Global Banking Credit Analytics Market Size to worth USD 30.22 Billion by 2033

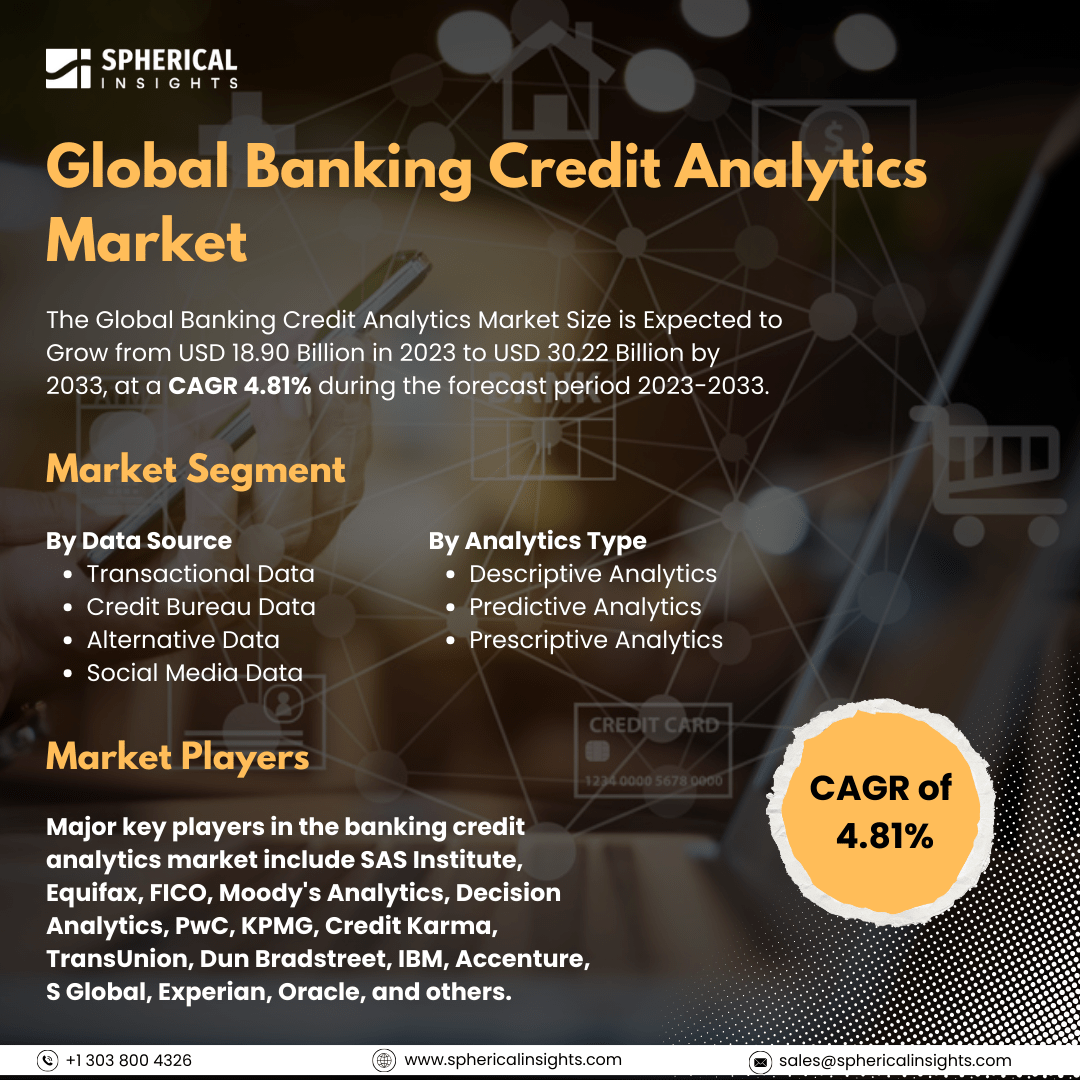

According to a research report published by Spherical Insights & Consulting, The Global Banking Credit Analytics Market Size is Expected to Grow from USD 18.90 Billion in 2023 to USD 30.22 Billion by 2033, at a CAGR 4.81% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Banking Credit Analytics Market Size, Share, and COVID-19 Impact Analysis, By Data Source (Transactional Data, Credit Bureau Data, Alternative Data, and Social Media Data), By Analytics Type (Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The banking credit analytics market refers to the sector that utilizes data analytics, machine learning, and various statistical techniques to help banks and financial institutions evaluate credit risk. This market is primarily driven by several factors, including the increasing availability of large data sets, growing needs for regulatory compliance, a desire to mitigate credit risk through advanced predictive modeling, the necessity for customer segmentation based on creditworthiness, and the adoption of advanced technologies like artificial intelligence and machine learning, which allow for the analysis of complex data sets. These advancements enable more accurate credit risk assessments and improved lending decisions. However, the banking credit analytics market faces several challenges that can hinder its growth. These include difficulties with integrating legacy systems, a shortage of skilled professionals capable of operating advanced analytics tools, concerns over data privacy, high implementation costs, the existence of inaccurate credit scoring models, and resistance to change within banking institutions. Such obstacles can limit the adoption of new credit analytics solutions, potentially affecting risk management and enhancements in customer experience.

The transactional data segment is predicted to hold the largest market share through the forecast period.

Based on the data source, the banking credit analytics market is classified into transactional data, credit bureau data, alternative data, and social media data. Among these, the transactional data segment is predicted to hold the largest market share through the forecast period. The importance of data analytics in real-time decision-making and operational efficiency cannot be overstated. As businesses increasingly rely on data-driven insights, analyzing transactional data helps organizations understand customer behavior, optimize processes, and enhance financial performance. This area benefits from advancements in data collection and processing technologies, which enable more accurate and timely analyses. Such capabilities are essential for maintaining a competitive edge in fast-paced markets.

The predictive analytics segment is anticipated to hold the highest market share during the projected timeframe.

Based on the analytics type, the banking credit analytics market is divided into descriptive analytics, predictive analytics, and prescriptive analytics. Among these, the predictive analytics segment is anticipated to hold the highest market share during the projected timeframe. Organizations are also keen to leverage data for forecasting future trends and behaviors. By employing advanced statistical techniques and machine learning algorithms, predictive analytics allows businesses to proactively identify opportunities and risks, leading to improved strategic decision-making. The growth of this segment is driven by increased investments in data analytics tools and the rising demand for personalized customer experiences that require deep insights into customer preferences and market dynamics.

North America is estimated to hold the largest share of the banking credit analytics market over the forecast period.

North America is estimated to hold the largest share of the banking credit analytics market over the forecast period. The growth of banking credit analytics is primarily due to the region's advanced technological infrastructure and high adoption rates of data analytics solutions. Major financial institutions increasingly utilize sophisticated analytics to enhance credit risk assessments, improve customer relationship management, and ensure compliance with regulatory requirements. Moreover, the presence of a diverse range of fintech companies further fuels innovation and competition, solidifying North America's leadership in this landscape.

Europe is expected to grow the fastest during the forecast period. The demand for innovative credit analytics solutions is driven by an increasing focus on digital transformation and regulatory compliance within the financial sector. As banks and financial institutions adopt advanced analytics to navigate complex regulatory environments and enhance customer insights, the need for these solutions rises. Additionally, the growth of artificial intelligence and machine learning technologies in the region empowers organizations to make more effective data-driven decisions, positioning Europe as a rapidly evolving market for banking credit analytics.

Company Profiling

Major key players in the banking credit analytics market include SAS Institute, Equifax, FICO, Moody's Analytics, Decision Analytics, PwC, KPMG, Credit Karma, TransUnion, Dun Bradstreet, IBM, Accenture, S Global, Experian, Oracle, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Galytix, a fintech company based in London and focused on Generative AI, launched CreditX, an innovative Generative AI-based credit agent solution for the Indian banking sector. This solution aims to help banks deliver credit more effectively, efficiently, and economically.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global banking credit analytics market based on the below-mentioned segments:

Global Banking Credit Analytics Market, By Data Source

- Transactional Data

- Credit Bureau Data

- Alternative Data

- Social Media Data

Global Banking Credit Analytics Market, By Analytics Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

Global Banking Credit Analytics Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa