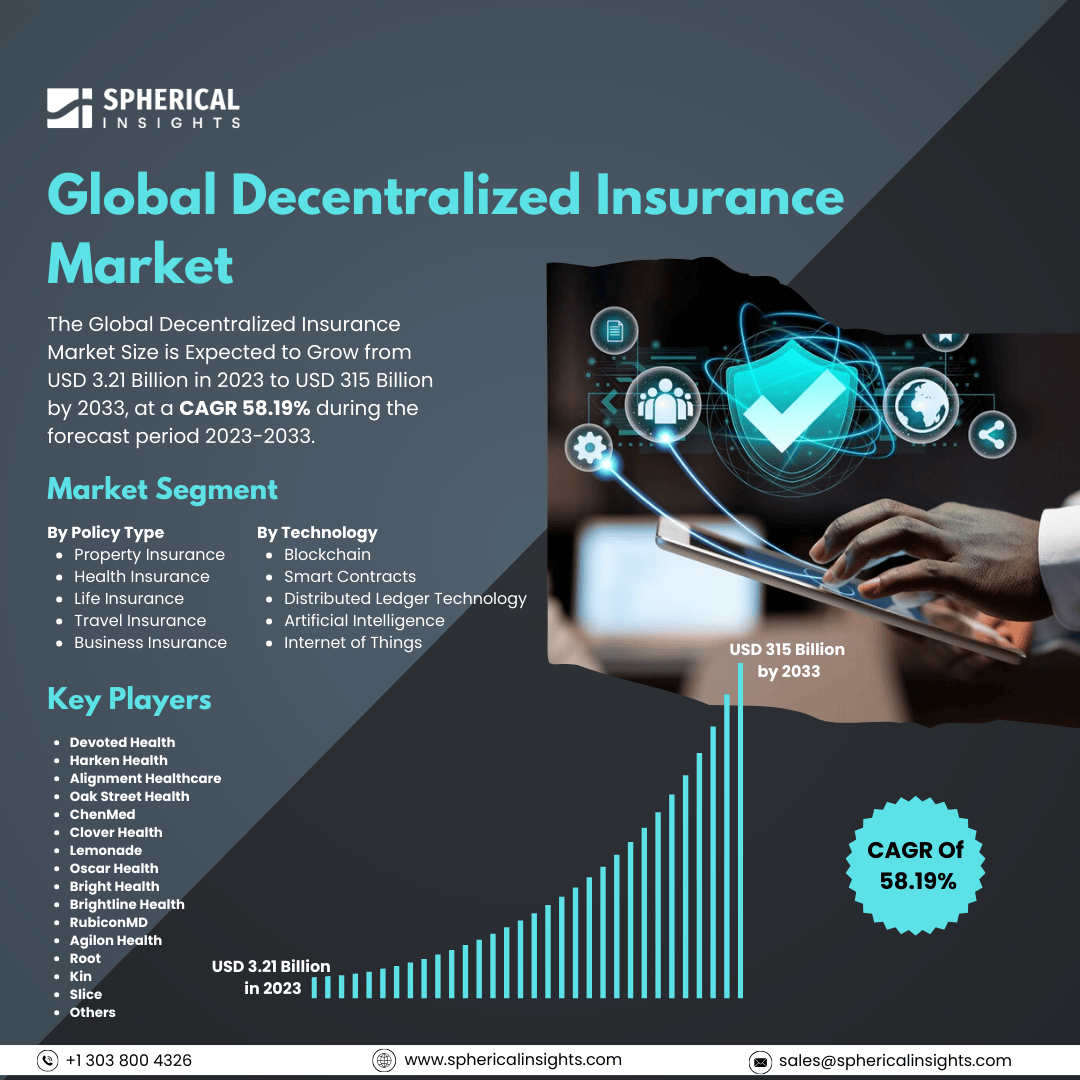

Global Decentralized Insurance Market Size to worth USD 315 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Decentralized Insurance Market Size is Expected to Grow from USD 3.21 Billion in 2023 to USD 315 Billion by 2033, at a CAGR 58.19% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Decentralized Insurance Market Size, Share, and COVID-19 Impact Analysis, By Policy Type (Property Insurance, Health Insurance, Life Insurance, Travel Insurance, and Business Insurance), By Technology (Blockchain, Smart Contracts, Distributed Ledger Technology, Artificial Intelligence, and Internet of Things), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The decentralized insurance market is an emerging industry that leverages blockchain technology to provide insurance coverage in a more transparent, efficient, and equitable manner compared to traditional insurance models. This type of insurance utilizes blockchain and smart contracts to manage claims and transactions without relying on conventional intermediaries such as insurance companies and brokers. The growth of the decentralized insurance market can be attributed to several factors. First, blockchain technology functions as a distributed ledger, enabling secure, transparent, and tamper-proof record-keeping. This technology can enhance efficiency, lower costs, and increase transparency. Additionally, there is a rising demand for decentralized and peer-to-peer insurance products that offer improved transparency, reduced costs, and faster claim processing times. Smart contracts also play a crucial role by automating insurance policies and claims. However, the decentralized insurance market faces some challenges. The legal and regulatory frameworks governing decentralized insurance products differ by jurisdiction, which can hamper growth. Furthermore, various decentralized insurance platforms and protocols may not be fully compatible with one another, creating obstacles to further development.

The property insurance segment is predicted to hold the largest market share through the forecast period.

Based on the policy type, the decentralized insurance market is classified into property insurance, health insurance, life insurance, travel insurance, and business insurance. Among these, the property insurance segment is predicted to hold the largest market share through the forecast period. The demand for property insurance products is increasing due to the rising frequency of natural disasters and the growing value of insured assets. Homeowners and businesses are seeking comprehensive protection against risks such as floods, fires, and theft. Additionally, advancements in risk assessment technologies and the availability of customized insurance solutions are enhancing consumer confidence and driving market growth in this segment.

The blockchain segment is anticipated to hold the highest market share during the projected timeframe.

Based on the technology, the decentralized insurance market is divided into blockchain, smart contracts, distributed ledger technology, artificial intelligence, and internet of things. Among these, the blockchain segment is anticipated to hold the highest market share during the projected timeframe. Blockchain technology is gaining traction in the insurance industry primarily because it enhances transparency, security, and efficiency in transactions. By utilizing decentralized ledgers, blockchain can streamline claims processing and reduce fraud, which leads to lower operational costs for insurers. Furthermore, the growing interest in smart contracts allows for automatic execution of agreements based on predefined conditions, making it appealing for both insurers and policyholders. This transformative potential positions blockchain as a key player in the future of insurance.

North America is estimated to hold the largest share of the decentralized insurance market over the forecast period.

North America is estimated to hold the largest share of the decentralized insurance market over the forecast period. The adoption of decentralized technologies is being driven by technological innovation and a robust regulatory environment. The region's well-established insurance sector is increasingly embracing these technologies to improve operational efficiency and enhance customer experience. Additionally, the presence of leading technology firms and startups concentrating on Insurtech solutions fosters rapid advancements in decentralized insurance models.

Europe is expected to grow the fastest during the forecast period. The market is experiencing significant growth due to increased consumer awareness of digital insurance solutions and supportive regulatory frameworks. Substantial investments are being made in technology, particularly in artificial intelligence and blockchain, which are transforming traditional practices. As European consumers become more open to innovative insurance products and services, there is a rising demand for solutions that offer greater flexibility and transparency. This trend is likely to accelerate the expansion of the insurance market across Europe.

Company Profiling

Major key players in the decentralized insurance market includes Devoted Health, Harken Health, Alignment Healthcare, Oak Street Health, ChenMed, Clover Health, Lemonade, Oscar Health, Bright Health, Brightline Health, RubiconMD, Agilon Health, Root, Kin, Slice, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Linuscoins has announced the launch of its groundbreaking decentralized insurance solutions, aiming to revolutionize the traditional insurance industry through the power of blockchain technology. These innovative services are designed to offer users more transparent, secure, and cost-effective insurance options, addressing the common inefficiencies and lack of trust associated with conventional insurance systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the decentralized insurance market based on the below-mentioned segments:

Global Decentralized Insurance Market, By Policy Type

- Property Insurance

- Health Insurance

- Life Insurance

- Travel Insurance

- Business Insurance

Global Decentralized Insurance Market, By Technology

- Blockchain

- Smart Contracts

- Distributed Ledger Technology

- Artificial Intelligence

- Internet of Things

Global Decentralized Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa