Global Credit Rating Software Market Size to worth USD 4.68 Billion by 2033

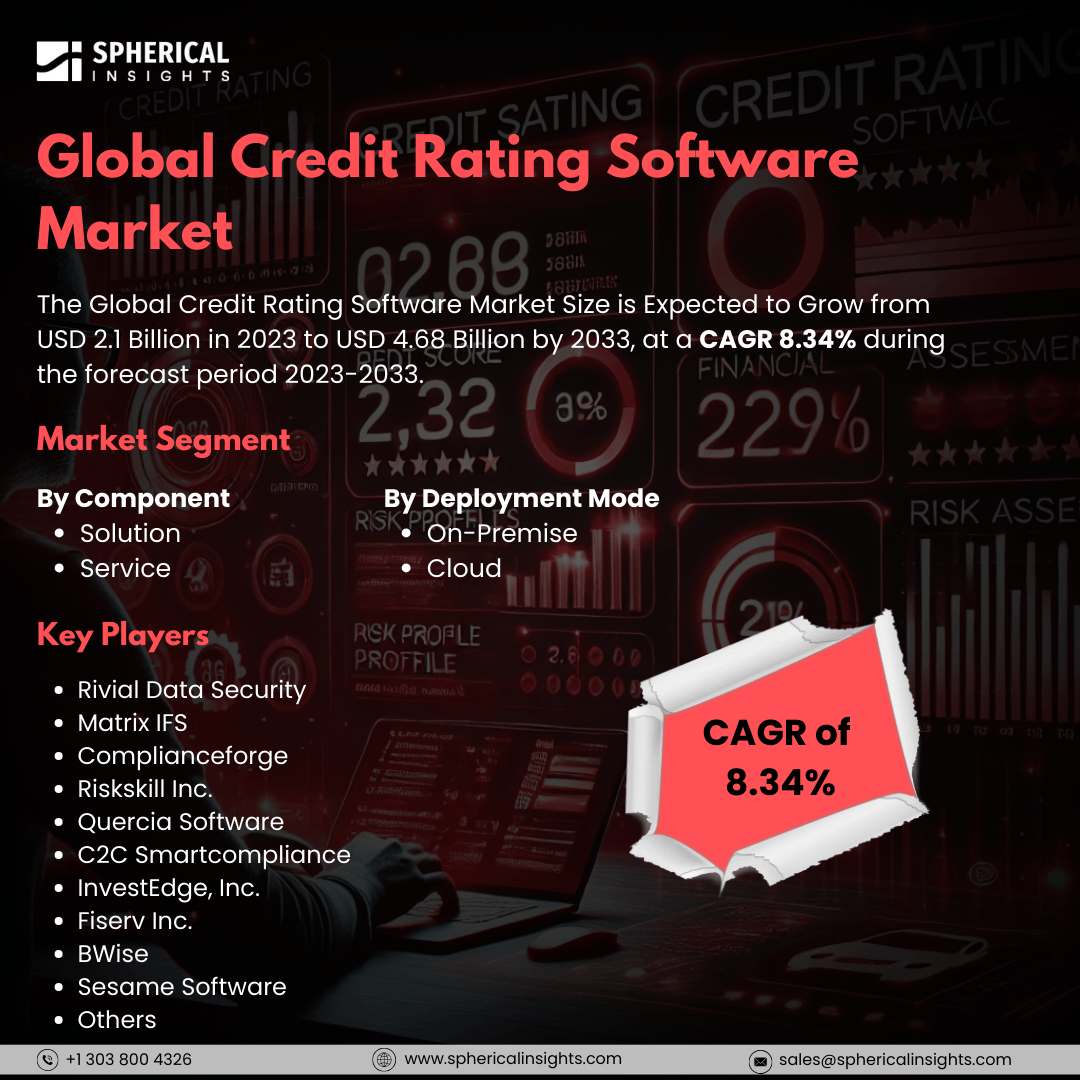

According to a research report published by Spherical Insights & Consulting, The Global Credit Rating Software Market Size is Expected to Grow from USD 2.1 Billion in 2023 to USD 4.68 Billion by 2033, at a CAGR 8.34% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Credit Rating Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Service), By Deployment Mode (On-Premise, Cloud), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Credit rating software is a program that financial institutions and lenders use to assess the creditworthiness of potential borrowers. It analyzes various data, including employment history and credit history, to generate a credit score for the borrower. Key drivers of the credit rating software market include the need for financial institutions to comply with strict regulations such as the Dodd-Frank Act and Basel III, which mandate robust risk management systems. Lenders are increasingly using alternative data sources, such as social media activity, to evaluate borrower’s creditworthiness. Additionally, AI-powered scoring models enhance the accuracy and efficiency of credit assessments. There is also a growing demand for timely and accurate credit risk assessments, as well as for solutions that integrate credit risk rating with other risk management functions, like fraud detection. However, the credit rating software market faces several challenges that may hinder its growth. Regulatory compliance complexities present a significant obstacle, as companies must navigate various financial regulations that can differ widely by region. Furthermore, the rise of competition from alternative credit assessment models, including those leveraging machine learning and big data analytics, can threaten traditional credit rating systems.

The solution segment is predicted to hold the largest market share through the forecast period.

Based on the component, the credit rating software market is classified into solution, service. Among these, the solution segment is predicted to hold the largest market share through the forecast period. Organizations are increasingly seeking integrated solutions that address various business needs, aiming to streamline operations, enhance productivity, and improve decision-making processes. The growing emphasis on automation, data analytics, and customer relationship management is driving the demand for these solutions. As businesses prioritize efficiency and innovation, the solution segment is expected to dominate the market, supported by ongoing advancements and the rising adoption of cloud-based technologies.

The cloud segment is anticipated to hold the highest market share during the projected timeframe.

Based on the deployment mode, the credit rating software market is divided into on-premise, cloud. Among these, the cloud segment is anticipated to hold the highest market share during the projected timeframe. This growth is primarily driven by the increasing preference for flexible and scalable IT infrastructure. Many organizations are migrating to cloud solutions to take advantage of benefits such as cost-effectiveness, enhanced accessibility, and improved collaboration. The rise of remote work, along with the need for real-time data processing and analytics, has accelerated the adoption of cloud technologies. As companies recognize the strategic advantages of cloud computing, this segment is poised for significant growth, positioning it as a leader in the market.

North America is estimated to hold the largest share of the credit rating software market over the forecast period.

North America is estimated to hold the largest share of the credit rating software market over the forecast period. The robust financial services sector and the presence of well-established credit rating agencies drive the demand for advanced software solutions. The high demand for accurate credit assessments and risk management tools is evident among banks, investment firms, and corporate entities. Additionally, stringent regulatory requirements and a strong focus on compliance further fuel the growth of credit rating software in North America, making it a key player in the global market.

Asia Pacific is expected to grow the fastest during the forecast period. Rapid economic development, increasing financial inclusion, and a burgeoning middle class are contributing to the rise in demand for advanced financial technologies, including credit rating software. The region's expanding digital infrastructure and rising internet penetration are fostering the adoption of these technologies. Furthermore, governments and financial institutions are investing in technological innovations to enhance credit assessment processes. As businesses in Asia Pacific recognize the importance of reliable credit ratings, the demand for sophisticated software solutions is set to surge, positioning the region for significant growth.

Company Profiling

Major key players in the credit rating software market includes Rivial Data Security, Matrix IFS, Complianceforge, Riskskill Inc., Quercia Software, C2C Smartcompliance, investedge, inc., Fiserv Inc., BWise, Sesame Software, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the credit rating software market based on the below-mentioned segments:

Global Credit Rating Software Market, By Component

Global Credit Rating Software Market, By Deployment Mode

Global Credit Rating Software Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa