Global Financial Crime Fraud Management Solution Market Size to worth USD 64.17 Billion by 2033

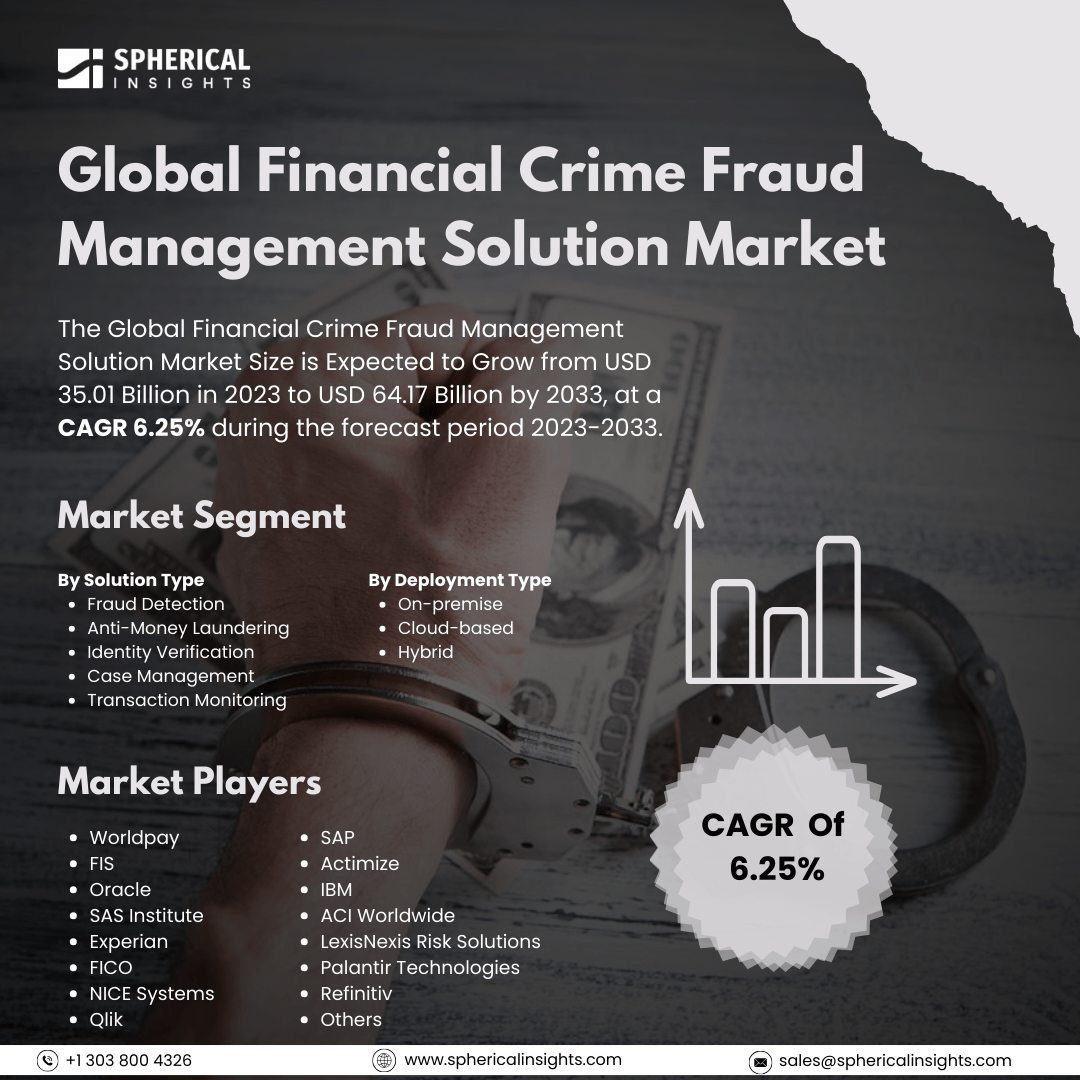

According to a research report published by Spherical Insights & Consulting, The Global Financial Crime Fraud Management Solution Market Size is Expected to Grow from USD 35.01 Billion in 2023 to USD 64.17 Billion by 2033, at a CAGR 6.25% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Financial Crime Fraud Management Solution Market Size, Share, and COVID-19 Impact Analysis, By Solution Type (Fraud Detection, Anti-Money Laundering, Identity Verification, Case Management, and Transaction Monitoring), By Deployment Type (On-premise, Cloud-based, and Hybrid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The financial crime and fraud management solutions market encompasses a diverse array of tools, methodologies, and advanced technologies specifically crafted to prevent, identify, and combat various forms of financial crimes and fraudulent activities. This dynamic market is primarily propelled by the escalating urgency to address financial crimes, which have surged in prevalence alongside the exponential growth of digital transactions and e-commerce. Several key factors are contributing to the robust expansion of this sector. Regulatory bodies worldwide are imposing stricter compliance requirements, particularly concerning anti-money laundering (AML) regulations. Organizations are increasingly compelled to adopt comprehensive solutions to adhere to these regulations and mitigate risks associated with non-compliance. Additionally, the escalating complexity and sophistication of cyber threats pose significant challenges, further driving the demand for effective financial crime prevention strategies. However, the growth of the financial crime and fraud management solutions market is not without its challenges. One notable concern is the issue of data privacy, which can significantly constrain the ability of organizations to share sensitive information related to financial crime incidents. The existence of inconsistent legal frameworks across various jurisdictions adds another layer of complexity; differing standards for the collection, storage, and processing of data can hinder effective cooperation among financial institutions. Moreover, the rise of cross-border financial crimes amplifies the risk of data breaches, as illicit activities can easily span multiple countries and exploit gaps in regulatory oversight. These challenges underscore the intricate landscape in which financial institutions operate, necessitating innovative and robust solutions to safeguard against the ever-evolving threats posed by financial crime and fraud.

The fraud detection segment is predicted to hold the largest market share through the forecast period.

Based on the solution type, the financial crime fraud management solution market is classified into fraud detection, anti-money laundering, identity verification, case management, and transaction monitoring. Among these, the fraud detection segment is predicted to hold the largest market share through the forecast period. The increasing sophistication of fraudulent activities and the growing demand for advanced analytical solutions are driving organizations across various sectors to prioritize fraud detection. This focus aims to safeguard against financial losses, protect customer trust, and comply with regulatory requirements. The rise of digital transactions and online services has further intensified the need for robust fraud detection systems that can identify and mitigate risks in real time, leading to significant investments in this area.

The on-premise segment is anticipated to hold the highest market share during the projected timeframe.

Based on the deployment type, the financial crime fraud management solution market is divided into on-premise, cloud-based, and hybrid. Among these, the on-premise segment is anticipated to hold the highest market share during the projected timeframe. Organizations also show a preference for enhanced control over their data and systems, which contributes to the demand for on-premise solutions. Many businesses, particularly in highly regulated industries like finance and healthcare, prioritize security and compliance. On-premise systems allow for customization to meet specific organizational needs while minimizing the risks associated with cloud-based solutions, resulting in sustained demand for these implementations.

North America is estimated to hold the largest share of the financial crime fraud management solution market over the forecast period.

North America is estimated to hold the largest share of the financial crime fraud management solution market over the forecast period. The presence of major financial institutions and technological advancements in the region primarily drives the adoption of fraud detection solutions. The high adoption of innovative technologies like artificial intelligence and machine learning enhances the effectiveness of these systems. Additionally, stringent regulations and a proactive approach to combating financial crime among businesses in North America further contribute to the region's dominance in this market.

Europe is expected to grow the fastest during the forecast period. The market is fueled by increasing regulatory pressures and a growing awareness of financial crime risks among enterprises. The implementation of stringent data protection laws, such as GDPR, has prompted organizations to invest significantly in financial crime fraud management solutions to ensure compliance and protect sensitive information. Furthermore, the integration of advanced technologies, including blockchain and data analytics, is enabling European companies to enhance their fraud detection capabilities, driving rapid market expansion in the region.

Company Profiling

Major key players in the financial crime fraud management solution market include Worldpay, FIS, Oracle, SAS Institute, Experian, Fico, NICE Systems, Qlik, SAP, Actimize, IBM, ACI Worldwide, LexisNexis Risk Solutions, Palantir Technologies, Refinitiv, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global crime fraud management solution market based on the below-mentioned segments:

Global Financial Crime Fraud Management Solution Market, By Solution Type

- Fraud Detection

- Anti-Money Laundering

- Identity Verification

- Case Management

- Transaction Monitoring

Global Financial Crime Fraud Management Solution Market, By Deployment Type

- On-premise

- Cloud-based

- Hybrid

Global Financial Crime Fraud Management Solution Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa