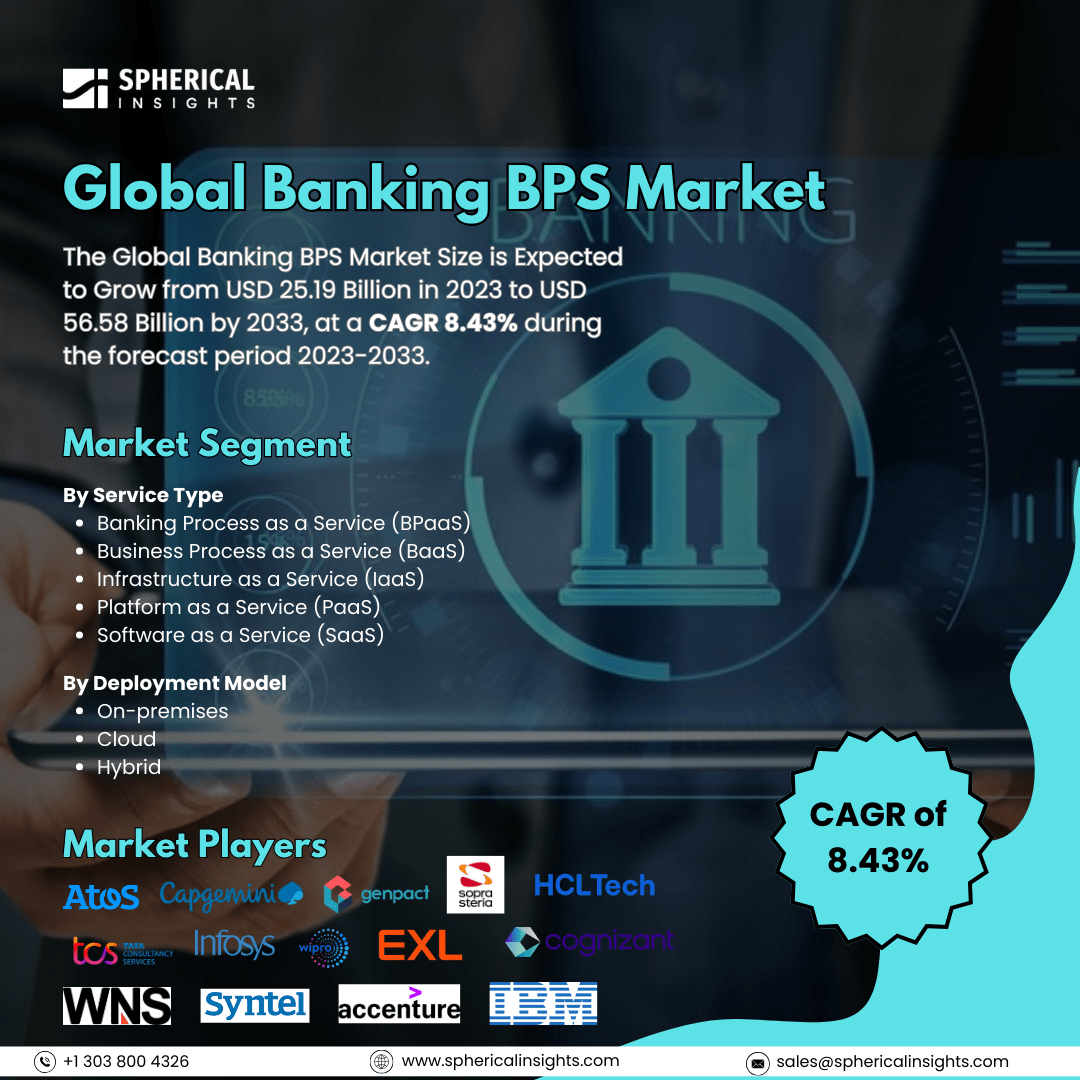

Global Banking BPS Market Size to worth USD 56.58 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Banking BPS Market Size is Expected to Grow from USD 25.19 Billion in 2023 to USD 56.58 Billion by 2033, at a CAGR 8.43% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Banking BPS Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Banking Process as a Service (BPaaS), Business Process as a Service (BaaS), Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Deployment Model (On-premises, Cloud, and Hybrid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The banking business process services (BPS) market refers to the outsourcing of banking operations to external service providers. The primary objective of banking BPS is to enhance operational efficiency and lower expenses. Various factors drive the banking BPS market, including the growing adoption of digital banking services and solutions such as online and mobile banking, as well as e-commerce. The implementation of emerging technologies like artificial intelligence, machine learning, and blockchain facilitates the development of innovative digital banking services. There is an increase in both lending and deposit activities. Additionally, heightened competition among banks globally is a contributing factor. There is also growing consumer demand for more personalized and efficient banking services. Moreover, there is a need for more flexible and valuable investment solutions. An increase in research and development initiatives is evident as well. The major challenges hindering the Banking Business Process Services (BPS) market encompass data security issues, the risk of cyberattacks, regulatory complications, difficulties in integrating legacy systems, a shortage of skilled professionals in some areas, high initial setup costs, and the possibility of vendor lock-in; essentially, these concerns pertain to the risks of outsourcing sensitive banking functions to third-party providers, particularly when navigating complex technological infrastructures and data privacy laws.

The banking process as a service (BPaaS) segment is predicted to hold the largest market share through the forecast period.

Based on the service type, the banking BPS market is classified into banking process as a service (BPaaS), business process as a service (BaaS), infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). Among these, the banking process as a service (BPaaS) segment is predicted to hold the largest market share through the forecast period. This is driven by the increasing demand for cost-effective and scalable banking solutions. BPaaS offers an assortment of services, including payment processing, loan management, and customer onboarding, all delivered through cloud-based platforms. As financial institutions look to streamline their operations and improve efficiency, the adoption of BPaaS is expected to rise significantly.

The on-premises segment is anticipated to hold the highest market share during the projected timeframe.

Based on the deployment model, the banking BPS market is divided into on-premises, cloud, and hybrid. Among these, the on-premises segment is anticipated to hold the highest market share during the projected timeframe. Organizations often prefer on-premises software deployments primarily because of the strong emphasis on data security and control. This is especially prevalent in industries with stringent compliance requirements. By keeping software installed on their own servers, organizations that handle sensitive data can maintain full control over their information and reduce the risks associated with third-party access. Additionally, on-premises solutions typically offer greater customization options to better meet specific business needs compared to cloud-based alternatives.

North America is estimated to hold the largest share of the banking BPS market over the forecast period.

North America is estimated to hold the largest share of the banking BPS market over the forecast period. The high adoption of technology in the banking sector and the presence of numerous major financial institutions in North America drive the demand for Banking Process Services (BPS) in the region. North America has a significant rate of digital banking adoption, which enhances the need for efficient banking processes that BPS can provide. Major and well-established banks such as JPMorgan Chase, Bank of America, and Wells Fargo play a significant role in contributing to the banking BPS market.

Asia pacific is expected to grow the fastest during the forecast period. This is due to a surge in digital banking adoption across the region, a large tech-savvy population is rapidly embracing new financial solutions, particularly in countries like India and China. This has led to an increased demand for efficient and cost-effective banking services, which can be supported through outsourcing to BPS providers. This trend is further fueled by the rise of fintech companies and the growing adoption of "Banking as a Service" (BaaS) models in the region.

Company Profiling

Major key players in the banking BPS market include Atos, Capgemini, Genpact, Steria, HCL Technologies, TCS, Infosys, Wipro, ExlService, Cognizant, WNS, Syntel, Accenture, IBM, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the banking BPS market based on the below-mentioned segments:

Global Banking BPS Market, By Service Type

- Banking Process as a Service (BPaaS)

- Business Process as a Service (BaaS)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Global Banking BPS Market, By Deployment Model

Global Banking BPS Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa