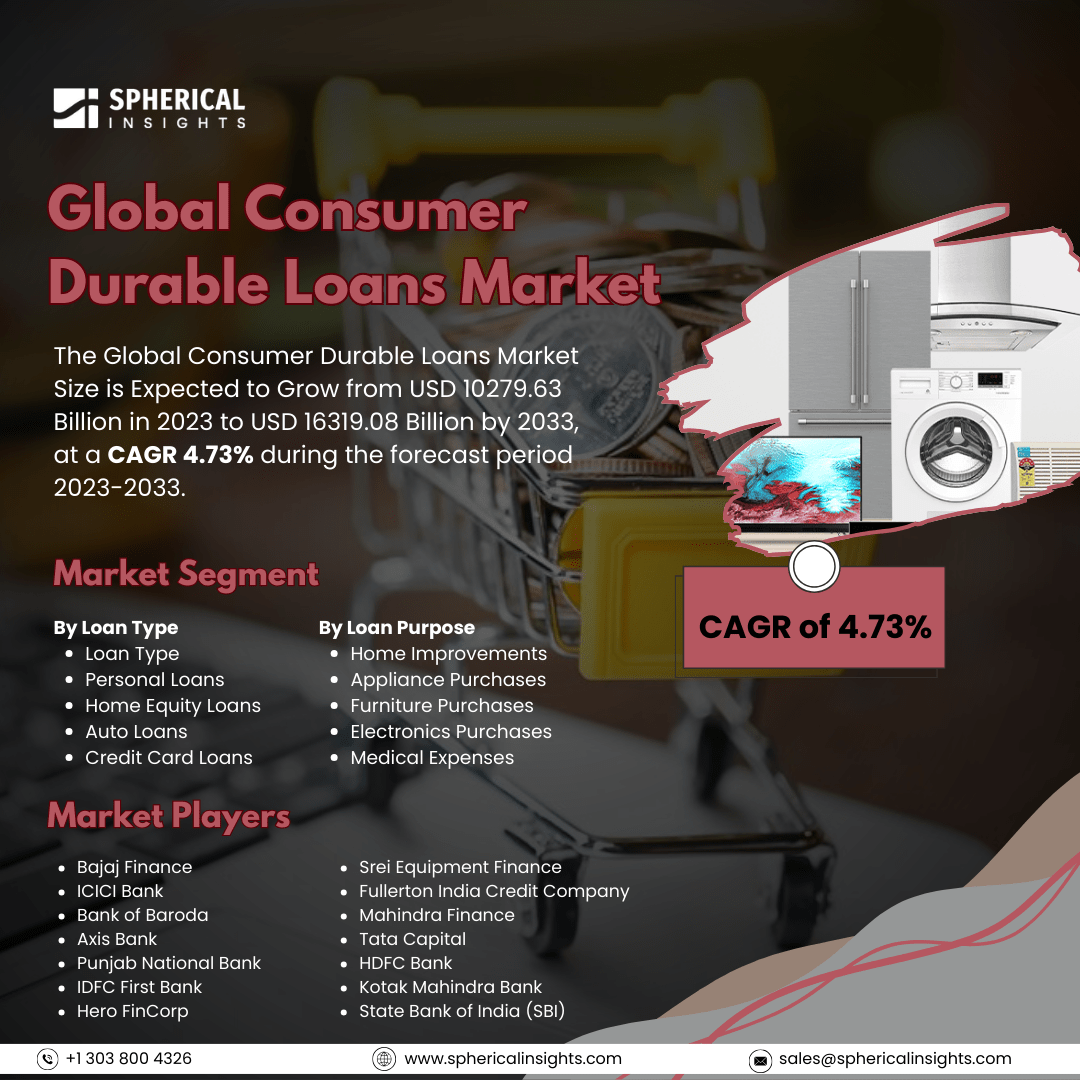

Global Consumer Durable Loans Market Size to worth USD 16319.08 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Consumer Durable Loans Market Size is Expected to Grow from USD 10279.63 Billion in 2023 to USD 16319.08 Billion by 2033, at a CAGR 4.73% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Consumer Durable Loans Market Size, Share, and COVID-19 Impact Analysis, By Loan Type (Personal Loans, Home Equity Loans, Auto Loans, and Credit Card Loans), By Loan Purpose (Home Improvements, Appliance Purchases, Furniture Purchases, Electronics Purchases, and Medical Expenses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The consumer durable loan market refers to the sector that offers loans for the purchase of household appliances, electronic devices, and other durable goods. Key factors driving the Consumer Durable Loan Market include increased disposable income, growing urban populations, heightened consumer aspirations, advancements in technology, easier access to financing via online channels, evolving lifestyles, government programs that support affordable financing, and a rising middle class, all of which lead to a greater demand for consumer durables, thereby making financing options such as consumer durable loans more appealing. However, the consumer durable loan market also encounters several challenges, such as economic fluctuations like inflation or recessions that may discourage consumers from purchasing high-value items. Lenders also confront credit risk when extending loans to consumers with inconsistent or unstable incomes. Elevated interest rates can render loans less affordable, potentially leading to increased debt levels. Additionally, the consumer durable loan market is characterized by intense competition.

The auto loans segment is predicted to hold the largest market share through the forecast period.

Based on the loan type, the consumer durable loans market is classified into personal loans, home equity loans, auto loans, and credit card loans. Among these, the auto loans segment is predicted to hold the largest market share through the forecast period. Several factors contribute to the increasing accessibility of vehicle ownership, such as the decreasing costs of cars and the growing demand for personal transportation. With low-interest rates and diverse financing options, more people are choosing to finance their vehicles, which makes owning a car more attainable. Furthermore, the rising interest in electric and hybrid vehicles is likely to boost demand in this category, as consumers look for ways to finance these modern alternatives.

The home improvements segment is anticipated to hold the highest market share during the projected timeframe.

Based on the loan purpose, the consumer durable loans market is divided into home improvements, appliance purchases, Furniture purchases, electronics purchases, and medical expenses. Among these, the home improvement is anticipated to hold the highest market share during the projected timeframe. This growth is propelled by a rise in home improvement projects and an increasing focus on home aesthetics and practicality. As more homeowners commit to enhancements that improve their living environments, the need for financing solutions for these endeavors is on the rise. Factors like increasing home equity and attractive loan conditions are motivating consumers to pursue major renovations, contributing to the growth and significance of this segment in the market.

North America is estimated to hold the largest share of the consumer durable loans market over the forecast period.

North America is estimated to hold the largest share of the consumer durable loans market over the forecast period. This growth is primarily influenced by a robust economy, elevated disposable income, and a consumer-focused culture. The region's well-established infrastructure, along with the widespread availability of financing solutions, enables consumers to secure loans for durable goods such as appliances, electronics, and furniture easily. The rising trend of upgrading home and lifestyle products, coupled with a growing dependence on credit, is anticipated to reinforce North America's dominant role in this market.

Asia Pacific is expected to grow the fastest during the forecast period. The swift urbanization, a burgeoning middle class, and heightened consumer spending on durable goods these factors are driving the growth of market. As economies in this area continue to grow, a greater number of consumers are seeking loans to finance their purchases, particularly in emerging markets where credit access is improving. Moreover, advancements in technology and the rise of digital lending platforms are making it easier for consumers to obtain loans for durable goods, further enhancing the region's growth potential in this industry.

Company Profiling

Major key players in the consumer durable loans market include Bajaj Finance, ICICI Bank , Bank of Baroda , Axis Bank, Punjab National Bank, IDFC First Bank, Hero FinCorp, Srei Equipment Finance, Fullerton India Credit Company, Mahindra Finance,Tata Capital, HDFC Bank, Kotak Mahindra Bank,State Bank of India (SBI), and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the consumer durable loans market based on the below-mentioned segments:

Global Consumer Durable Loans Market, By Loan Type

- Loan Type

- Personal Loans

- Home Equity Loans

- Auto Loans

- Credit Card Loans

Global Consumer Durable Loans Market, By Loan Purpose

- Home Improvements

- Appliance Purchases

- Furniture Purchases

- Electronics Purchases

- Medical Expenses

Global Consumer Durable Loans Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa