Global Consumer Credit Market Size to worth USD 19.08 Billion by 2033

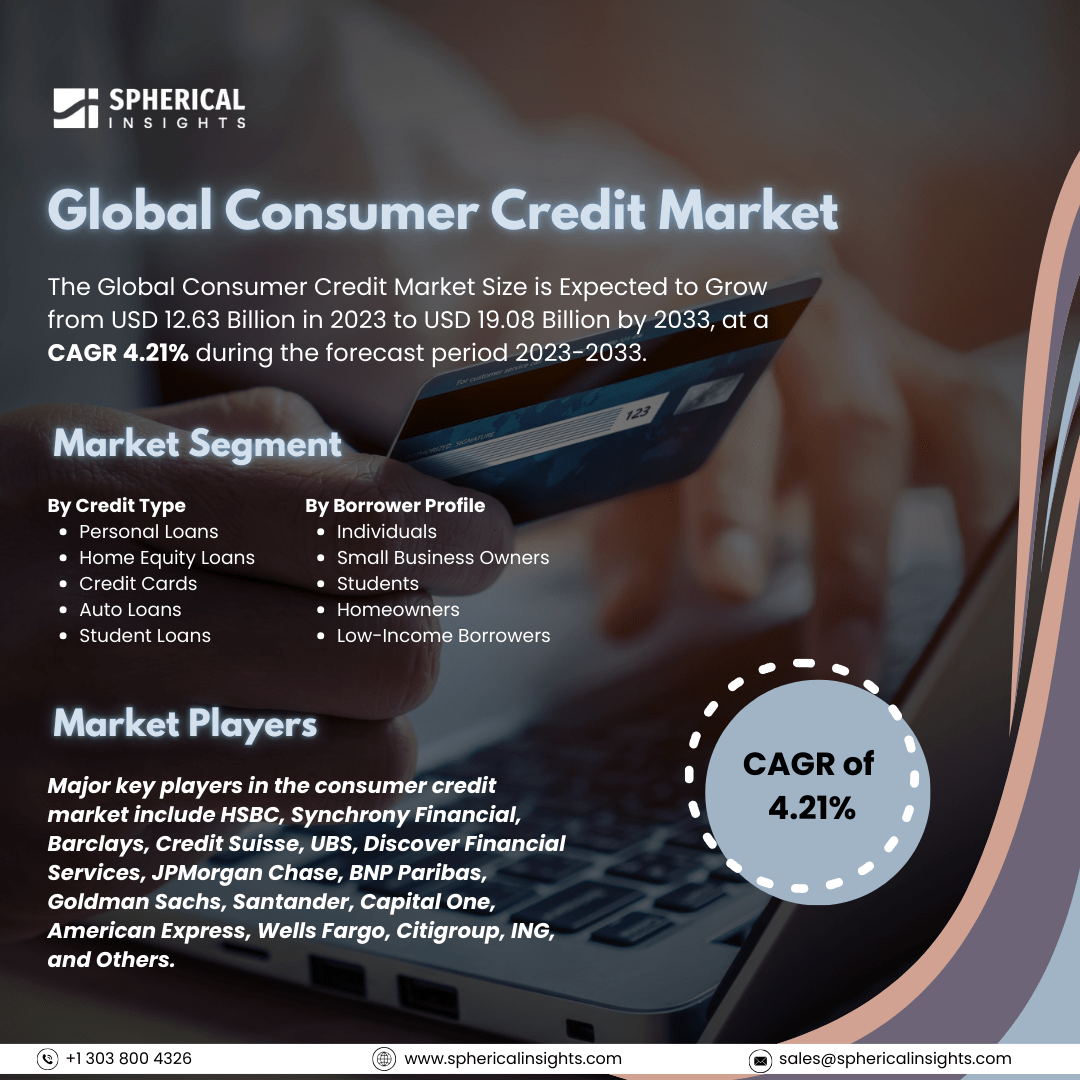

According to a research report published by Spherical Insights & Consulting, The Global Consumer Credit Market Size is Expected to Grow from USD 12.63 Billion in 2023 to USD 19.08 Billion by 2033, at a CAGR 4.21% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Consumer Credit Market Size, Share, and COVID-19 Impact Analysis, By Credit Type (Personal Loans, Home Equity Loans, Credit Cards, Auto Loans, and Student Loans), By Borrower Profile (Individuals, Small Business Owners, Students, Homeowners, and Low-Income Borrowers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The consumer credit market refers to the sector that provides money lending services enabling individuals to purchase goods and services immediately. This market encompasses various financial products such as credit cards, personal loans, and mortgages. A range of factors influences the consumer credit market, including the increase in consumer income, which leads to a greater demand for credit to sustain their lifestyle. The growth of online shopping and banking has heightened the appetite for digital credit solutions. Fintech firms are innovating and introducing new financial products and services, including mobile banking and peer-to-peer lending. Efforts by the government and financial technology companies aim to enhance the accessibility of financial services. Consumers are seeking adaptable repayment solutions, tailored credit offers, and short-term loan options. The disparity between income and expenses is expanding, thereby raising the financial requirements of consumers. The consumer credit market faces several limitations, including stringent compliance requirements imposed by governments and financial regulators on lenders that may hinder their capacity to provide flexible financing. Elevated interest rates can raise borrowing costs, potentially decreasing loan demand. As the number of loans taken out rises, the risk of consumer debt defaults increases, particularly during economic downturns. Lenders tend to exercise greater caution in extending credit amid economic instability and the threat of recession. Numerous potential borrowers may lack awareness of available financing options or effective debt management strategies. Digital payment systems face risks associated with fraud, data breaches, and unauthorized access.

The credit cards segment is predicted to hold the largest market share through the forecast period.

Based on the credit type, the consumer credit market is classified into personal loans, home equity loans, credit cards, auto loans, and student loans. Among these, the credit cards segment is predicted to hold the largest market share through the forecast period. Consumers have widely embraced credit cards for daily transactions and online shopping due to their convenience, security features, and rewards programs, making them more appealing and encouraging increased spending. Moreover, the growing trend towards cashless payments and heightened consumer awareness of credit card advantages reinforce their market dominance, positioning them as a preferred option for many.

The individuals segment is anticipated to hold the highest market share during the projected timeframe.

Based on the borrower profile, the consumer credit market is divided into individuals, small business owners, students, homeowners, and low-income borrowers. Among these, the individuals segment is anticipated to hold the highest market share during the projected timeframe. due to the increasing demand for personalized financial products and services tailored to individual needs. As consumers become more financially savvy and seek greater control over their financial decisions, there is a growing preference for credit options that cater specifically to personal circumstances, such as tailored credit limits and customized repayment plans.

North America is estimated to hold the largest share of the consumer credit market over the forecast period.

North America is estimated to hold the largest share of the consumer credit market over the forecast period. This growth is supported by a strong economy, elevated consumer spending levels, and a sophisticated credit infrastructure. The region's well-established financial institutions and diverse credit offerings provide consumers with easy access to credit, fostering a vibrant credit market. Additionally, the growing inclination towards digital payment options and the emergence of fintech companies enhance competition and drive innovation, reinforcing North America's prominence in consumer credit.

Europe is expected to grow the fastest during the forecast period. The growth market is propelled by both rising consumer interest in innovative financial products and the swift uptake of digital banking solutions. The regulatory framework in the region is also adapting to foster fintech expansion and improve consumer protection, encouraging more companies to enter the market. Furthermore, the increasing focus on sustainable finance and green credit offerings aligns with consumer preferences, further propelling growth in the European consumer credit sector.

Company Profiling

Major key players in the consumer credit market include HSBC, Synchrony Financial, Barclays, Credit Suisse, UBS, Discover Financial Services, JPMorgan Chase, BNP Paribas, Goldman Sachs, Santander, Capital One, American Express, Wells Fargo, Citigroup, ING, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In April 2024, President Bola Tinubu has sanctioned the initiation of the first phase of the Consumer Credit Scheme in Nigeria, a program aimed at providing credit options to employed citizens in the nation. The President’s special adviser on media and publicity, Ajuri Ngelale, announced this in a statement.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the consumer credit market based on the below-mentioned segments:

Global Consumer Credit Market, By Credit Type

- Personal Loans

- Home Equity Loans

- Credit Cards

- Auto Loans

- Student Loans

Global Consumer Credit Market, By Borrower Profile

- Individuals

- Small Business Owners

- Students

- Homeowners

- Low-Income Borrowers

Global Consumer Credit Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa