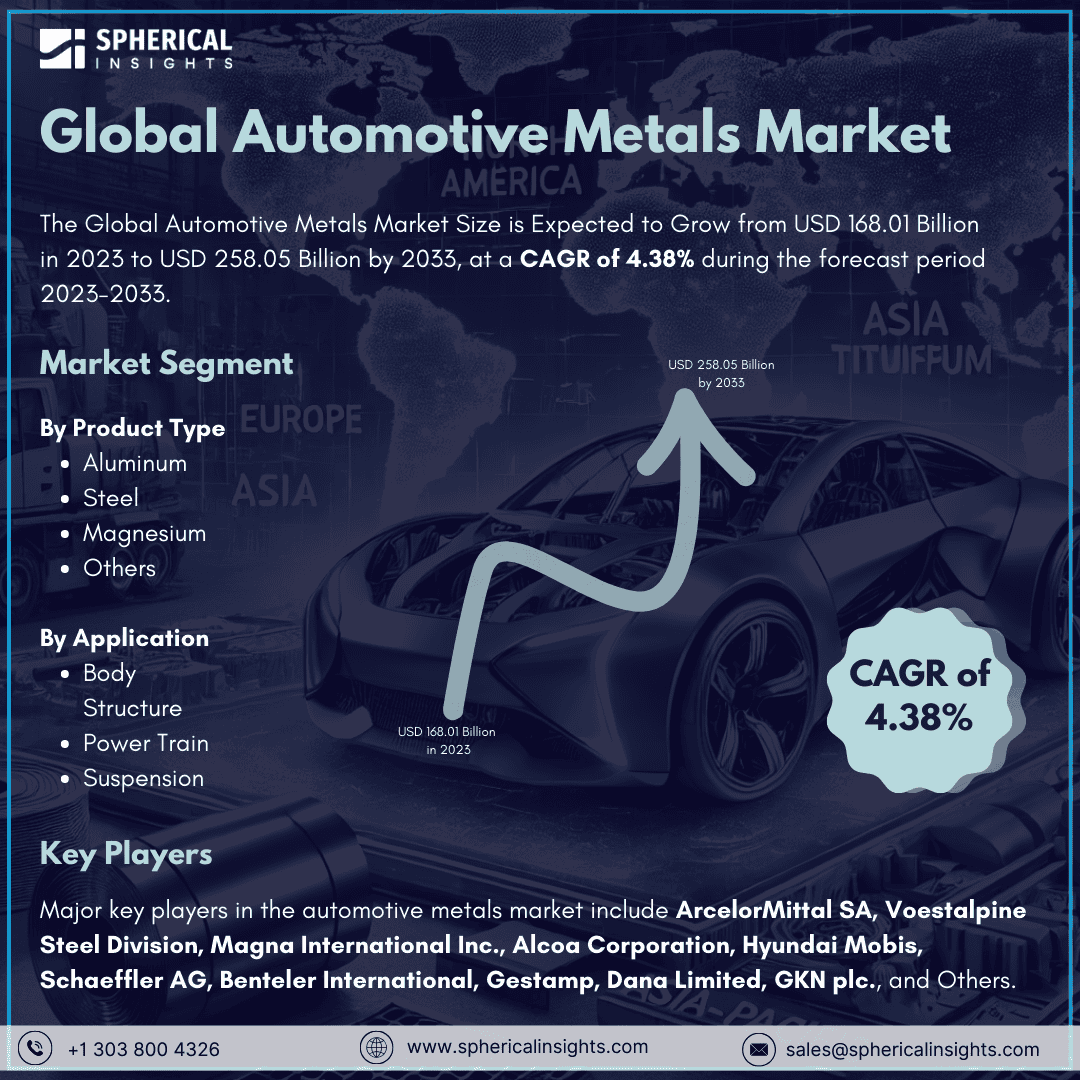

Global Automotive Metals Market Size to worth USD 258.05 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Automotive Metals Market Size is Expected to Grow from USD 168.01 Billion in 2023 to USD 258.05 Billion by 2033, at a CAGR of 4.38% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Automotive Metals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Aluminum, Steel, Magnesium, and Others), By Application (Body Structure, Power Train, and Suspension), By End Use (Passenger Vehicles and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Automotive metals, including steel and aluminum, are used in manufacturing various vehicle parts like chassis, engine oil systems, doors, exhaust systems, suspensions, steering systems, fuel supply systems, wheels, transmission systems, and tire parts. The growing demand for passenger cars, which is bolstered by increased disposable income in developing nations, is the main factor driving the automotive metal industry's need for raw materials. It is anticipated that the market share will increase due to the efficient use of metals in auto parts such as wheels, brakes, radiators, engines, roofs, panels, and chassis. The market for lightweight materials, such as aluminum, has expanded because of its low density and resistance to corrosion, which makes it perfect for use in the production of automobiles and aircraft. Automakers are switching to lightweight metals because their manufacturing techniques are causing financial and environmental problems. This change replaces steel parts, reducing the weight of the car without making it larger. Various government initiatives drive the market of automotive metals. For instance, Zero Emission Vehicles (ZEVs), such as battery electric vehicles and hydrogen fuel cell vehicles, are among the Advanced Automotive Technology (AAT) items that the Production Linked Incentive (PLI) Scheme seeks to increase production of. However, the industry's growth is hindered by expensive goods, strict government regulations, and the potential replacement of metals in vehicles with high-grade carbon and plastic materials.

The aluminum segment is predicted to hold the largest market share through the forecast period.

Based on the product type, the automotive metals market is classified into aluminum, steel, magnesium, and others. Among these, the aluminum segment is predicted to hold the largest market share through the forecast period. The increasing use of aluminum in the automotive industry is due to it is environmental-friendly, safe, and high-strength properties. The global automotive market is expected to see a rise in the demand for vehicle body structures due to the high steel content required.

The body structure segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the application, the antimicrobial medical device coatings market is divided into body structure, power train, and suspension. Among these, the body structure segment is anticipated to hold the greatest market share during the projected timeframe. Steel is anticipated to become more and more common in automobile suspension applications because of its high strength and rigidity, particularly in springs, which are subjected to high levels of stress and vibration and require parts made of materials that can endure these circumstances without breaking. Stricter safety standards around the world are likely to increase the use of steel in car body parts, such as frames, panels, doors, bonnets, and trunk closures.

The commercial segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the end use, the automotive metals market is divided into passenger vehicles and commercial vehicles. Among these, the commercial segment is anticipated to hold the greatest market share during the projected timeframe. Commercial vehicles are expected to experience significant global growth due to the growing logistics and transportation industry and easy financing from private and government institutions. The FAME scheme, regulated by the Ministry of Heavy Industries and Public Enterprises, supports eco-friendly vehicles, particularly commercial electric ones.

North America is estimated to hold the largest share of the automotive metals market over the forecast period.

North America is estimated to hold the largest share of the automotive metals market over the forecast period. North America is predicted to experience significant growth in the automotive metal market due to initiatives to produce fuel-efficient vehicles and the presence of major automotive manufacturers like Ford, Fiat, Toyota, and Volkswagen.

Asia Pacific is predicted to have the fastest CAGR growth in the automotive metals market over the forecast period. With an increase in the manufacturing of cars and commercial vehicles, Asia Pacific is predicted to lead the worldwide automotive metal market due to the growing demand for passenger and commercial vehicles from emerging economies like as China, India, Taiwan, Thailand, Korea, and Malaysia.

Company Profiling

Major key players in the automotive metals market include ArcelorMittal SA, Voestalpine Steel Division, Magna International Inc., Alcoa Corporation, Hyundai Mobis, Schaeffler AG, Benteler International, Gestamp, Dana Limited, GKN plc., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the automotive metals market based on the below-mentioned segments:

Global Automotive Metals Market, By Product Type

- Aluminum

- Steel

- Magnesium

- Others

Global Automotive Metals Market, By Application

- Body Structure

- Power Train

- Suspension

Global Automotive Metals Market, By End Use

- Passenger Vehicles

- Commercial Vehicles

Global Automotive Metals Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa