Global Debt Financing Market Size to worth USD 55.44 Billion by 2033

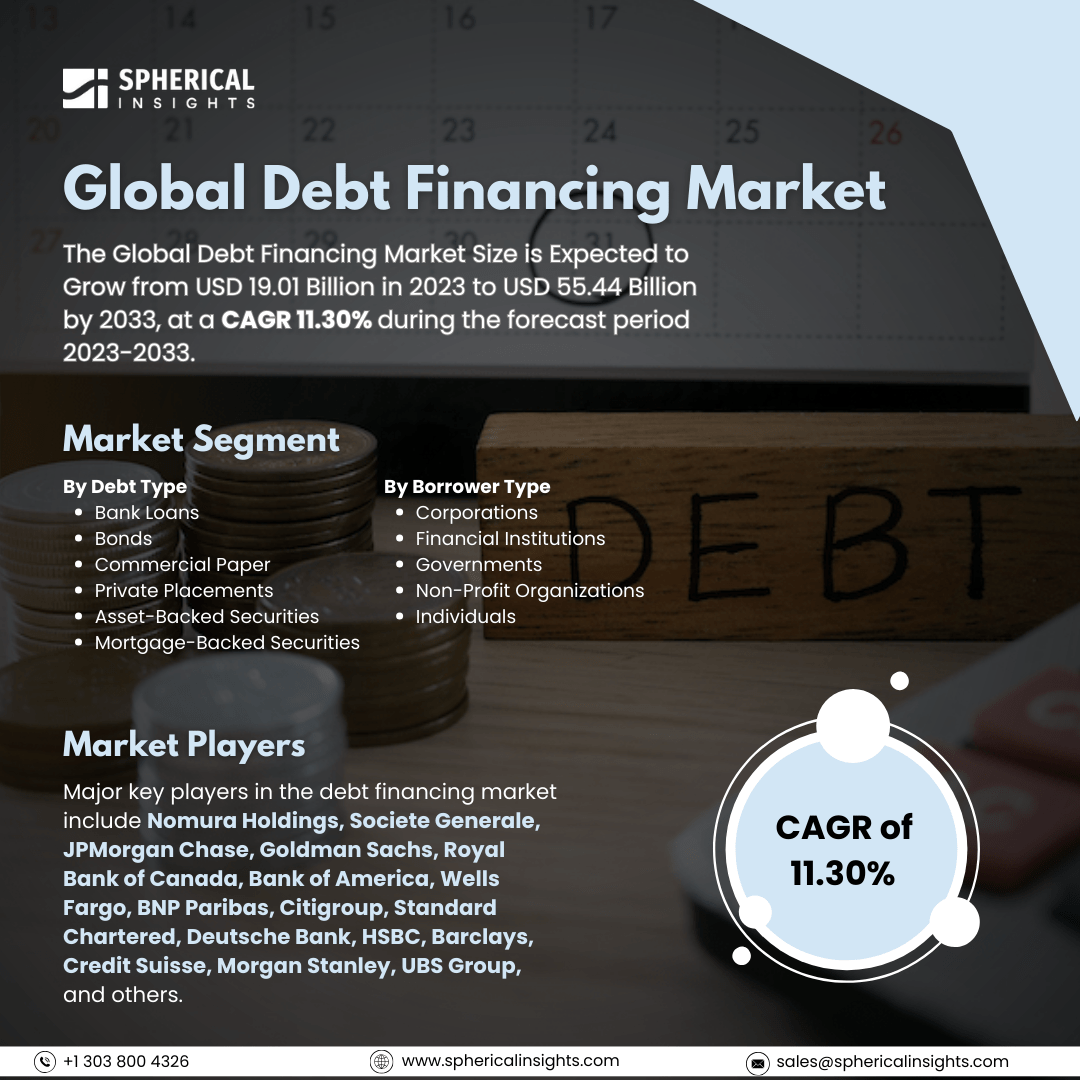

According to a research report published by Spherical Insights & Consulting, The Global Debt Financing Market Size is Expected to Grow from USD 19.01 Billion in 2023 to USD 55.44 Billion by 2033, at a CAGR 11.30% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Debt Financing Market Size, Share, and COVID-19 Impact Analysis, By Debt Type (Bank Loans, Bonds, Commercial Paper, Private Placements, Asset-Backed Securities, and Mortgage-Backed Securities), By Borrower Type (Corporations, Financial Institutions, Governments, Non-Profit Organizations, and Individuals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The debt financing market is a platform where borrowers and lenders connect to exchange debt securities. This type of financing allows companies, governments, and individuals to raise funds by borrowing money and agreeing to repay it with interest. Several factors drive the debt financing market, including low interest rates, tax-deductible interest payments, the ability to maintain ownership control, access to substantial capital sums, repayment flexibility, and the potential to leverage assets to secure loans. These characteristics enable businesses to raise capital without diluting ownership and take advantage of the tax benefits associated with interest payments. Consequently, debt financing is often a preferred option for various growth strategies and expansion projects. However, the debt financing market also faces challenges. Factors such as economic uncertainty, rising interest rates, strict credit regulations, poor creditworthiness of borrowers, volatile market conditions, limited access to capital for certain businesses, and the risk of default can make it difficult for companies to secure loans or issue bonds on favorable terms. This can hinder their growth plans and investment opportunities.

The bank loans segment is predicted to hold the largest market share through the forecast period.

Based on the debt type, the debt financing market is classified into bank loans, bonds, commercial paper, private placements, asset-backed securities, and mortgage-backed securities. Among these, the bank loans segment is predicted to hold the largest market share through the forecast period. Traditional banking institutions have established a strong foothold in the lending market, offering competitive interest rates and a wide variety of loan products tailored to meet the needs of both individuals and businesses. Additionally, the growing reliance on bank loans for financing capital expenditures, real estate investments, and personal expenses has further solidified their dominance. Regulatory frameworks that support banking operations, combined with the trust that consumers place in established banks, contribute to this segment's robust market position.

The corporations segment is anticipated to hold the highest market share during the projected timeframe.

Based on the borrower type, the debt financing market is divided into corporations, financial institutions, governments, non-profit organizations, and individuals. Among these, the corporations segment is anticipated to hold the highest market share during the projected timeframe. This is primarily due to the increasing demand for capital to fund expansion, innovation, and operational efficiency. Corporations often seek debt financing to leverage their growth potential while maintaining equity control, leading to a rise in corporate bonds and loans. The trend of low-interest rates encourages corporations to borrow more, as they can secure favorable terms for financing. Moreover, the need for liquidity in uncertain economic environments pushes corporations to rely on robust debt instruments to ensure operational stability, thereby enhancing their market share.

North America is estimated to hold the largest share of the debt financing market over the forecast period.

North America is estimated to hold the largest share of the debt financing market over the forecast period. This is driven by its mature financial infrastructure and the presence of a diverse range of lending institutions. The region's strong economy, characterized by high consumer spending and business investments, fosters a favorable environment for debt financing. Additionally, the increasing trend of companies seeking refinancing options and the rise in mortgage and consumer loans contribute to this growth. Regulatory support and technological advancements in financial services also play a crucial role in enhancing access to debt financing in North America.

Europe is expected to grow the fastest during the forecast period. The market is fueled by a combination of economic recovery and increased demand for financing solutions among businesses and consumers. The European Central Bank's accommodative monetary policy, including low-interest rates and quantitative easing measures, encourages borrowing and investment. Additionally, the growing emphasis on sustainable finance and green bonds is attracting investments into the region, further stimulating market growth. As businesses adapt to changing economic conditions and seek innovative financing options

Company Profiling

Major key players in the debt financing market include Nomura Holdings, Societe Generale, JPMorgan Chase, Goldman Sachs, Royal Bank of Canada, Bank of America, Wells Fargo, BNP Paribas, Citigroup, Standard Chartered, Deutsche Bank, HSBC, Barclays, Credit Suisse, Morgan Stanley, UBS Group, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the debt financing market based on the below-mentioned segments:

Global Debt Financing Market, By Debt Type

- Bank Loans

- Bonds

- Commercial Paper

- Private Placements

- Asset-Backed Securities

- Mortgage-Backed Securities

Global Debt Financing Market, By Borrower Type

- Corporations

- Financial Institutions

- Governments

- Non-Profit Organizations

- Individuals

Global Debt Financing Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa