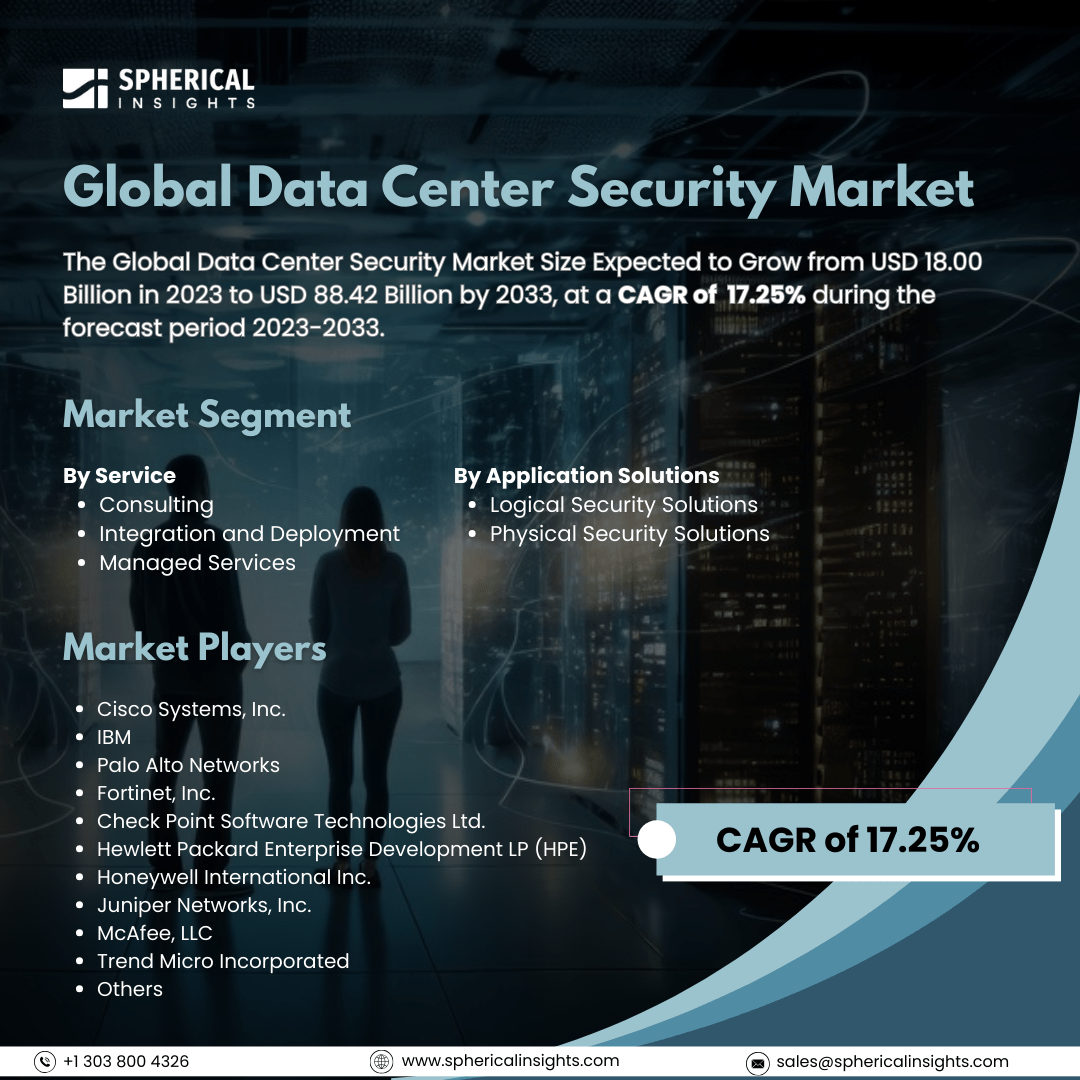

Global Data Center Security Market Size to Exceed USD 88.42 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Data Center Security Market Size Expected to Grow from USD 18.00 Billion in 2023 to USD 88.42 Billion by 2033, at a CAGR of 17.25% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Data Center Security Market Size, Share, and COVID-19 Impact Analysis, By Service (Consulting, Integration and Deployment, and Managed Services), By Application Solutions (Logical Security Solutions and Physical Security Solutions), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The data center security market would be defined as the industry involved in the protection of data centers from cyber-attacks, physical breaks, and operation disruptions. Security solutions such as firewalls, intrusion detection systems, encryption, access control, and surveillance all fall within its scope. This ensures the availability, integrity, and confidentiality of critical IT infrastructure. Moreover, Rising cyber threats, data breaches, and the rising adoption of cloud computing and IoT technologies are propelling the market for data center security. Compliance requirements from stricter regulations force organizations to spend more on high-end security solutions. The market grows with rising demand for AI-driven threat detection, zero-trust architecture, and encryption technologies. Hyperscale data center expansion and rising edge computing require robust security frameworks. The growing digital transformation across industries and increased investment in cybersecurity accelerate market adoption. However, the restraints of the data center security market include high implementation costs, complexity in integrating security solutions, evolving cyber threats, and compliance challenges. Also, the shortage of skilled cybersecurity professionals is a restraint on the growth and adoption of the market.

The managed services segment accounted for a substantial share of the global data center security market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of service, the global data center security market is divided into consulting, integration, deployment, and managed services. Among these, the managed services segment accounted for a substantial share of the global data center security market in 2023 and is anticipated to grow at a rapid pace during the projected period. Increasing cyber threats, rising cloud adoption, and the need for continuous monitoring drive demand. Organizations prefer outsourcing security management for cost efficiency, real-time threat detection, and compliance with evolving regulations.

The logical security solutions segment accounted for the largest share of the global data center security market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of application solutions, the global data center security market is divided into logical security solutions and physical security solutions. Among these, the logical security solutions segment accounted for the largest share of the global data center security market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Rising cyber threats, data breaches, and increasing cloud adoption drive demand for firewalls, encryption, and intrusion detection systems. Compliance regulations and the need for AI-driven threat detection further boost market growth.

North America is projected to hold the largest share of the global data center security market over the projected period.

North America is projected to hold the largest share of the global data center security market over the projected period. The region has hyperscale data centers, stringent cybersecurity regulations, and high adoption of cloud computing, which is driving demand. Moreover, the rising cyber threats and investments in AI-driven security solutions are further driving market growth.

Asia Pacific is expected to grow at the fastest CAGR growth of the global data center security market during the projected timeframe. Rapid digital transformation, increasing cloud adoption, and increasing threats in countries such as China, India, and Japan are fueling this market. In addition, government initiatives to protect data and expand hyperscale data centers result in accelerating demand for security solutions.

Major vendors in the global data center security market are Cisco Systems, Inc., IBM, Palo Alto Networks, Fortinet, Inc., Check Point Software Technologies Ltd., Hewlett Packard Enterprise Development LP, Honeywell International Inc., Juniper Networks, Inc., McAfee, LLC, Trend Micro Incorporated, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, Cisco Systems Inc. unveiled the latest innovation: Cisco Hypershield, a new security architecture; this is to restructure and reimagine the security of clouds and data centers, especially with the growing penetration of artificial intelligence technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global data center security market based on the below-mentioned segments:

Global Data Center Security Market, By Service

- Consulting

- Integration and Deployment

- Managed Services

Global Data Center Security Market, By Application Solutions

- Logical Security Solutions

- Physical Security Solutions

Global Data Center Security Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa