Global Co-living Market Size to Worth USD 25.19 Billion by 2033

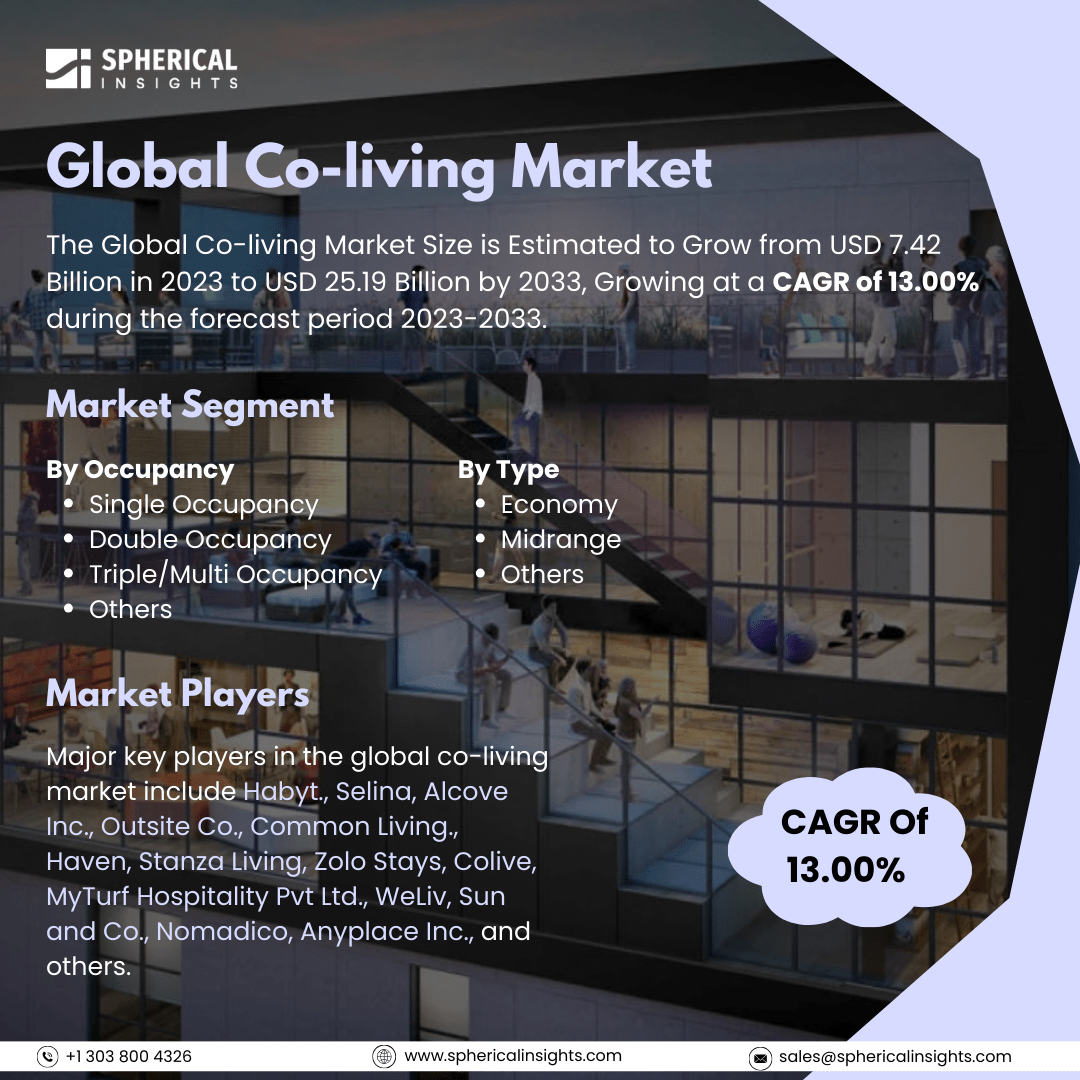

According to a research report published by Spherical Insights & Consulting, The Global Co-living Market Size is Estimated to Grow from USD 7.42 Billion in 2023 to USD 25.19 Billion by 2033, Growing at a CAGR of 13.00% during the forecast period 2023-2033.

Browse key industry insights spread across 215 pages with 110 Market data tables and figures & charts from the report on the Global Co-living Market Size, Share, and COVID-19 Impact Analysis, By Occupancy (Single Occupancy, Double Occupancy, Triple/Multi Occupancy, and Others), By Type (Economy, Midrange, and Others), By End-User (Students, Single Women, Working Class, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Sharing resources and living quarters is a growing trend in the global co-living market. Co-living is a contemporary type of communal living that provides reasonably priced housing options for individuals such as young professionals, students, and digital nomads. The growing cost of living in urban areas drives the demand for co-living spaces. Particularly for students and young professionals, co-living provides an affordable alternative as cities continue to grow and housing costs rise. Rent, utilities, and maintenance costs can be greatly decreased by sharing living quarters and common areas, making city living more affordable for those on a restricted budget. Co-living environments emphasize shared experiences and interactions to promote a feeling of community. Common areas such as kitchens, lounges, and coworking spaces are often advantageous to residents because they promote networking and teamwork. Since they place a higher value on relationships and experiences than material belongings, millennials and Gen Z find this appeal especially compelling. Co-living has become more popular due to the trend toward shared and sustainable consumption. With eco-friendly practices, pooled resources, and energy-efficient equipment, many of these areas are created with sustainability in mind. Co-living supports a more sustainable urban living model and is consistent with the values of environmentally conscious people by lowering individual consumption and promoting shared resource use. However, concerns about security and privacy are growing, restricting market expansion.

The single occupancy segment held the largest share of 45.63% in 2023 and is estimated to grow at a CAGR of 8.78% throughout the projection period.

Based on the occupancy, the global co-living market is categorized into single occupancy, double occupancy, triple/multi-occupancy, and others. Among these, the single occupancy segment held the largest share of 45.63% in 2023 and is estimated to grow at a CAGR of 8.78% throughout the projection period. Co-living encourages social interaction and shared experiences, but many residents—especially students and working professionals—value having a private place where they may relax work, or concentrate on personal tasks without being disturbed. Rising incomes and a desire for better living arrangements are also contributing factors to this trend, which enables people to afford single occupancy while yet taking advantage of communal amenities and a feeling of community. The post-pandemic focus on cleanliness and health has increased demand for private areas in shared accommodation, which makes single occupancy a desirable option for people looking to strike a balance between freedom and closeness.

The economy segment accounted for the largest share of 52.09% in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the global co-living market is classified into economy, midrange, and others. Among these, the economy segment accounted for the largest share of 52.09% in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The economy type also serves people who value functionality over luxury, providing shared spaces and services that meet basic living needs without incurring high expenses. As urbanization and housing costs continue to rise, the economy segment offers a sustainable solution for those seeking affordable housing without compromising on connectivity, convenience, and access to communal experiences. This segment enables residents to enjoy essential amenities and community living at a lower cost, making it an appealing alternative to traditional rental options in pricey cities.

The students segment held the largest market share of 27.10% in 2023 and is estimated to grow at a CAGR of 7.19% throughout the projection period.

Based on the end-user, the global co-living market is divided into students, single women, working class, and others. Among these, the students segment held the largest market share of 27.10% in 2023 and is estimated to grow at a CAGR of 7.19% throughout the projection period. Co-living spaces provide a convenient, cost-effective, and community-focused substitute for traditional student accommodation, which is either costly or scarce. These areas meet the needs of students looking for comfort and connection by offering fully furnished rooms, communal utilities, and an inviting environment that encourages social contact and teamwork. Furthermore, co-living facilities frequently place a high value on being close to colleges, public transportation, and other necessities, which makes them the perfect option for students looking for convenience.

Asia Pacific is expected to hold the largest share of the global co-living market through the forecast period.

Asia Pacific is expected to hold the largest share of the global co-living market through the forecast period. The popularity of co-living spaces has been fueled by the region's growing disposable incomes as well as the incorporation of smart technologies and first-rate amenities. Co-living is still a popular way to satisfy the region's rising housing demand as a result of public and private investments in urban housing infrastructure. These issues are resolved by co-living facilities, which offer affordable, adaptable lodging in desirable urban areas. Co-living spaces are intended to provide the convenience and community-focused living arrangements that the younger generation in the area, particularly millennials and Gen Z, prefers.

North America is predicted to grow at the fastest CAGR of the global co-living market over the forecast period. The housing affordability issue in major U.S. and Canadian cities such as New York, Los Angeles, and Toronto is pushing young professionals, remote workers, and students to look for affordable living options. To overcome these obstacles, co-living facilities provide shared housing options with contemporary conveniences, adjustable lease terms, and an inherent feeling of community. Furthermore, the growing popularity of remote and hybrid work models has raised the demand for housing arrangements that offer networking possibilities and coworking spaces in addition to convenience.

Company Profiling

Major key players in the global co-living market include Habyt., Selina, Alcove Inc., Outsite Co., Common Living., Haven, Stanza Living, Zolo Stays, Colive, MyTurf Hospitality Pvt Ltd., WeLiv, Sun and Co., Nomadico, Anyplace Inc., and others.

Recent Developments

- In March 2024, Zolo Stays announced the opening of "Zolo Diya," a co-living facility exclusively for women in Mathikere, Bengaluru, that is run by women. In keeping with the theme 'Invest in Women: Accelerate Progress,' the program was launched on International Women's Day to empower women by creating inclusive and safe home environments. 50% of the property was already occupied during the pre-launch stage. Offering fully equipped rooms with features like fast Wi-Fi, round-the-clock security, and daily housekeeping, Zolo Diya appeals to professionals and students looking for a welcoming community setting.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global co-living market based on the below-mentioned segments:

Global Co-living Market, By Occupancy

- Single Occupancy

- Double Occupancy

- Triple/Multi Occupancy

- Others

Global Co-living Market, By Type

Global Co-living Market, By End-User

- Students

- Single Women

- Working Class

- Others

Global Co-living Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa