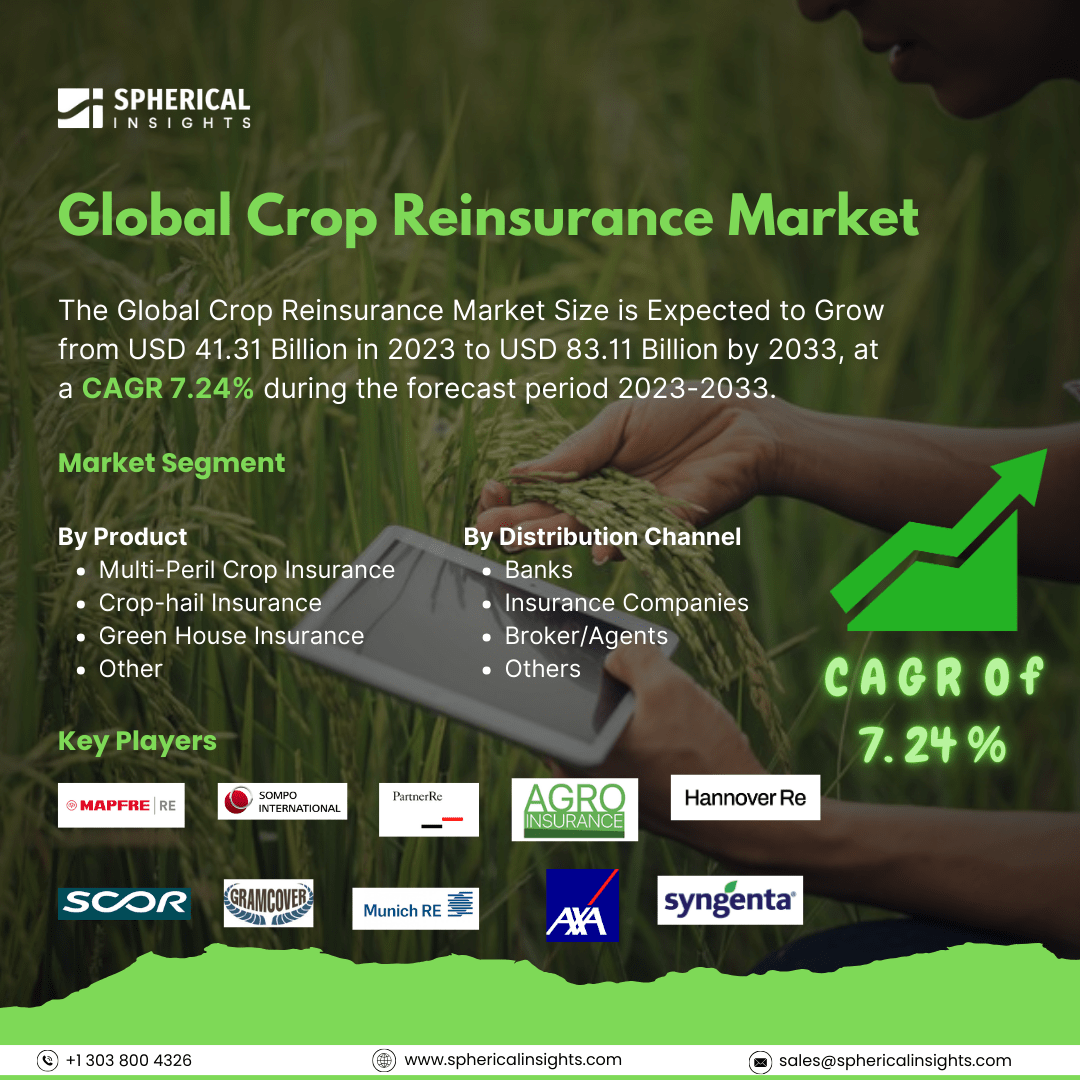

Global Crop Reinsurance Market Size to worth USD 83.11 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Crop Reinsurance Market Size is Expected to Grow from USD 41.31 Billion in 2023 to USD 83.11 Billion by 2033, at a CAGR 7.24% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Crop Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Product (Multi-Peril Crop Insurance, Crop-hail Insurance, Green House Insurance, and Other), By Distribution Channel (Banks, Insurance Companies, Broker/Agents, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The crop reinsurance market offers financial protection to crop insurers against losses resulting from natural disasters, pests, and diseases. It serves as a safeguard for farmers against financial losses due to crop failures. Moreover, several factors drive the demand for crop reinsurance, including the increasing frequency and severity of climate-related disasters, such as droughts, floods, hurricanes, and wildfires. Also, government initiatives aimed at promoting agricultural risk management can considerably enhance the crop insurance market. The growing use of technology in risk assessment and underwriting is also boosting the expansion of the agriculture reinsurance market. However, some factors can hinder the crop reinsurance market. High premiums for reinsurance can be unaffordable for farmers, particularly in developing regions, which may result in underinsurance or a complete lack of coverage. Moreover, complex policy terms, eligibility criteria, and claims procedures can make it challenging for farmers to understand the insurance offerings. This complexity can discourage farmer’s especially small-scale ones from investing in insurance. Furthermore, overly complicated regulatory requirements can stifle competition and innovation in insurance products.

The crop-hail Insurance segment is predicted to hold the largest market share through the forecast period.

Based on the product, the crop reinsurance market is classified into multi-peril crop insurance, crop-hail Insurance, green house insurance, and other. Among these, the crop-hail Insurance segment is predicted to hold the largest market share through the forecast period. This is due to the increasing frequency of extreme weather events, especially hailstorms, there are substantial risks to agricultural yields. Crop-hail insurance provides farmers with financial protection against losses resulting from hail damage, ensuring their economic stability and encouraging ongoing investment in agricultural practices. As climate change leads to more unpredictable weather patterns, the demand for crop-hail insurance is likely to rise, solidifying its role as a key component in the agricultural insurance market.

The broker/agents segment is anticipated to hold the highest market share during the projected timeframe.

Based on the distribution channel, the crop reinsurance market is divided into banks, insurance companies, broker/agents, and others. Among these, the broker/agents segment is anticipated to hold the highest market share during the projected timeframe. As brokers and agents, play a crucial role in connecting farmers with insurance providers. Their expertise in understanding farmers' specific needs and the complexities of insurance products enables them to tailor solutions effectively, enhancing customer satisfaction and retention. Furthermore, as the agricultural sector becomes more sophisticated, brokers and agents are increasingly relied upon to provide insights and guidance on risk management strategies, further driving demand for their services.

North America is estimated to hold the largest share of the crop reinsurance market over the forecast period.

North America is estimated to hold the largest share of the crop reinsurance market over the forecast period. The crop reinsurance market is driven by a well-established agricultural sector and a growing emphasis on risk management among farmers and insurers. The region's diverse crop production and the use of advanced farming technologies create a significant need for reinsurance solutions that can mitigate potential losses from adverse weather and market fluctuations. Additionally, existing regulatory frameworks and financial support systems enhance the attractiveness of the crop reinsurance market in the region.

Europe is expected to grow the fastest during the forecast period. The market is driven by increasing awareness of agricultural insurance products and a growing emphasis on sustainable farming practices. The region's commitment to enhancing food security and resilience against the impacts of climate change drives demand for innovative insurance solutions. Furthermore, supportive government policies and initiatives aimed at boosting agricultural productivity contribute to the rapid growth of the crop insurance and related services market, making Europe a dynamic and evolving landscape.

Company Profiling

Major key players in the crop reinsurance market includes Mapfre Re, Sompo International Holdings Ltd., Partner Re, Agroinsurance, Hanover Re, Scor Re, Gramcover, Munich Re, AXA XL, Syngenta, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Lockton Re, a prominent global reinsurance broker, has announced a strategic partnership with Verisk (Nasdaq: VRSK), a leading provider of data analytics and technology. This collaboration aims to introduce new (re)insurance products to the market. Lockton Re will utilize Verisk’s agricultural risk modeling solutions, including the Multiple Peril Crop Insurance (MPCI) and Crop Hail Model for the United States, to analyze how climate change and meteorological factors are affecting crop production and potential insured losses.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the crop reinsurance market based on the below-mentioned segments:

Global Crop Reinsurance Market, By Product

- Multi-Peril Crop Insurance

- Crop-hail Insurance

- Green House Insurance

- Other

Global Crop Reinsurance Market, By Distribution Channel

- Banks

- Insurance Companies

- Broker/Agents

- Others

Global Crop Reinsurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa