Global Business Travel Accident Insurance Market Size to worth USD 12.23 Billion by 2033

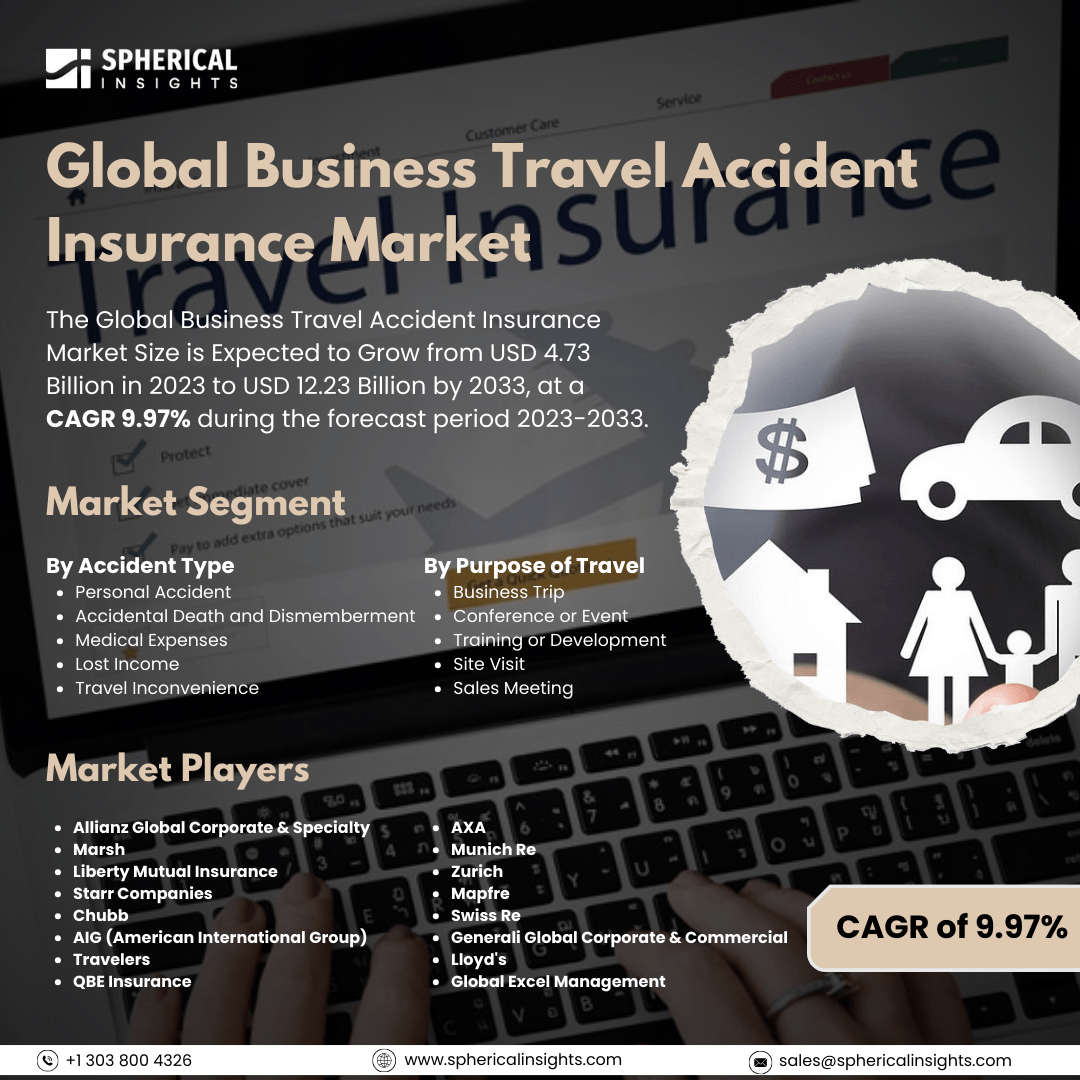

According to a research report published by Spherical Insights & Consulting, The Global Business Travel Accident Insurance Market Size is Expected to Grow from USD 4.73 Billion in 2023 to USD 12.23 Billion by 2033, at a CAGR 9.97% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Business Travel Accident Insurance Market Size, Share, and COVID-19 Impact Analysis, By Accident Type (Personal Accident, Accidental Death and Dismemberment, Medical Expenses, Lost Income, and Travel Inconvenience), By Purpose of Travel (Business Trip, Conference or Event, Training or Development, Site Visit, and Sales Meeting), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The business travel accident insurance market encompasses insurance policies designed to protect business travelers from accidents, injuries, and illnesses. This type of insurance also covers death and dismemberment. Key factors driving the growth of the business travel accident insurance market include a significant rise in global business travel, increasing awareness of travel-related risks, a growing corporate emphasis on employee well-being, a surge in international conferences and events, and the need to mitigate potential risks associated with frequent business trips. As more employees travel for work, companies are prioritizing comprehensive insurance coverage to safeguard them against accidents and unforeseen medical emergencies while abroad. However, a major obstacle in the business travel accident insurance market is the high cost of premiums tied to comprehensive policies. This can discourage businesses, particularly smaller ones, from purchasing coverage, especially when they are constrained by budget limitations. Additionally, a lack of awareness regarding the benefits of such insurance among some companies may also impede market growth.

The personal accident segment is predicted to hold the largest market share through the forecast period.

Based on the accident type, the business travel accident insurance market is classified into personal accident, accidental death and dismemberment, medical expenses, lost income, and travel inconvenience. Among these, the personal accident segment is predicted to hold the largest market share through the forecast period. The demand for personal accident insurance is expected to rise significantly due to increasing awareness of the need for personal safety and financial protection against unforeseen incidents. As individuals recognize the importance of safeguarding themselves and their families from accidents, more people are likely to invest in personal accident policies. Factors such as urbanization, a growing middle class, and increased disposable income are also driving this trend, cementing the dominance of this insurance segment in the market.

The business trip segment is anticipated to hold the highest market share during the projected timeframe.

Based on the purpose of travel, the business travel accident insurance market is divided into business trips, conferences or events, training or development, site visits, and sales meetings. Among these, the business trip segment is anticipated to hold the highest market share during the projected timeframe. As more companies expand their global operations and require employees to travel for work, the need for comprehensive insurance coverage has become more pressing. This uptick in business travel has heightened the demand for protection against potential accidents and health issues that employees may face while traveling. With a growing emphasis on employee welfare and risk management, organizations are increasingly likely to invest in business trip insurance, contributing significantly to this market segment.

North America is estimated to hold the largest share of the business travel accident insurance market over the forecast period.

North America is estimated to hold the largest share of the business travel accident insurance market over the forecast period. The demand for business travel accident insurance is fueled by a robust economy, high levels of corporate travel, and well-established insurance frameworks. The region's extensive travel networks and business infrastructure facilitate frequent travel for meetings, conferences, and collaborations, creating a necessity for comprehensive coverage for business travelers. Furthermore, the increasing awareness of the risks associated with business travel, along with legal requirements for employer liability insurance, further bolsters the demand for this type of insurance.

Asia Pacific is expected to grow the fastest during the forecast period. Rapid economic development, rising disposable incomes, and an increasing number of businesses expanding into the area are driving the demand for travel accident insurance. As companies establish operations and employees engage in international travel for business, the need for adequate insurance coverage is anticipated to surge. Improved travel infrastructure and heightened awareness of travel risks are prompting both businesses and individuals to seek comprehensive coverage, positioning Asia Pacific as a dynamic and rapidly growing market in the business travel accident insurance sector.

Company Profiling

Major key players in the business travel accident insurance market include Allianz Global Corporate Specialty, Marsh, Liberty Mutual Insurance, Starr Companies, Chubb, AIG, Travelers, QBE Insurance, AXA, Munich Re, Zurich, Mapfre, Swiss Re, Generali Global Corporate Commercial, Lloyd's, Global Excel Management, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Collinson, a global leader in travel experiences and loyalty programs, announced a strategic partnership with World Nomads, the global travel insurance provider. This partnership includes the launch of a new Annual Multi-Trip (AMT) product in the UK and Ireland.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the business travel accident insurance market based on the below-mentioned segments:

Global Business Travel Accident Insurance Market, By Accident Type

- Personal Accident

- Accidental Death and Dismemberment

- Medical Expenses

- Lost Income

- Travel Inconvenience

Global Business Travel Accident Insurance Market, By Purpose of Travel

- Business Trip

- Conference or Event

- Training or Development

- Site Visit

- Sales Meeting

Global Business Travel Accident Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa