Global Constrained Layer Damping Market Size to worth USD 911.99 Million by 2033

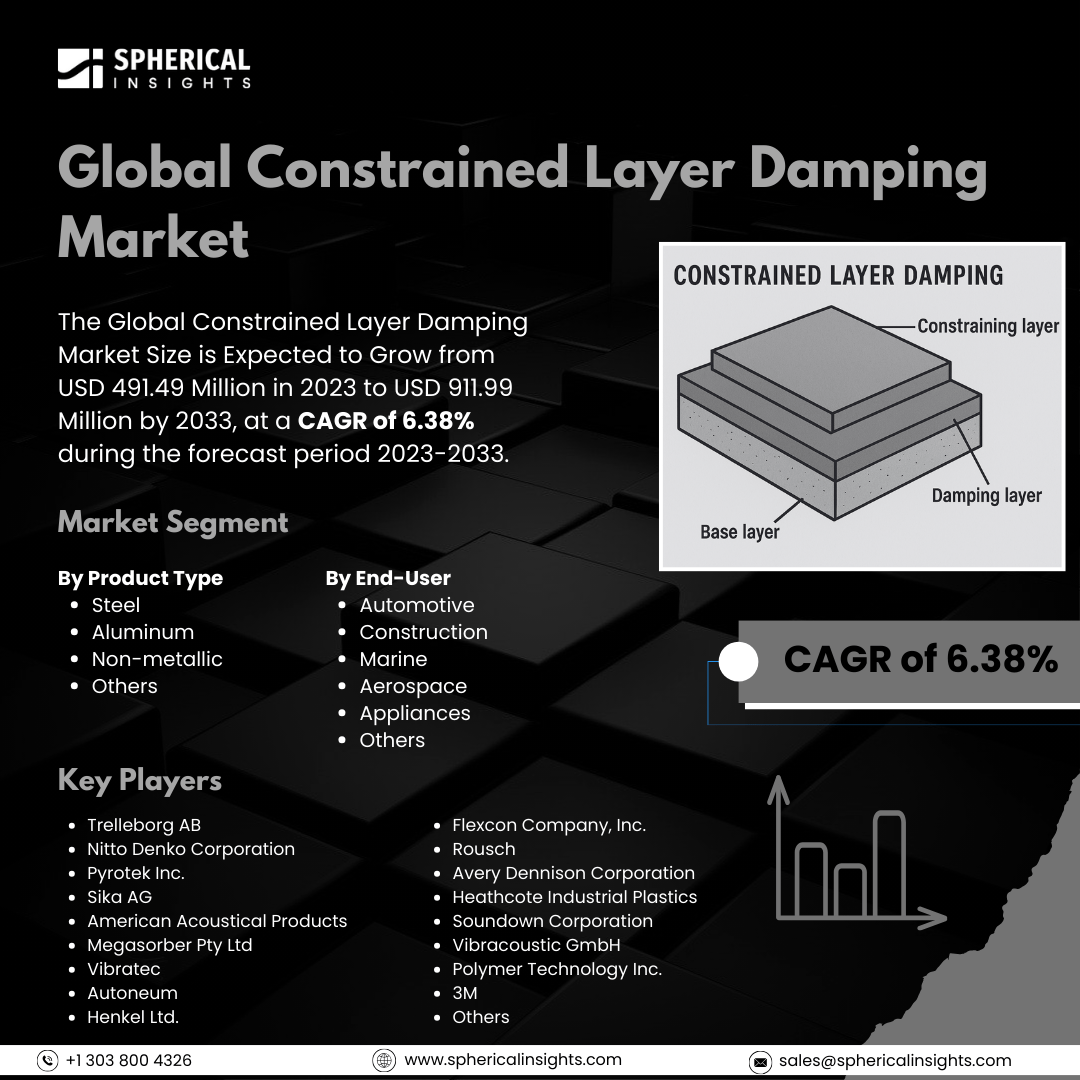

According to a research report published by Spherical Insights & Consulting, The Global Constrained Layer Damping Market Size is Expected to Grow from USD 491.49 Million in 2023 to USD 911.99 Million by 2033, at a CAGR of 6.38% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Constrained Layer Damping Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Steel, Aluminum, Non-metallic, and Others), By End-User (Automotive, Construction, Marine, Aerospace, Appliances, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The market for constrained layer damping (CLD) is centered on creating and implementing methods and materials to dampen vibrations and lower noise levels in structures and machines. These systems improve performance and durability by encasing a viscoelastic material between two stiff layers. They are extensively utilized in sectors like electronics, automobiles, aircraft, construction, and industrial gear to increase comfort, safety, and product lifetime. Constrained layer damping (CLD) is a technique used to reduce vibrations in machinery, such as ship constructions and mounted machinery, by trapping surface vibrations between two stiff sheets and degrading them as sheer energy. The automotive industry is focusing on reducing weight and improving noise, vibration, and harshness performance, leading to increased demand for lightweight acoustic materials. Constrained layer damping (CDC) is an efficient technique for subduing vibration and sound in heavy vehicles, driving growth in the market. This aims to reduce noise, vibration, and harshness impacts, ultimately lowering fuel consumption. However, the report evaluates market restraints, drivers, and factors affecting growth, enabling strategic planning and understanding lucrative opportunities. It also incorporates expert opinions for better market understanding.

The steel segment accounted highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product type, the constrained layer damping market is divided into steel, aluminum, non-metallic, and others. Among these, the steel segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Steel is a strong and durable material ideal for maintaining structural integrity in composite laminated layer (CLD) systems. Its stiffness and rigidity contribute to the overall strength and load-bearing capacity of the composite, making it an ideal choice for CLD applications.

The automotive segment accounted greatest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the constrained layer damping market is divided into automotive, construction, marine, aerospace, appliances, and others. Among these, the automotive segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Constrained layer damping (CLD) is a technique used in various industries to enhance product performance. In the automotive sector, it reduces noise and vibrations in vehicle parts like floor panels, firewall, roof, and doors. In the aerospace sector, it reduces vibrations in critical areas like wings and engine mounts. CLD's versatility and effectiveness make it a preferred choice for enhancing user experience.

Asia Pacific is estimated to hold the largest share of the constrained layer damping market over the forecast period.

Asia Pacific is estimated to hold the largest share of the constrained layer damping market over the forecast period. Carbon-Like Carbon (CLD) technology is being used in the Asia Pacific area, especially in China, South Korea, and Japan, to enhance the acoustics and comfort of automobiles. This is because to the region's expanding industrialization and economy, which has improved the overall driving experience by significantly lowering noise and vibrations in internal car components.

North America is predicted to have the fastest CAGR growth in the constrained layer damping market over the forecast period. North America's aerospace industry uses Carbon Fiber (CLD) to address vibration challenges in aircraft structures, enhancing passenger comfort and safety. CLD is also used in the industrial sector to mitigate noise and vibrations in machinery and equipment, improving working environment and equipment performance. In the construction industry, it minimizes structure-borne noise transmission, providing a more peaceful living or working space.

Company Profiling

Major key players in the constrained layer damping market include Trelleborg AB, Nitto Denko Corporation, Pyrotek Inc., Sika AG, American Acoustical Products, Megasorber Pty Ltd, Vibratec, Autoneum, Henkel Ltd., Flexcon Company, Inc, Rousch, Avery Dennison Corporation, Heathcote Industrial Plastics, Soundown Corporation, Vibracoustic Gmbh, Polymer Technology Inc., 3M, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the constrained layer damping market based on the below-mentioned segments:

Global Constrained Layer Damping Market, By Product Type

- Steel

- Aluminum

- Non-metallic

- Others

Global Constrained Layer Damping Market, By End-User

- Automotive

- Construction

- Marine

- Aerospace

- Appliances

- Others

Global Constrained Layer Damping Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa