Global Chatbot for Banking Market Size to worth USD 59.41 Billion by 2033

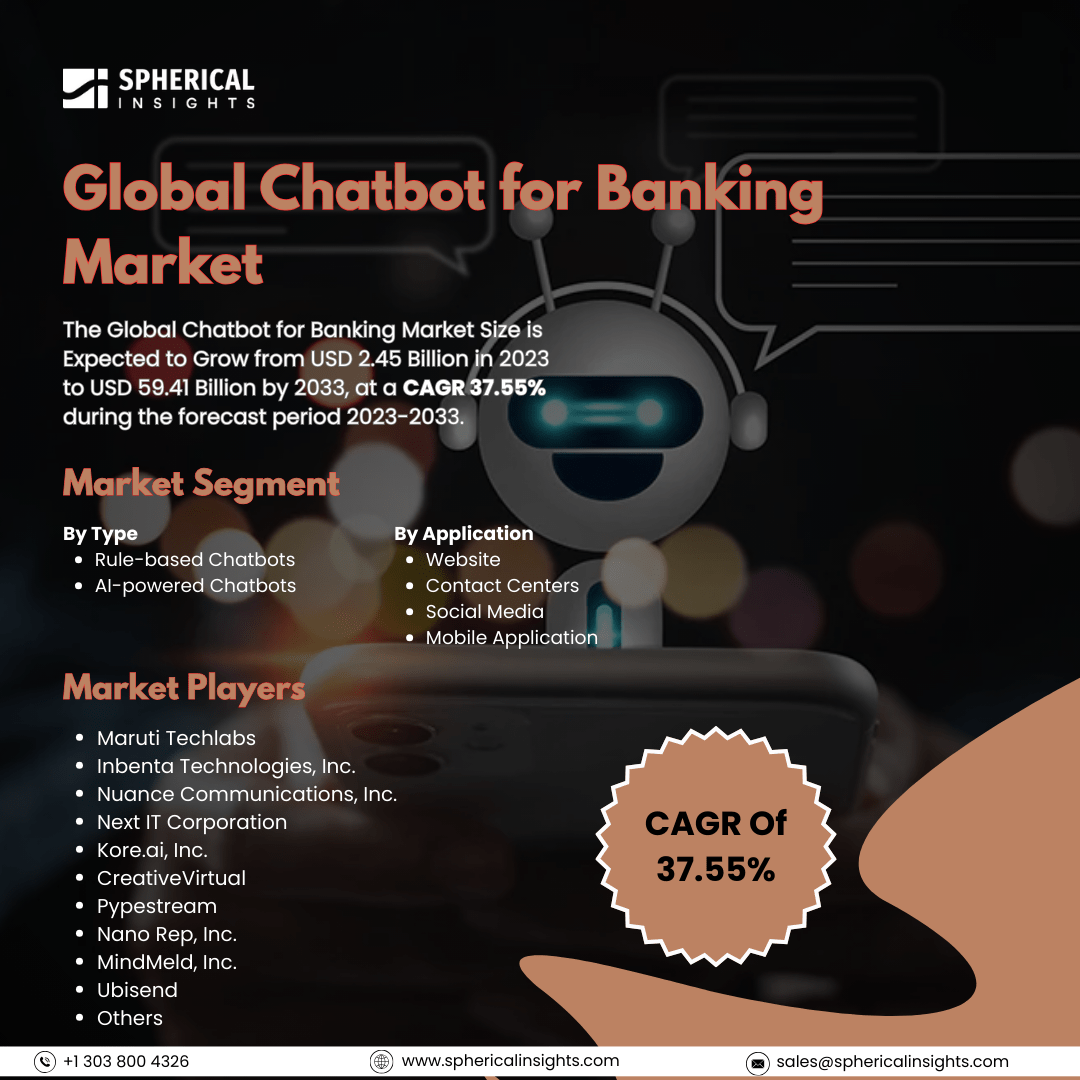

According to a research report published by Spherical Insights & Consulting, The Global Chatbot for Banking Market Size is Expected to Grow from USD 2.45 Billion in 2023 to USD 59.41 Billion by 2033, at a CAGR 37.55% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Chatbot for Banking Market Size, Share, and COVID-19 Impact Analysis, By Type (Rule-based Chatbots and AI-powered Chatbots), By Application (Website, Contact Centers, Social Media, and Mobile Application), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A chatbot for banking is an AI-powered virtual assistant that provides various banking services to customers. These chatbots can interact with users through text, voice, or both, and they can be integrated into websites, mobile apps, and messaging platforms. The chatbot market in banking is primarily driven by several factors, including improved customer service from side to side 24/7 availability, cost lessening by automating rhythmic tasks, personalized monetary advice, faster transaction processing, deception detection capabilities, as well as the growing implementation of digital banking. These advancements in artificial intelligence (AI) and natural language processing (NLP) have made banking interactions more handy and accessible for customers. However, despite their significant potential, quite a lot of challenge can limit the extensive adoption of banking chatbots. These include complex implementation and maintenance, concerns on the theme of security and privacy, limited advanced NLP capabilities for understanding complex queries, customer resistance to new expertise, and regulatory hurdles related to sensitive monetary data. This factor can discourage banks from fully integrating chatbots into their customer service operation.

The rule-based chatbots segment is predicted to hold the largest market share through the forecast period.

Based on the type, the chatbot for banking market is classified into rule-based chatbots and AI-powered chatbots. Among these, the rule-based chatbots segment is predicted to hold the largest market share through the forecast period. This is due to their straightforward functionality and ease of implementation. These chatbots operate based on predefined rules and scripts, making them an attractive option for businesses looking to enhance customer service without the complexity of advanced AI systems. Their ability to handle common inquiries efficiently allows organizations to streamline operations, reduce response times, and improve user satisfaction,

The mobile application segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the chatbot for banking market is divided into website, contact centers, social media, and mobile application. Among these, the mobile application segment is anticipated to hold the highest market share during the projected timeframe. This is driven by the increasing reliance on mobile devices for banking and financial services. As consumers seek convenient, on-the-go solutions for managing their finances, banks and financial institutions are investing in mobile apps integrated with chatbot functionality. This trend reflects a broader shift towards digitization and the need for seamless user experiences, positioning mobile applications as a critical component in the evolving landscape of banking services.

North America is estimated to hold the largest share of the chatbot for banking market over the forecast period.

North America is estimated to hold the largest share of the chatbot for banking market over the forecast period. Largely due to the region's advanced technological infrastructure and high adoption rate of digital banking solutions. The presence of major financial institutions and tech companies fosters innovation and investment in chatbot technologies, enabling banks to enhance customer engagement and operational efficiency. Additionally, the growing consumer expectation for personalized and immediate service further drives the demand for chatbots in this market.

Europe is expected to grow the fastest during the forecast period. This is fueled by increasing digital transformation initiatives and a strong emphasis on enhancing customer experiences in the banking sector. European banks are rapidly adopting chatbot technologies to streamline operations, reduce costs, and offer personalized services. This growth is also supported by regulatory frameworks promoting digital solutions, as well as a tech-savvy consumer base that increasingly prefers automated interactions for banking services.

Company Profiling

Major key players in the chatbot for banking market include Maruti Techlabs, Inbenta Technologies, Inc., Nuance Communications, Inc., Next IT Corporation, Kore.ai, Inc., CreativeVirtual, Pypestream, Nano Rep, Inc., Mindmeld, Inc., Ubisend, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Prime Bank Investment Ltd. (PBIL), a prominent merchant bank, has announced the launch of PrimeInvest, an AI-powered digital assistant chatbot. This innovative tool is designed to enhance client interactions in the investment banking sector in Bangladesh, representing a pioneering effort in the industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the chatbot for banking market based on the below-mentioned segments:

Global Chatbot for Banking Market, By Type

- Rule-based Chatbots

- AI-powered Chatbots

Global Chatbot for Banking Market, By Application

- Website

- Contact Centers

- Social Media

- Mobile Application

Global Chatbot for Banking Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa