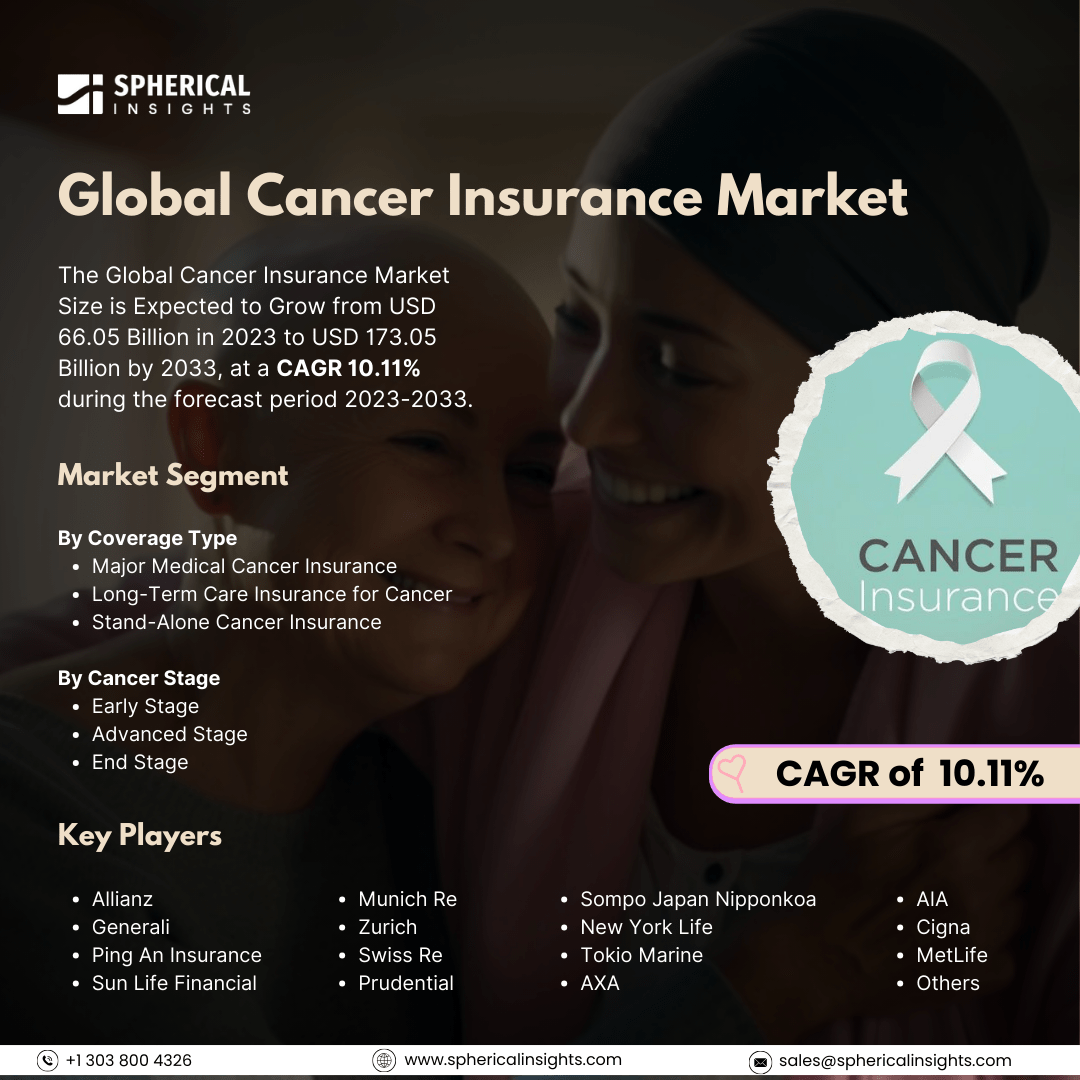

Global Cancer Insurance Market Size to worth USD 173.05 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Cancer Insurance Market Size is Expected to Grow from USD 66.05 Billion in 2023 to USD 173.05 Billion by 2033, at a CAGR 10.11% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Cancer Inand End Stage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analyssurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Major Medical Cancer Insurance, Long-Term Care Insurance for Cancer, and Stand-Alone Cancer Insurance), By Cancer Stage (Early Stage, Advanced Stage, is and Forecast 2023 – 2033.

The cancer insurance market consists of insurance policies designed to cover the costs associated with cancer diagnosis and treatment. These policies serve as a form of supplemental health insurance, providing financial support to individuals facing a cancer diagnosis. The market is primarily driven by the increasing prevalence of cancer worldwide, rising healthcare costs, and growing awareness of the need for financial protection against medical expenses related to cancer treatment. Advancements in medical technology and treatment options also contribute to higher treatment costs, leading individuals to seek insurance coverage. However, there are several factors that restrain the market's growth. These include the high premiums associated with specialized cancer insurance policies, limited awareness in certain demographics regarding the benefits of such coverage, and regulatory challenges that may hinder market expansion. These dynamics create a complex landscape for the cancer insurance market, influencing both consumer demand and the offerings of insurance providers.

The major medical cancer insurance segment is predicted to hold the largest market share through the forecast period.

Based on the coverage type, the cancer insurance market is classified into major medical cancer insurance, long-term care insurance for cancer, and stand-alone cancer insurance. Among these, the major medical cancer insurance segment is predicted to hold the largest market share through the forecast period. This is due to its comprehensive coverage options, which cater to a wide range of cancer-related expenses such as diagnostics, treatment, and follow-up care. This segment appeals to consumers seeking robust financial protection against the high costs associated with cancer treatment, thereby driving demand. Additionally, increased awareness of cancer risks and advancements in treatment options contribute to the growing preference for major medical plans, solidifying its position in the market.

The early stage segment is anticipated to hold the highest market share during the projected timeframe.

Based on the cancer stage, the cancer insurance market is divided into early stage, advanced stage, and end stage. Among these, the early stage segment is anticipated to hold the highest market share during the projected timeframe. as it aligns with a growing emphasis on preventive care and early detection of cancers. Policies targeting early-stage cancer treatment often offer lower premiums and more accessible coverage, appealing to health-conscious consumers. This proactive approach not only encourages regular health check-ups but also enhances the likelihood of favourable treatment outcomes, reinforcing the segment's attractiveness and driving its anticipated growth during the forecast period.

North America is estimated to hold the largest share of the cancer insurance market over the forecast period.

North America is estimated to hold the largest share of the cancer insurance market over the forecast period. This is primarily due to its advanced healthcare infrastructure, high prevalence of cancer, and significant investments in cancer research and treatment. The region benefits from a well-established insurance framework and a growing awareness of the financial implications of cancer treatment. Furthermore, the presence of major insurance providers and competitive market dynamics enhance the availability of diverse cancer insurance products, making North America a key player in the global cancer insurance landscape.

Europe is expected to grow the fastest during the forecast period. This is driven by several factors including an aging population, rising cancer incidence rates, and increasing healthcare expenditures. The region is witnessing an uptick in policies focused on comprehensive cancer care, combined with government initiatives aimed at improving access to healthcare services. Additionally, the growing public awareness around cancer risks and the benefits of early intervention are likely to stimulate demand for specialized cancer insurance, positioning Europe as a rapidly evolving market for cancer coverage evolving market for cancer coverage.

Company Profiling

Major key players in the cancer insurance market includes Allianz, Generali, Ping An Insurance, Sun Life Financial, Munich Re, Zurich, Swiss Re, Prudential, Sompo Japan Nipponkoa, New York Life, Tokio Marine, AXA, AIA, Cigna, MetLife, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, Symetra Life Insurance Company announced the introduction of Cancer Care Compass, an industry-first optional rider package that offers a unique combination of cancer care benefits and services and is available at application on Symetra’s indexed universal life (IUL) products, Accumulator Ascent IUL and Protector IUL.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cancer insurance market based on the below-mentioned segments:

Global Cancer Insurance Market, By Coverage Type

- Major Medical Cancer Insurance

- Long-Term Care Insurance for Cancer

- Stand-Alone Cancer Insurance

Global Cancer Insurance Market, By Cancer Stage

- Early Stage

- Advanced Stage

- End Stage

Global Cancer Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa