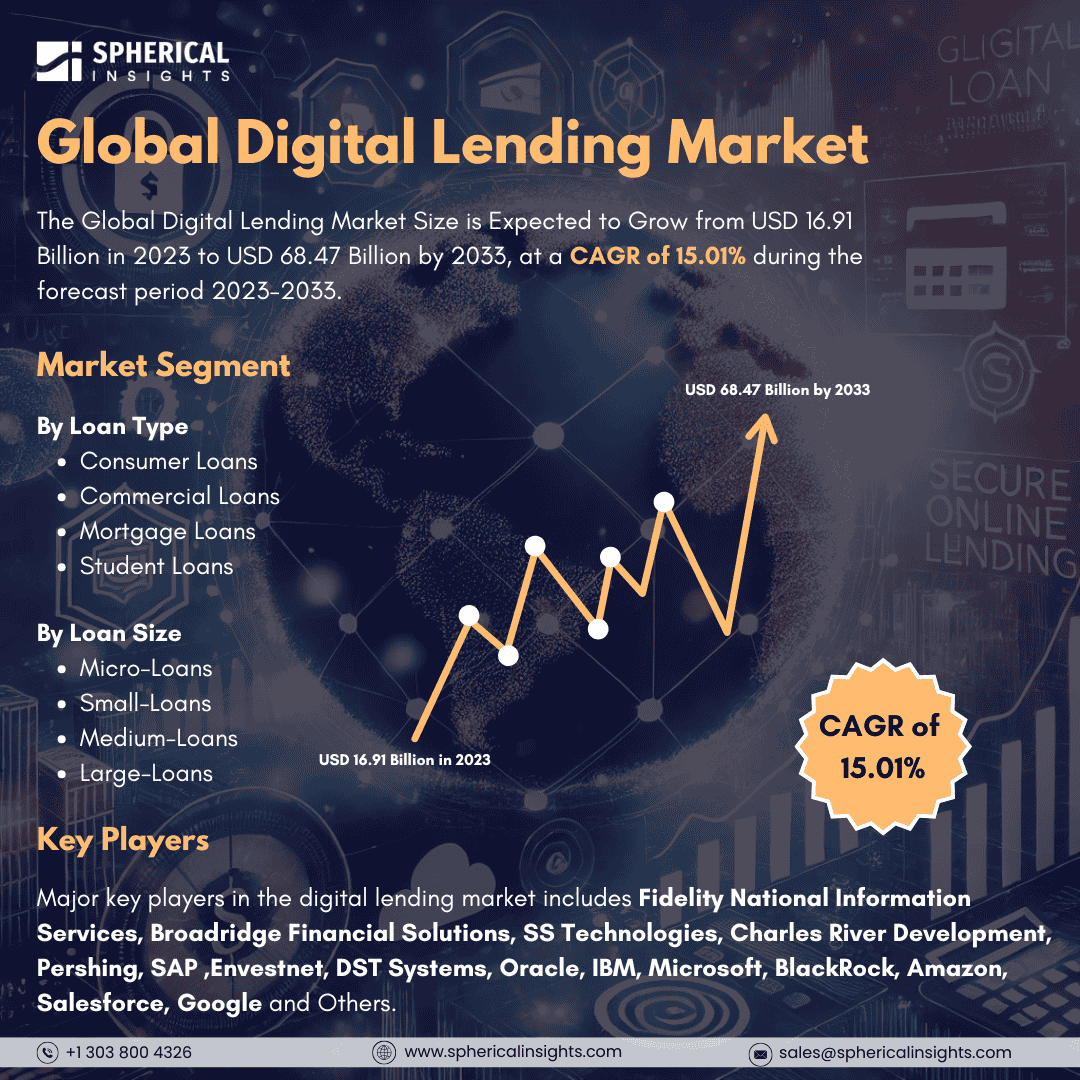

Global Digital Lending Market Size to worth USD 68.47 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Digital Lending Market Size is Expected to Grow from USD 16.91 Billion in 2023 to USD 68.47 Billion by 2033, at a CAGR 15.01% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Digital Lending Market Size, Share, and COVID-19 Impact Analysis, By Loan Type (Consumer Loans, Commercial Loans, Mortgage Loans, and Student Loans), By Loan Size (Micro-Loans, Small-Loans, Medium-Loans, and Large-Loans), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Digital lending refers to the process of offering loans online through digital channels, such as websites and mobile applications, rather than through traditional in-person methods. This approach utilizes technology to streamline the lending process, from application to repayment, and offers several advantages. The digital lending market is driven by various factors. The integration of artificial intelligence (AI), machine learning, and cloud computing enables banks and fintech companies to process large volumes of customer data. This data can be leveraged to develop personalized services and solutions for customers. Additionally, the increasing number of smartphone users and greater internet connectivity has led to a rising demand for digital lending services. Affordable smartphones can run lending applications, allowing individuals to apply for loans conveniently from their phones. Moreover, the growing importance of open banking worldwide is expected to further propel the digital lending platform market. A favorable regulatory environment can also facilitate growth in this sector. However, there are factors that may restrain the growth of digital lending. Regulations can limit the types of loans that digital lending platforms can offer, as well as the interest rates they are permitted to charge, making it more challenging for digital lenders to compete with traditional financial institutions. Additionally, businesses often have concerns about data security when transferring information through digital lending platforms. It is crucial for digital lending providers to comply with data protection laws to safeguard customer data.

The consumer loans segment is predicted to hold the largest market share through the forecast period.

Based on the loan type, the digital lending market is classified into consumer loans, commercial loans, mortgage loans, and student loans. Among these, the consumer loans segment is predicted to hold the largest market share through the forecast period. The growth in consumer loans is primarily driven by increasing demand for personal financing options, favorable interest rates, and the rise of online lending platforms. Individuals are seeking quick access to funds for various purposes, such as education, home improvements, and debt consolidation. In response, financial institutions are enhancing their offerings and simplifying application processes, making these services more accessible and convenient, which is expected to lead to significant growth in the consumer loans segment.

The micro-loans segment is anticipated to hold the highest market share during the projected timeframe.

Based on the loan size, the digital lending market is divided into micro-loans, small-loans, medium-loans, and large-loans. Among these, the micro-loans segment is anticipated to hold the highest market share during the projected timeframe. Micro-loans are gaining traction, particularly among underserved populations and entrepreneurs who require small-scale financing. These loans provide essential support to individuals who may lack access to traditional banking services, fostering economic inclusion and promoting small business growth. As digital lending platforms become more widespread, obtaining micro-loans is expected to become easier, further increasing their popularity and market presence.

North America is estimated to hold the largest share of the digital lending market over the forecast period.

North America is estimated to hold the largest share of the digital lending market over the forecast period. growth is attributed to an advanced financial technology ecosystem and a high level of consumer adoption of digital services. The region benefits from a strong regulatory framework that encourages innovation and competition among lenders, leading to the development of user-friendly online platforms. Additionally, the rising demand for efficient lending processes and personalized financial solutions is boosting growth, positioning North America as a key player in the global digital lending landscape.

Europe is expected to grow the fastest during the forecast period, the rapid adoption of fintech solutions and changing consumer behaviour towards online financial services is driving growth. The region's focus on digital transformation, supported by government initiatives and regulatory frameworks, is enhancing the availability and attractiveness of digital lending products. Furthermore, increased consumer awareness and the demand for alternative financing options are likely to contribute to the growth of digital lending in European markets.

Company Profiling

Major key players in the digital lending market includes Fidelity National Information Services, Broadridge Financial Solutions, SS Technologies, Charles River Development, Pershing, SAP ,Envestnet, DST Systems, Oracle, IBM, Microsoft, BlackRock, Amazon, Salesforce, Google and Others.

Recent Developments

- In May 2024, PhonePe has launched a secure digital lending platform within its app, allowing over 535 million users to access loans in six categories, including mutual fund, gold, and car loans. This service is in partnership with banks, non-banking financial companies (NBFCs), and fintech firms like Tata Capital and L&T Finance. Currently featuring 15 lending partners, PhonePe aims to increase this number to 25 by the next quarter.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the digital lending market based on the below-mentioned segments:

Global Digital Lending Market, By Loan Type

- Consumer Loans

- Commercial Loans

- Mortgage Loans

- Student Loans

Global Digital Lending Market, By Loan Size

- Micro-Loans

- Small-Loans

- Medium-Loans

- Large-Loans

Global Digital Lending Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa