vehicles.

North America is projected to hold the largest share of the global automotive finance market over the forecast period.

North America is projected to hold the largest share of the global automotive finance market over the projected period. Strong automotive industry, high vehicle ownership rates, and wide acceptance of financing options. Well-established financial institutions, digital lending advancement, and rising demand for leasing solutions, especially for electric vehicles, will boost market dominance.

Asia Pacific is expected to grow at the fastest CAGR growth of the global automotive finance market during the projected period. Rapid urbanization, increased production of vehicles, and the rise in demand for driver training programs in countries like China, India, and Japan are driving market growth. Moreover, investments in the development of autonomous vehicles and technology advancements in simulation are further driving adoption across the region.

Company Profiling

Major vendors in the global automotive finance market are Ally Financial, Bank of America, Capital One, Chase Auto Finance, Daimler Financial Services, Ford Motor Credit Company, GM Financial Inc., Hitachi Capital, Toyota Financial Services, Volkswagen Financial Services, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, Santander Consumer USA Inc., a subsidiary of Santander Holdings USA Inc., partnered with AutoFi Inc. to develop a digital car-buying solution for the former company. The solution will comprise mobile, desktop, as well as in-dealership tools that shall help find cars within the consumer budget, streamline the financing process, and assist customers in procuring vehicles as per the demand of customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global automotive finance market based on the below-mentioned segments:

Global Automotive Finance Market, By Provider

Global Automotive Finance Market, By Purpose

Global Automotive Finance Market, By Vehicle

- Commercial Vehicles

- Passenger Vehicles

Global Automotive Finance Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa