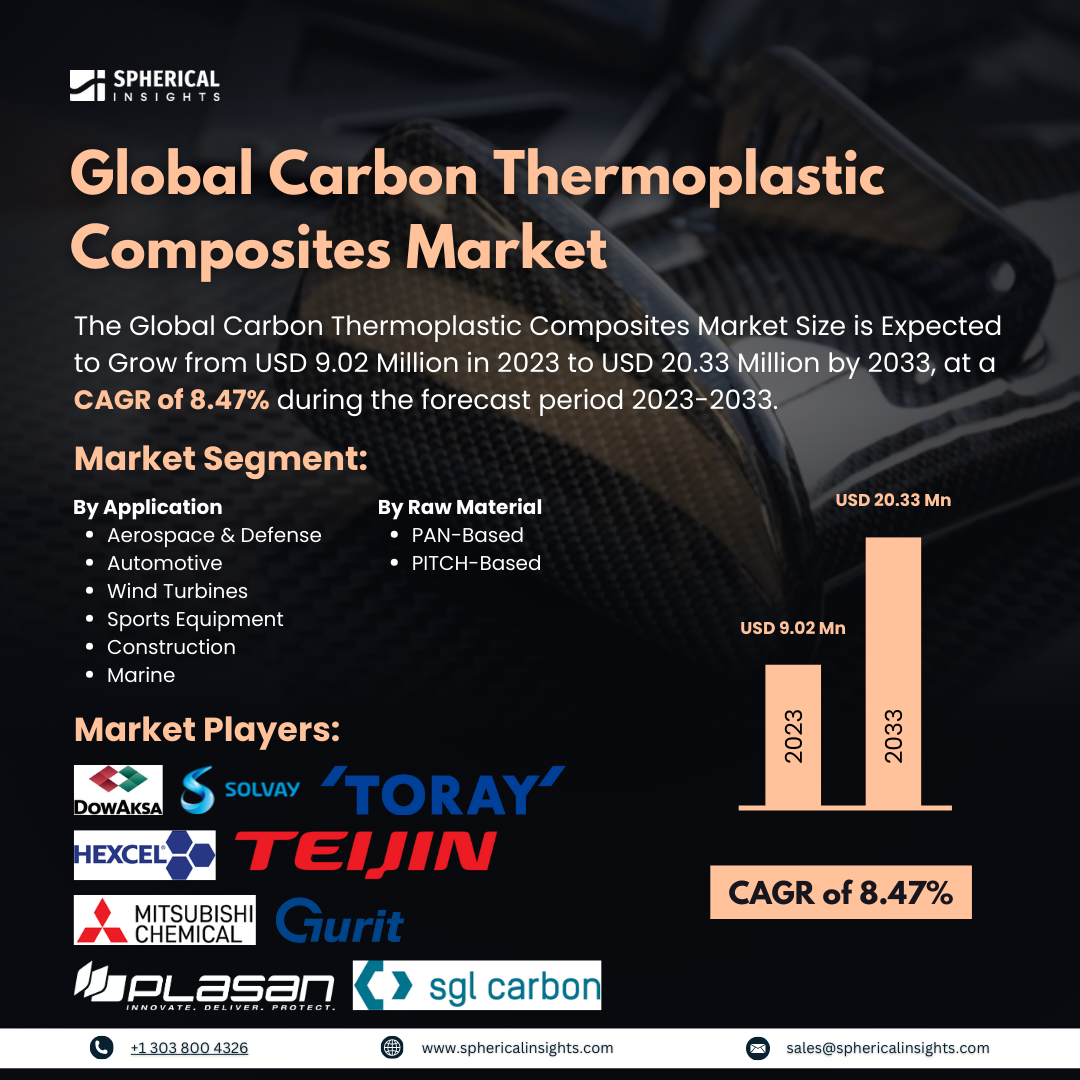

Global Carbon Thermoplastic Composites Market Size to worth USD 20.33 Million by 2033

According to a research report published by Spherical Insights & Consulting, the Global Carbon Thermoplastic Composites Market Size is Expected to Grow from USD 9.02 Million in 2023 to USD 20.33 Million by 2033, at a CAGR of 8.47% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Carbon Thermoplastic Composites Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (PAN-Based and PITCH-Based), By Application (Aerospace & Defense, Automotive, Wind Turbines, Sports Equipment, Construction and Marine), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Carbon thermoplastic composites are modern composite materials. Carbon fibers or advanced carbon fibers are set into a matrix of thermosets. Combining strengths from carbon fibers or the high strength and high modulus of stiffness of a thermoplastic resin provides better processability and higher recyclability in aerospace industries. The materials have better mechanical properties for elevated thermal resistance and more substantial weight saving than conventional polymers. Furthermore, there are several critical growth drivers for carbon thermoplastic composites. First, there is a significant demand for these lightweight high-performance materials in the automotive and aerospace markets. CTCs contribute to fuel efficiency and enhanced durability, critical to reducing carbon emissions. The ever-increasing attention to sustainability and recyclability is increasingly driving the thermoplastic composite market, as the materials may be melted and recycled toward a much-coveted circular economy. Advancements in production technology, such as automated fiber placement, are also stimulating expansion in the market. However, the market still faces some challenges. The high initial cost of raw materials and production processes is a significant barrier to widespread adoption. In addition, the technical difficulty of designing and manufacturing carbon thermoplastic composite structures is a challenge.

The PAN-based segment is predicted to hold the greatest market share through the forecast period.

Based on the raw material, the carbon thermoplastic composites market is classified into PAN-based and PITCH-based. Among these, the PAN-based segment is predicted to hold the greatest market share through the forecast period. This is attributed to the fact that PAN is used as a precursor in thermoplastic composites for carbon fibers. The PAN-based carbon fibers are strong and of high modulus with superior thermal properties, making them very ideal for demanding applications in aerospace, automotive, and defense industries. Well-established production processes and consistency in quality also contribute to PAN-based carbon fibers' market domination.

The automotive segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the application, the carbon thermoplastic composites market is divided into aerospace & defense, automotive, wind turbines, sports equipment, construction, and marine. Among these, the automotive segment is anticipated to hold the greatest market share during the projected timeframe. This is attributed to the rising demand for lightweight materials in the manufacture of automobiles to gain more efficiency in fuel usage, lesser emissions, and performance in vehicles. Carbon thermoplastic composites have very high strength-to-weight ratios, making them highly suited for vehicle body panels, interior parts, and structural components.

Asia-Pacific is estimated to hold the largest carbon thermoplastic composites market share over the forecast period.

Asia-Pacific is estimated to hold the largest carbon thermoplastic composites market share over the forecast period. This is primarily due to the rapid industrialization and growing demand for advanced materials in key sectors, such as automotive, aerospace, and wind energy, primarily in countries like China, Japan, South Korea, and India. The APAC region is a significant contributor to the automotive industry that involves countries such as China and Japan leading the lightweight materials adoption in vehicle manufacturing to enhance fuel efficiency and ensure stringent emission regulations.

North America is predicted to have the fastest CAGR growth in the carbon thermoplastic composites market over the forecast period. This growth is due to several factors, among which is the high demand for lightweight, high-performance materials in the aerospace, automotive, and defense industries. Carbon thermoplastic composites are being increasingly adopted in the automotive sector in North America, particularly in the United States, due to the increasing demand for lighter vehicles to increase fuel efficiency and meet environmental regulations.

Competitive Analysis

Major key players in the carbon thermoplastic composites market are DowAksa, Solvay, Toray Industries, Inc., SGL Carbon, Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Corporation, Gurit Holding AG, Plasan Carbon Composites, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Toray Industries, Inc. announced the expansion of its French subsidiary Toray Carbon Fibers Europe S.A.’s manufacturing facilities for certain carbon fibers, starting production in 2025 to increase the plant’s annual capacity significantly.

Market Segment

This study forecasts global, regional, and country revenue from 2023 to 2033. Spherical Insights has segmented the carbon thermoplastic composites market based on the below-mentioned segments:

Global Carbon Thermoplastic Composites Market, By Raw Material

Global Carbon Thermoplastic Composites Market, By Application

- Aerospace & Defense

- Automotive

- Wind Turbines

- Sports Equipment

- Construction

- Marine

Global Carbon Thermoplastic Composites Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa