Global Autonomous Construction Equipment Market Size to worth USD 30.2 Billion by 2033

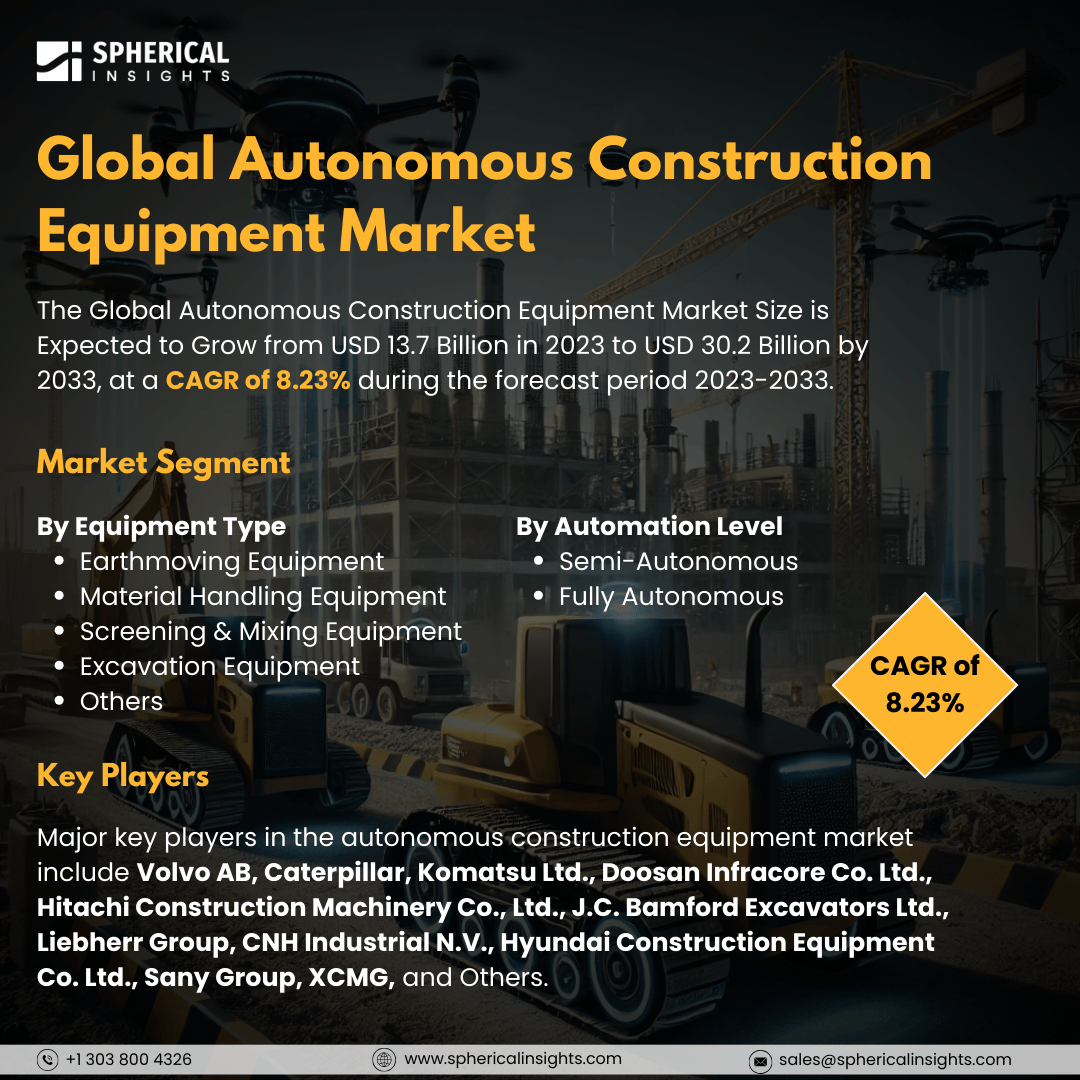

According to a research report published by Spherical Insights & Consulting, The Global Autonomous Construction Equipment Market Size is Expected to Grow from USD 13.7 Billion in 2023 to USD 30.2 Billion by 2033, at a CAGR of 8.23% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Autonomous Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Screening & Mixing Equipment, Excavation Equipment, and Others), By Automation Level (Semi-Autonomous and Fully Autonomous), By Application (Residential, Commercial, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Autonomous construction equipment is modern automated equipment that can effectively perform operations on constructive sites. On building sites, dirt can be graded and excavated using autonomous haul trucks, load carriers, excavators, and dozers. Workers with tools and supplies can be followed by little rovers. To enable coordinated actions, the vehicles are frequently connected. Growing labor costs and their benefits in distant settings are the main drivers of the market expansion for autonomous construction equipment. Additional advantages of this technology include financial effectiveness, increased job safety, and a move toward low-emission equipment. The growing focus on operational efficiency & safety as well as growing infrastructural & mining activities is propelling the market growth. On the contrary, the increased initial investments, regulatory compliance challenges, and infrastructure limitations that hinder the adoption of autonomous construction equipment are restraining the market growth.

The earthmoving equipment segment dominates the market with the largest market share during the forecast period.

Based on the equipment type, the global autonomous construction equipment market is divided into earthmoving equipment, material handling equipment, screening & mixing equipment, excavation equipment, and others. Among these, the earthmoving equipment segment dominates the market with the largest market share during the forecast period. The emergence of advanced products with eco-friendly features and low maintenance and technological advancements facilitating real-time monitoring are driving the market.

The fully autonomous construction equipment segment is dominating the autonomous construction equipment market during the forecast period.

Based on the automation level, the global autonomous construction equipment market is divided into semi-autonomous and fully autonomous. Among these, the fully autonomous construction equipment segment is dominating the autonomous construction equipment market during the forecast period. The need for increased operational efficiency and reduced labor costs along with the growing technological advancements in AI, ML, and sensor technology are driving the market demand in the fully autonomous construction equipment segment.

The residential segment dominates the market with the largest market share during the forecast period.

Based on the application, the global autonomous construction equipment market is divided into residential, commercial, and industrial. Among these, the residential segment dominates the market with the largest market share during the forecast period. It is further reinforced by rising infrastructure development investments and a greater focus on affordable home building by the government. The growing application of construction equipment in the residential sector is driving the market.

North America is projected to hold the largest share of the global autonomous construction equipment market over the forecast period.

North America is projected to hold the largest share of the global autonomous construction equipment market over the forecast period. The demand for autonomous machinery is driven by the region's growing investments in technical developments and infrastructural development. Further, North America's focus on using automation to increase construction safety and efficiency is the primary reason behind the market growth.

Asia Pacific is predicted to grow at the fastest CAGR in the autonomous construction equipment market over the forecast period. The market is expected to increase significantly due to the expansion of building activities and the advancements in smart technologies. Further, the rapid urbanization and massive infrastructure projects in countries like China, Japan, and South Korea are propelling the market demand.

Company Profiling

Major key players in the autonomous construction equipment market include Volvo AB, Caterpillar, Komatsu Ltd., Doosan Infracore Co. Ltd., Hitachi Construction Machinery Co., Ltd., J.C. Bamford Excavators Ltd., Liebherr Group, CNH Industrial N.V., Hyundai Construction Equipment Co. Ltd., Sany Group, XCMG, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Liebherr launched a new six-axle crane mobile crane, the LTM 1400-6.1, which it says is the most powerful six-axle machine on the market. It unveiled the LTM 1400-6.1 at its recent Customer Days in Berg-Ehingen, Germany. The 400-tonner has a 70-metre telescopic boom and is characterised by clever yet simple set-up processes.

- In May 2024, Caterpillar Inc. announced a $90 million investment to prepare its facilities in Schertz and Seguin, Texas, to produce the all-new Cat C13D industrial engine. The investment would create 25 jobs at Schertz starting in 2026.

- In May 2024, Hitachi Construction Machinery Co., Ltd. would establish the ZERO EMISSION EV-LAB, a research facility for collaborative creation with customers and partners to achieve zero emissions at work sites, in the city of Ichikawa, Chiba prefecture, in May 2024.

- In March 2023, Caterpillar Inc. is showcasing its latest products, services, and technologies at this year’s CONEXPO-CON/AGG in Las Vegas, Nevada. More than 30 machines, including model unveilings and battery electric machine prototypes, would be on display at the company’s largest exhibit to date at the event.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global autonomous construction equipment market based on the below-mentioned segments:

Global Autonomous Construction Equipment Market, By Equipment Type

- Earthmoving Equipment

- Material Handling Equipment

- Screening & Mixing Equipment

- Excavation Equipment

- Others

Global Autonomous Construction Equipment Market, By Automation Level

- Semi-Autonomous

- Fully Autonomous

Global Autonomous Construction Equipment Market, By Application

- Residential

- Commercial

- Industrial

Global Autonomous Construction Equipment Market, Regional Analysis

- North America

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa