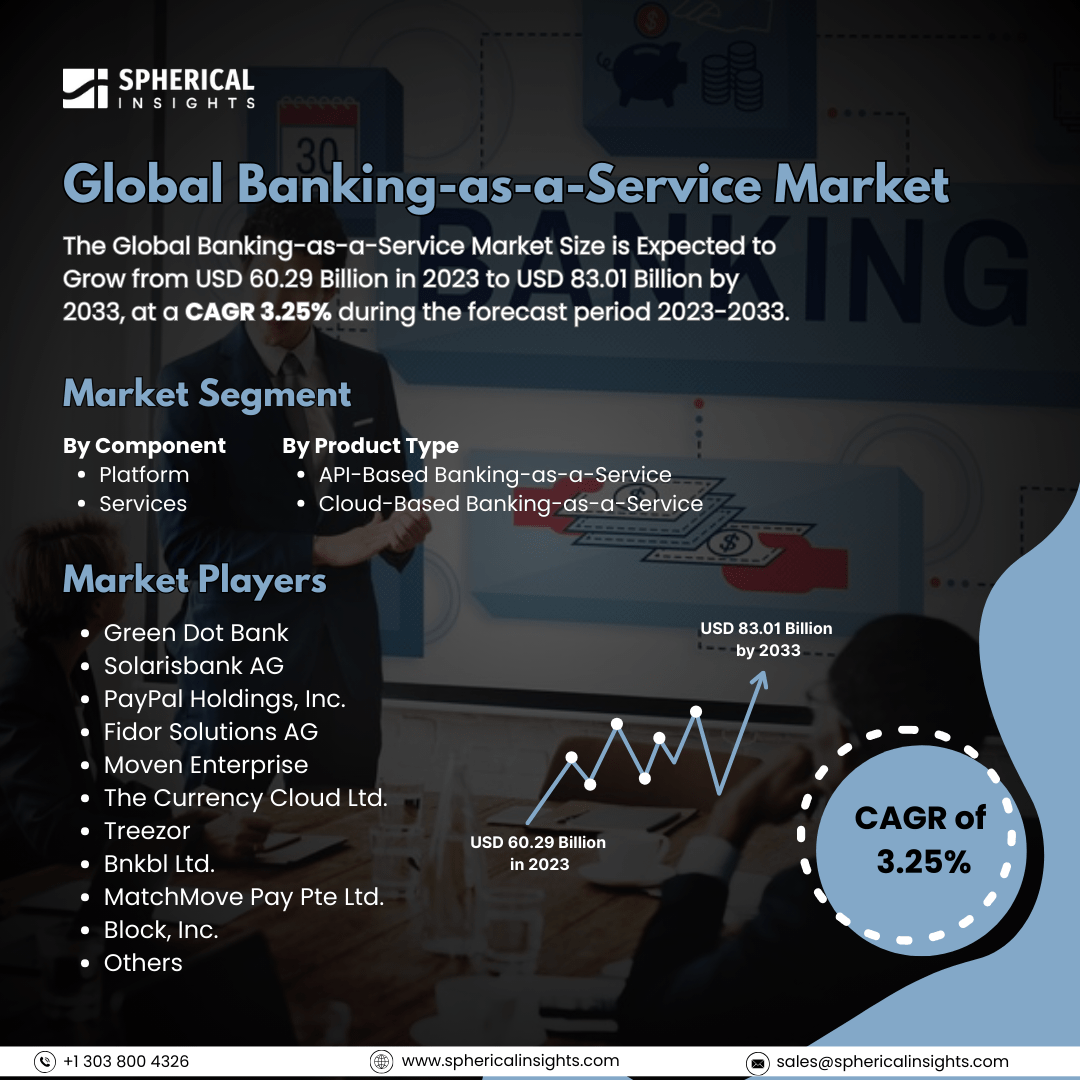

Global Banking-as-a-Service Market Size to worth 83.01 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Banking-as-a-Service Market Size is Expected to Grow from USD 60.29 Billion in 2023 to USD 83.01 Billion by 2033, at a CAGR 3.25% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Banking-as-a-Service Market Size, Share, and COVID-19 Impact Analysis, By Component (Platform, Services), By Product Type (API-Based Banking-as-a-Service, Cloud-Based Banking-as-a-Service), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The banking-as-a-service (BaaS) market is a financial technology sector that allows non-bank entities to offer banking services. BaaS is growing rapidly, driven by digitalization, customer demand, and partnerships between banks and fintech companies. The Banking as a Service (BaaS) market is primarily driven by the increasing demand for digital financial services, the rise of embedded finance where non-financial businesses can integrate banking attributes directly into their platforms, growing adoption of APIs for seamless integration, the need for faster innovation, and government initiatives promoting digital banking transformation, enabling businesses of all dimensions to offer financial products without building their complex banking infrastructure. While Banking as a Service (BaaS) presents significant market potential, several factors can impede its expansion including, complex regulatory landscapes, data privacy concerns, security risks, legacy infrastructure challenges within traditional banks, potential customer resistance to new embedded finance models, and the need for robust integration capabilities with existing systems, all of which require detailed navigation by BaaS providers to assure successful adoption and market penetration.

The platform segment is predicted to hold the largest market share through the forecast period.

Based on the component, the banking-as-a-service market is classified into platform, services. Among these, the risk management segment is predicted to hold the largest market share through the forecast period, due to the increasing demand for integrated financial services that provide a streamlined user experience. As businesses and consumers seek more efficient solutions, platforms that offer a wide range of banking services, including payment processing, account management, and customer engagement tools, become essential. This trend is further fueled by advancements in technology, which allow for seamless integration of various banking functionalities, enhancing operational efficiency and customer satisfaction.

The cloud-based banking-as-a-service segment is anticipated to hold the highest market share during the projected timeframe.

Based on the product type, the banking-as-a-service market is divided into channel API-based banking-as-a-service, cloud-based banking-as-a-service. Among these, the cloud-based banking-as-a-service segment is anticipated to hold the highest market share during the projected timeframe, as financial institutions increasingly adopt cloud solutions for their flexibility, scalability, and cost-effectiveness. By leveraging cloud technology, banks can offer a broad array of services without the need for extensive infrastructure investments, enabling them to innovate rapidly and respond to market demands. This shift not only improves operational efficiency but also allows for enhanced customer experiences, driving widespread adoption of cloud-based BaaS offerings.

North America is estimated to hold the largest share of the banking-as-a-service market over the forecast period.

North America is estimated to hold the largest share of the banking-as-a-service market over the forecast period, primarily due to the region's advanced technological infrastructure and a high concentration of established financial institutions. The presence of numerous fintech startups and a strong regulatory framework further contribute to the region's dominance, fostering innovation and competition in the banking sector. Additionally, consumers in North America have shown a growing preference for digital banking solutions, prompting banks to adopt BaaS platforms to meet evolving customer expectations.

Asia Pacific is expected to grow the fastest during the forecast period. As more people in this region embrace digital banking solutions, financial institutions are compelled to enhance their offerings through BaaS platforms. Furthermore, supportive government initiatives aimed at promoting financial inclusion and innovation in the banking sector are fueling the growth of BaaS solutions. This combination of technological advancement and consumer demand positions Asia Pacific as a key player in the global banking-as-a-service market.

Company Profiling

Major key players in the banking-as-a-service market include Green Dot Bank, Solarisbank AG, PayPal Holdings, Inc., Fidor Solutions AG, Moven Enterprise, The Currency Cloud Ltd., Treezor, Bnkbl Ltd., MatchMove Pay Pte Ltd., Block, Inc., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Zenus Bank announced the successful integration of Tuum’s Accounts and Payments modules into its proprietary technology ecosystem. This important landmark aligns with Zenus’ mission to create a global Banking-as-a-Service (BaaS) platform; enabling banks, fintechs, super apps, and businesses worldwide to entrench U.S. banking services and extend them to their customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the banking-as-a-service market based on the below-mentioned segments:

Global Banking-as-a-Service Market, By Component

Global Banking-as-a-Service Market, By Product Type

- API-Based Banking-as-a-Service

- Cloud-Based Banking-as-a-Service

Global Banking-as-a-Service Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa