Global Finance and Accounting Business Process Outsourcing Market Size to worth USD 147.20 Billion by 2033

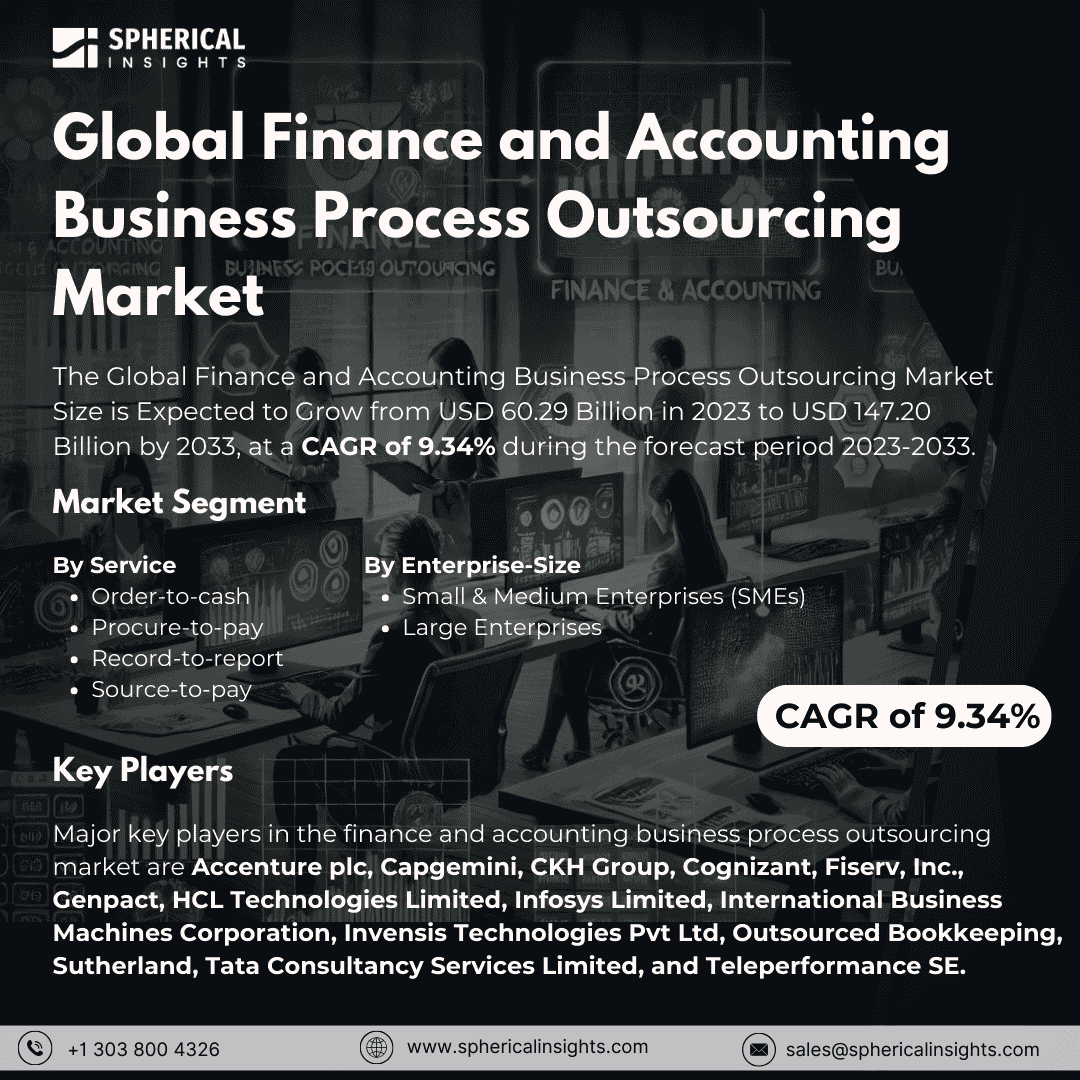

According to a research report published by Spherical Insights & Consulting, The Global Finance and Accounting Business Process Outsourcing Market Size is Expected to Grow from USD 60.29 Billion in 2023 to USD 147.20 Billion by 2033, at a CAGR of 9.34% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Finance and Accounting Business Process Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Order-to-cash, Procure-to-pay, Record-to-report, and Source-to-pay), By Enterprise-Size (Small & Medium Enterprises (SMEs) and Large Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Finance and accounting business process outsourcing, or F&A BPO, is a delegation of financial and accounting functions to third-party service providers. It helps organizations streamline operational efficiency, reduce costs, and focus on their core business activities. Services in this area include accounts payable and receivable, payroll processing, financial reporting, tax preparation, and bookkeeping. F&A BPO solutions are based on advanced technologies and expertise to ensure accurate financial management, regulatory compliance, and streamlined operations, offering significant value to businesses in various sectors. As organizations increasingly look to enhance their financial operations, the demand for F&A BPO services has grown, driven by the need for improved efficiency, cost savings, and access to specialized skills. Furthermore, the growth of the Finance and Accounting BPO market has been mainly influenced by pressure to reduce operational costs, compliance with emerging financial regulations, and increased complexity of global financial operations. More recently, cloud-based solution adoption and automation technologies have contributed to the expansion of the market. However, challenges such as data security concerns, cultural and language barriers, and potential loss of control over critical business functions may restrain the wide adoption of F&A BPO services.

The order-to-cash segment is predicted to hold the greatest market share through the forecast period.

Based on the service, the finance and accounting business process outsourcing market is classified into order-to-cash, procure-to-pay, record-to-report, and source-to-pay. Among these, the order-to-cash segment is predicted to hold the greatest market share through the forecast period. This is driven by the critical role that order-to-cash processes play in improving cash flow, optimizing revenue cycles, and ensuring efficient management of customer transactions. The growing demand for streamlined sales order processing, invoicing, and collections management makes this segment a must for businesses looking to improve financial performance and reduce operational costs.

The large enterprises segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the enterprise size, the finance and accounting business process outsourcing market is divided into small & medium enterprises (SMEs) and large enterprises. Among these, the large enterprises segment is anticipated to hold the greatest market share during the projected timeframe. This is mainly because large organizations have increasingly complex financial operations, which require specialized skills, scalability, and advanced technological solutions. Large enterprises often look for ways to optimize their finance and accounting functions through outsourcing to improve efficiency, reduce costs, and ensure compliance with evolving financial regulations.

North America is estimated to hold the largest finance and accounting business process outsourcing market share over the forecast period.

North America is estimated to hold the largest finance and accounting business process outsourcing market share over the forecast period. The region is likely to continue leading the way due to growing demand for business process outsourcing services in light of the lower cost, greater efficiency, and global expansion as well as a focus on core business functions.

Asia-Pacific is predicted to have the fastest CAGR growth in the finance and accounting business process outsourcing market over the forecast period. The growth of the Asia Pacific market can be attributed to the implementation of advanced technologies. The adoption of F&A BPO in APAC has continued to be fueled by cost savings. Organizations can lower operating costs by outsourcing the maintenance of internal finance and accounting staff. Major APAC countries, such as China, India, and Japan, are known to boast a well-trained labor pool and modern technology infrastructure, thereby making the region attractive as a BPO services center for F&A.

Company Profiling

Major key players in the finance and accounting business process outsourcing market are Accenture plc, Capgemini, CKH Group, Cognizant, Fiserv, Inc., Genpact, HCL Technologies Limited, Infosys Limited, International Business Machines Corporation, Invensis Technologies Pvt Ltd, Outsourced Bookkeeping, Sutherland, Tata Consultancy Services Limited, and Teleperformance SE.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, CKH Group partnered with local government across 611 cities in Georgia to help enable auditing services and staff augmentation. Local governments may be excluded from certain federal or state funding if they fall behind on their annual financial statement audits. The Government Auditing Division of CKH Group assists local governments, rapidly expanding as they realize and address this need in diverse communities.

Market Segment

This study forecasts global, regional, and country revenue from 2023 to 2033. Spherical Insights has segmented the finance and accounting business process outsourcing market based on the below-mentioned segments:

Global Finance and Accounting Business Process Outsourcing Market, By Service

- Order-to-cash

- Procure-to-pay

- Record-to-report

- Source-to-pay

Global Finance and Accounting Business Process Outsourcing Market, By Enterprise-Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Global Finance and Accounting Business Process Outsourcing Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa