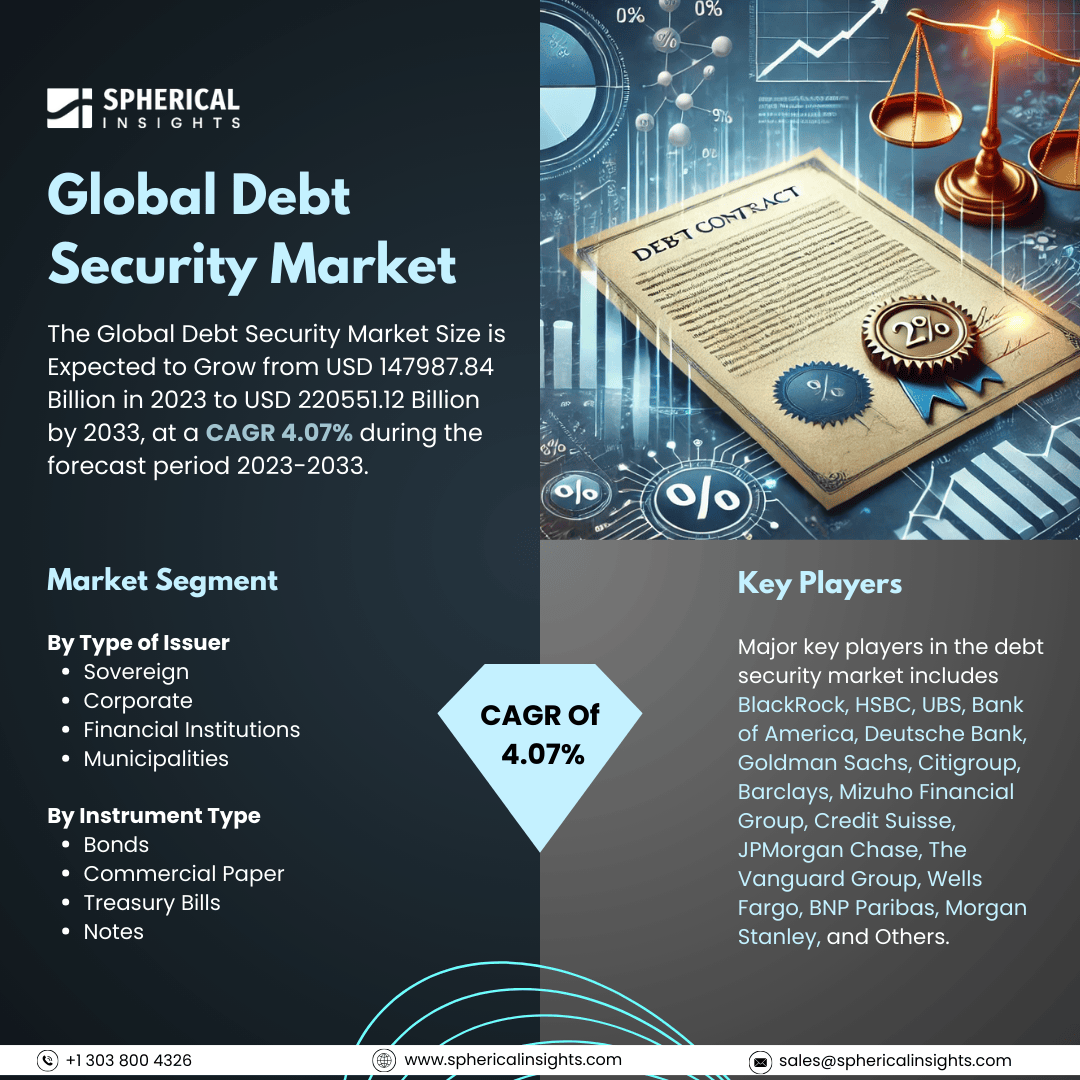

Global Debt Security Market Size to worth USD 220551.12 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Debt Security Market Size is Expected to Grow from USD 147987.84 Billion in 2023 to USD 220551.12 Billion by 2033, at a CAGR 4.07% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Debt Security Market Size, Share, and COVID-19 Impact Analysis, By Type of Issuer (Sovereign, Corporate, Financial Institutions, and Municipalities), By Instrument Type (Bonds, Commercial Paper, Treasury Bills, and Notes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The debt security market, also known as the bond market, fixed-income market, or credit market, is where debt securities are traded and issued. Debt securities are financial assets that represent a debt owed by an issuer to an investor. In this relationship, the investor acts as a lender, receiving interest payments and the return of the principal amount at maturity. Several key factors drive the debt security market, including interest rates, inflation expectations, economic growth, and investor sentiment. Low interest rates generally make debt securities more attractive since they offer stable returns, encouraging investment. Conversely, rising interest rates can lead to declining bond prices, thus impacting market dynamics. Inflation expectations also play a crucial role, higher anticipated inflation can erode the real value of fixed-income returns, prompting investors to seek protection against yield loss. However, the debt security market faces several challenges that can hamper its growth and reduce its appeal to investors. One primary concern is the fluctuation of interest rates, as rising rates can decrease bond prices, making existing securities less attractive. Additionally, increasing inflation can diminish real returns, leading investors to explore alternative assets with better yield potential.

The sovereign segment is predicted to hold the largest market share through the forecast period.

Based on the type of issuer, the debt security market is classified into sovereign, corporate, financial institutions, and municipalities. Among these, the sovereign segment is predicted to hold the largest market share through the forecast period. This due to the perceived safety and stability of government-issued securities, investors often view sovereign bonds, especially those from stable economies, as low-risk investments that provide predictable returns. This reliability becomes particularly appealing during economic uncertainty, leading to increased demand for sovereign debt. Additionally, government bonds often serve as benchmark securities for pricing other debt instruments, further solidifying their dominant position in the market.

The bonds segment is anticipated to hold the highest market share during the projected timeframe.

Based on the instrument type, the debt security market is divided into bonds, commercial paper, treasury bills, and notes. Among these, the bonds segment is anticipated to hold the highest market share during the projected timeframe. The demand for bonds is driven by the diverse range of offerings available to investors, including government bonds, corporate bonds, and municipal bonds, which cater to various risk appetites and investment strategies. The fixed-income nature of bonds provides a steady stream of income through interest payments, making them especially attractive in low-interest-rate environments. Furthermore, the increasing trend of institutional investment in bonds, along with a growing emphasis on fixed-income portfolios, is expected to significantly bolster the segment’s market share.

North America is estimated to hold the largest share of the debt security market over the forecast period.

North America is estimated to hold the largest share of the debt security market over the forecast period. The U.S. debt security market, in particular, is characterized by robust financial infrastructure and a diverse range of issuers. The U.S. Treasury market, known for its liquidity and safety, attracts both domestic and international investors, driving demand for U.S. government bonds. The region also benefits from a stable economic environment, a strong regulatory framework, and well-established capital markets, which provide a favourable backdrop for the issuance and trading of debt securities. These combined factors position North America as a leader in the global debt security market.

Europe is expected to grow the fastest during the forecast period. The growth of the debt security market is driven by several factors, including increasing investor interest in sustainable finance and green bonds. The European Union's commitment to sustainability and environmental initiatives has promoted the issuance of green debt securities, attracting a growing pool of socially conscious investors. Additionally, the region's economic recovery post-pandemic, coupled with low interest rates and favourable monetary policies, enhances the attractiveness of European debt securities. Diversifying debt products and increasing cross-border investment within the EU further contribute to its rapid growth potential in the debt security market.

Company Profiling

Major key players in the debt security market includes BlackRock, HSBC, UBS, Bank of America, Deutsche Bank, Goldman Sachs, Citigroup, Barclays, Mizuho Financial Group, Credit Suisse, JPMorgan Chase, The Vanguard Group, Wells Fargo, BNP Paribas, Morgan Stanley, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, The Securities and Exchange Board of India (SEBI) has launched a new facility designed to enhance liquidity for investors holding debt securities. This initiative became effective on November 1st and enables investors to sell their listed bonds back to the issuers. This will facilitate easier access to funds when required.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the debt security market based on the below-mentioned segments:

Global Debt Security Market, By Type of Issuer

- Sovereign

- Corporate

- Financial Institutions

- Municipalities

Global Debt Security Market, By Instrument Type

- Bonds

- Commercial Paper

- Treasury Bills

- Notes

Global Debt Security Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa