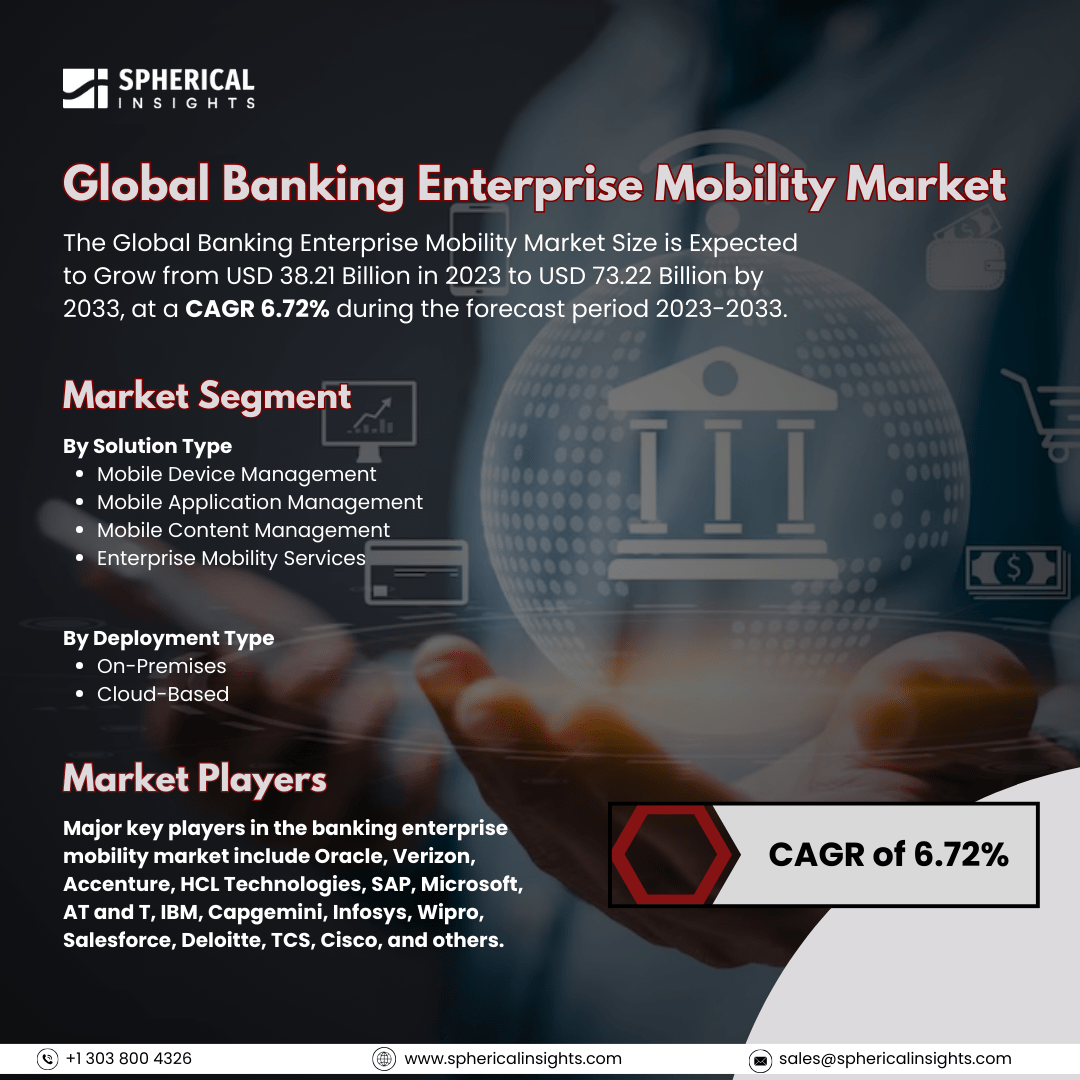

Global Banking Enterprise Mobility Market Size to worth USD 73.22 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Banking Enterprise Mobility Market Size is Expected to Grow from USD 38.21 Billion in 2023 to USD 73.22 Billion by 2033, at a CAGR 6.72% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Banking Enterprise Mobility Market Size, Share, and COVID-19 Impact Analysis, By Solution Type (Mobile Device Management, Mobile Application Management, Mobile Content Management, and Enterprise Mobility Services), By Deployment Type (On-Premises and Cloud-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The banking enterprise mobility market encompasses the tools and technologies that banks use to manage and maintain mobile devices for their business operations. This market is primarily driven by several factors, including the increasing customer demand for convenient mobile banking services, technological advancements that facilitate seamless mobile experiences, the need for banks to enhance operational efficiency, the growing adoption of smartphones and tablets, regulatory pressures to offer digital banking options, and competition from fintech companies that are pushing for innovation in mobile banking. However, there are also significant constraints affecting the enterprise mobility market within the banking sector. These include high implementation costs, complex integration with existing systems, security concerns related to sensitive financial data, a lack of standardization across devices and platforms, resistance to change within banking culture, and worries about data privacy when implementing Bring Your Own Device (BYOD) policies. All these factors can impede the widespread adoption of mobile banking solutions.

The mobile device management segment is predicted to hold the largest market share through the forecast period.

Based on the solution type, the banking enterprise mobility market is classified into mobile device management, mobile application management, mobile content management, and enterprise mobility services. Among these, the mobile device management segment is predicted to hold the largest market share through the forecast period. This is driven by the increasing adoption of mobile devices in businesses, rising concerns about data security, and the growth of remote work culture, which requires effective device management solutions. As organizations rely more on mobile devices, the demand for security features offered by MDM solutions is becoming more urgent. Additionally, the trend of employees using their personal devices for work is contributing to the rise in MDM adoption, as businesses seek to manage a variety of devices and ensure data protection.

The on-Premises segment is anticipated to hold the highest market share during the projected timeframe.

Based on the deployment type, the banking enterprise mobility market is divided into on-Premises and cloud-based. Among these, the on-Premises segment is anticipated to hold the highest market share during the projected timeframe. The on-premise deployment option for corporate mobility allows organizations to install software directly on their existing systems, rather than relying on multiple cloud services. Most businesses prefer on-premise implementation because it offers higher data transmission speed and enhanced security, which in turn drives the growth of the enterprise mobility market.

North America is estimated to hold the largest share of the banking enterprise mobility market over the forecast period.

North America is estimated to hold the largest share of the banking enterprise mobility market over the forecast period. This is due to its digital economy and increasing government support for entrepreneurship and global innovation. Various industries in the region are implementing enterprise mobility solutions. Companies are adopting security measures that address data security concerns while protecting employees' personal information. Additionally, the rise of an employee-centric professional culture across different sectors, along with the presence of key market players, is contributing to the expansion of the North American enterprise mobility market.

Asia Pacific is expected to grow the fastest during the forecast period. The rise in the banking enterprise mobility management market is attributed to the increasing penetration of mobile devices and the ongoing digitalization efforts. This trend is expected to be a key driver of demand in the local market. Additionally, the growing number of small and medium-sized enterprises (SMEs) and their adherence to Bring Your Own Device (BYOD) policies are contributing to an increase in sales volume of EMM solutions.

Company Profiling

Major key players in the banking enterprise mobility market include Oracle, Verizon, Accenture, HCL Technologies, SAP, Microsoft, AT and T, IBM, Capgemini, Infosys, Wipro, Salesforce, Deloitte, TCS, Cisco, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, NinjaOne, a leading IT platform for endpoint management, security, and visibility, has announced the expansion of its platform to include mobile device management (MDM). This new solution enhances employee productivity and simplifies the management process for IT teams by allowing them to manage Android and Apple mobile devices, as well as other endpoints, from a single, user-friendly console. With the addition of MDM, NinjaOne now offers comprehensive coverage that goes beyond unified endpoint management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the banking enterprise mobility market based on the below-mentioned segments:

Global Banking Enterprise Mobility Market, By Solution Type

- Mobile Device Management

- Mobile Application Management

- Mobile Content Management

- Enterprise Mobility Services

Global Banking Enterprise Mobility Market, By Deployment Type

Global Banking Enterprise Mobility Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa