Global Aviation Insurance Market Size to worth USD 7.68 Billion by 2033

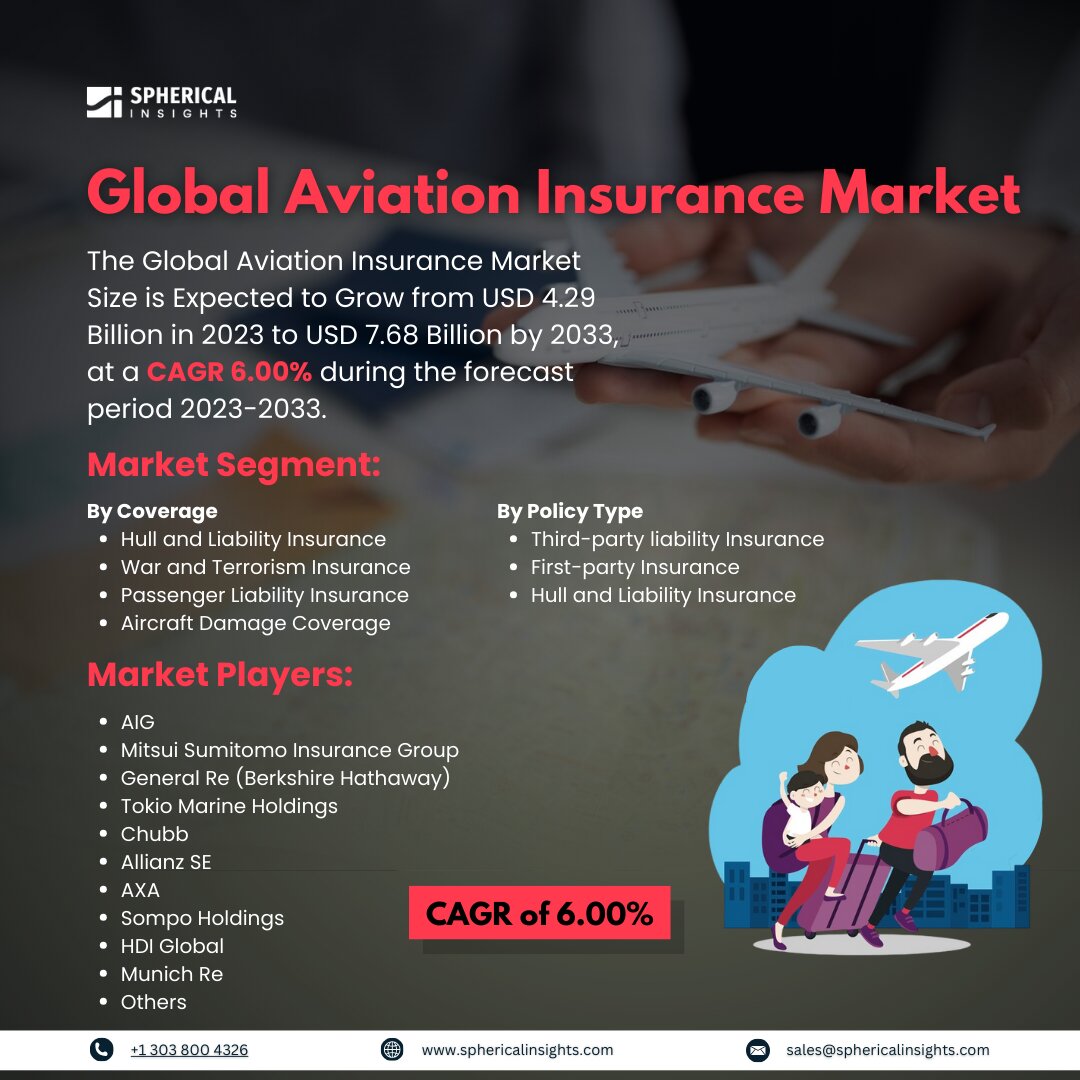

According to a research report published by Spherical Insights & Consulting, the Global Aviation Insurance Market Size is Expected to Grow from USD 4.29 Billion in 2023 to USD 7.68 Billion by 2033, at a CAGR 6.00% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Aviation Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Hull and Liability Insurance, War and Terrorism Insurance, Passenger Liability Insurance, and Aircraft Damage Coverage), By Policy Type (Third-party liability insurance, First-party Insurance, and Hull and Liability Insurance), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Aviation insurance is a specialized type of commercial insurance that protects against risks associated with aircraft operations. Unlike other transportation insurance policies, aviation insurance policies utilize specific terminology, coverage limits, and clauses unique to the aviation industry. In some countries, aviation insurance is mandatory for certain risks, such as accidents and illnesses involving airline passengers and crew members. The aviation insurance market is influenced by several factors. The growing demand for aircraft for various uses, including transportation and military applications, is expected to drive market expansion. Insurers have reported rising reinsurance costs, which have prompted them to restructure their coverage programs. Additionally, inflationary pressures have contributed to insurers seeking premium increases. However, factors may hinder the growth of the aviation insurance market. The high cost of aviation insurance premiums can be a significant barrier, and the frequency and severity of claims can further limit market growth.

The hull and liability insurance segment is predicted to hold the largest market share through the forecast period.

Based on the coverage, the aviation insurance market is classified into hull and liability insurance, war and terrorism insurance, passenger liability insurance, and aircraft damage coverage. Among these, the hull and liability insurance segment is predicted to hold the largest market share through the forecast period. Aviation insurance plays a critical role in protecting aircraft assets from physical damage and third-party claims. This type of insurance offers comprehensive coverage against a wide range of risks, including accidents, theft, and natural disasters. As a consequence, it provides peace of mind to aircraft owners and operators. With the ongoing expansion of the aviation industry, the increasing number of aircraft and rising operational complexities are expected to drive demand for robust hull and liability insurance solutions, solidifying its dominant position in the market.

The third-party liability insurance segment is anticipated to hold the highest market share during the projected timeframe.

Based on the policy type, the aviation insurance market is divided into third-party liability insurance, first-party insurance, and hull and liability insurance. Among these, the third-party liability insurance segment is anticipated to hold the highest market share during the projected timeframe. Third-party liability insurance is essential primarily due to regulatory requirements and the inherent risks associated with aviation operations. This insurance safeguards against claims made by third parties for bodily injury or property damage resulting from aviation activities. As concerns about safety and legal liabilities grow, airlines and operators will likely prioritize comprehensive third-party liability coverage, enhancing its significant presence within the aviation sector.

North America is estimated to hold the largest share of the aviation insurance market over the forecast period.

North America is estimated to hold the largest share of the aviation insurance market over the forecast period, driven by its advanced aviation infrastructure, extensive fleet size, and high demand for commercial air travel. The region hosts numerous leading airlines, aircraft manufacturers, and insurance providers, creating a robust ecosystem that supports the aviation insurance market. Additionally, stringent regulatory frameworks and high safety standards in the industry further underscore the necessity for comprehensive insurance solutions.

Asia Pacific is expected to grow the fastest during the forecast period. This is driven by rapid economic development and increasing air travel demand. As more countries in this region enhance their aviation capabilities and invest in new aircraft, the need for specialized insurance products to cover emerging risks is on the rise. The emergence of low-cost carriers and a growing middle class in countries like China and India are contributing to the surge in air travel, thus driving demand for aviation insurance solutions and positioning Asia-Pacific as a vibrant market for future growth.

Competitive Analysis

Major key players in the aviation insurance market includes AIG, Mitsui Sumitomo Insurance Group, General Re (Berkshire Hathaway), Tokio Marine Holdings, Chubb, Allianz SE, AXA, Sompo Holdings, HDI Global, Munich Re, Everest Re Group, Bermudan re/insurers, Swiss Re, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Redline Underwriting, a specialty underwriting firm and Lloyd’s coverholder, launched its General Aviation Insurance solution in collaboration with Allianz Commercial from the UK.This new offering, designed specifically for the Latin American and Caribbean markets, will provide comprehensive coverage for private, pleasure, and business fixed and rotor wing aircraft.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the aviation insurance market based on the below-mentioned segments:

Global Aviation Insurance Market, By Coverage

- Hull and Liability Insurance

- War and Terrorism Insurance

- Passenger Liability Insurance

- Aircraft Damage Coverage

Global Aviation Insurance Market, By Policy Type

- Third-party liability Insurance

- First-party Insurance

- Hull and Liability Insurance

Global Aviation Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa