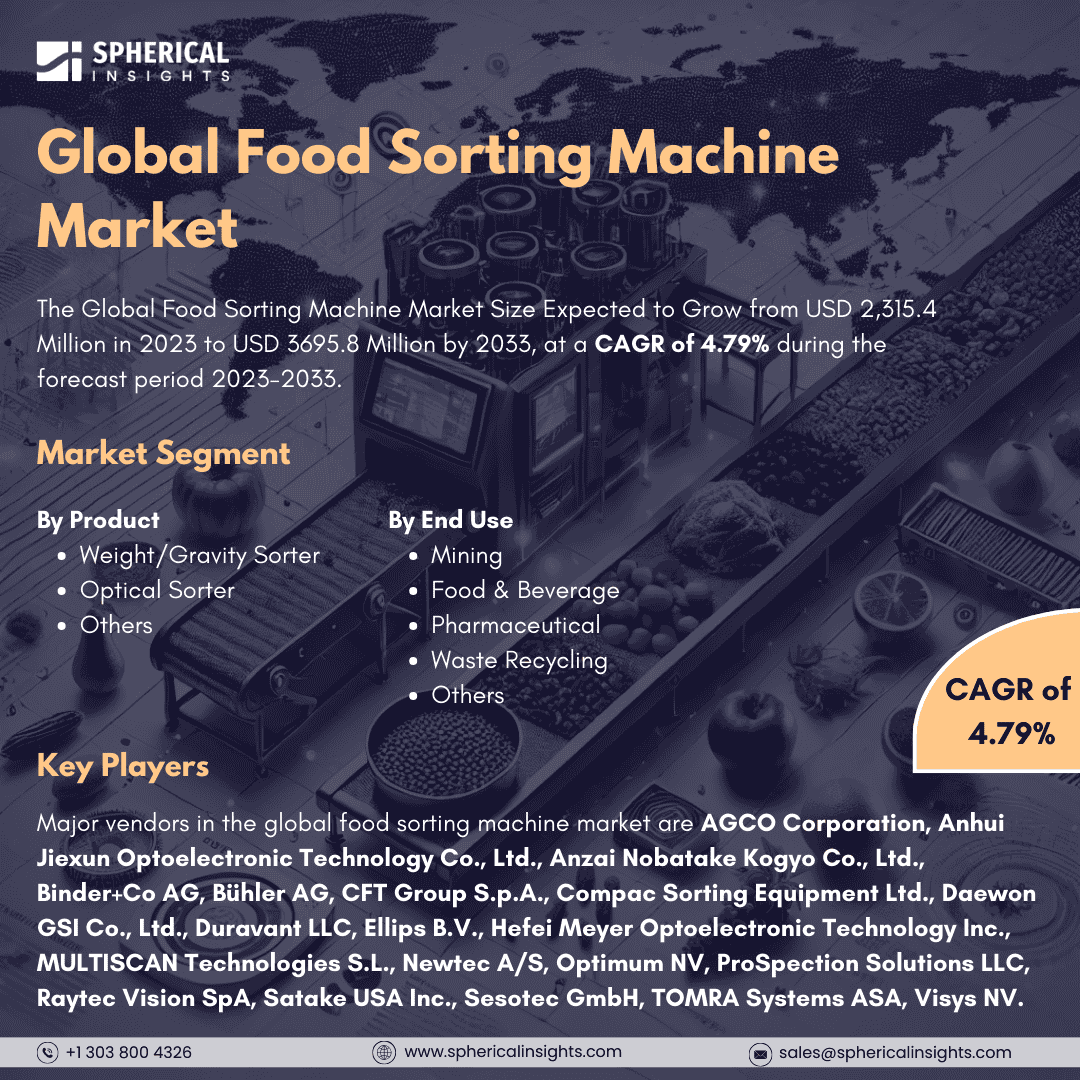

Global Food Sorting Machine Market Size to Exceed Usd 3695.8 Million by 2033

According to a research report published by Spherical Insights & Consulting, The Global Food Sorting Machine Market Size Expected to Grow from USD 2,315.4 Million in 2023 to USD 3695.8 Million by 2033, at a CAGR of 4.79% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Food Sorting Machine Market Size, Share, and COVID-19 Impact Analysis, By Product (Weight/Gravity Sorter, Optical Sorter, Others), By End-Use (Mining, Food & Beverage, Pharmaceutical, Waste Recycling, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Food sorting machines are used by processing enterprises to classify and separate food commodities, such as fruits and vegetables, dairy products, packaged and dry processed foods, meat, fish, and sea delicacies. These things boost improvements in efficiency, reductions in labor costs, and product quality and safety. Innovative technologies such as optical sensors, cameras, lasers, and artificial intelligence (AI) are to be adopted for quick and accurate inspection and classification of food items. Speedy expansion in demand for suitable processing in the food industry and rapid dispatch are contributing to the advancement in advanced food sorting machines. Convenience foods, healthy, nutritious, and easy to prepare are indeed major driving factors propelling the food sorting equipment market. With the burgeoning population coupled with rapid urbanization, demands for food sorting equipment are projected to be above normal. Facilities such as better food safety, reduced delivery cycles, improved food quality, as well as increased output are driving the growth of the food sorting equipment market. However, the steep costs for equipment and diverse environmental regulations regarding the disposal of food waste are expected to inhibit growth in the food sorting equipment market, while changing consumption patterns in combination with downsized households may pose a challenge to the food sorting equipment market.

The optical sorter segment is anticipated to hold the largest share of the global food sorting machine market during the projected timeframe.

Based on product, the global food sorting machine market is categorized as Weight/Gravity Sorter, Optical Sorter, and Others. Among these, the optical sorter segment is anticipated to hold the largest share of the global Food Sorting Machine market during the projected timeframe. The growth is attributed to optical sorters being highly utilized across the food industry around the world and are increasingly being employed in post-harvest applications for fruits, vegetables, nuts, and potatoes, where it is feasible to achieve, with no damage at 100%, in-line auditing of whole production volumes.

The food & beverages segment dominates the global food sorting machine market during the projected timeframe.

Based on the end use, the global food sorting machine market is categorized into mining, food & beverage, pharmaceuticals, waste recycling, and others. Among these, the food & beverages segment dominates the global food sorting machine market during the projected timeframe. The growth is driven by increasing demand for automation to enhance operational efficiency and ensure food safety, which has fueled progress in advanced technologies. Besides, increasing concern for the reduction of waste and optimization of processes leads the organization to automated sorting machines, making it possible for the organization to deliver high-quality products as per consumer expectations.

Europe is projected to hold the biggest share of the global food sorting machine market over the forecast period.

Europe is projected to hold the biggest share of the global food sorting machine market over the forecast period. High health and wellness valuation among customers in this region generates a huge demand for processed and nutritional foods and value-added products. Many sorting machines are extensively used in the food and nutraceutical industry, which is great for market development, as these companies want to spend less time on the production process and the delivery of products.

Asia Pacific is expected to grow at the rapid CAGR of the global food sorting machine market during the forecast period. The increasing rise of industrialization and urbanization, moreover increasing focus on quality, led to more manufacturers adopting advanced sorting technologies. Consumer expectations continue to rise concerning the quality of products; thus, industries are positively affected and invested in sorting machines for higher operational efficiency and regulatory compliance.

Company Profiling

Major vendors in the global food sorting machine market are AGCO Corporation, Anhui Jiexun Optoelectronic Technology Co., Ltd., Anzai Nobatake Kogyo Co., Ltd., Binder+Co AG, Bühler AG, CFT Group S.p.A., Compac Sorting Equipment Ltd., Daewon GSI Co., Ltd., Duravant LLC, Ellips B.V., Hefei Meyer Optoelectronic Technology Inc., MULTISCAN Technologies S.L., Newtec A/S, Optimum NV, ProSpection Solutions LLC, Raytec Vision SpA, Satake USA Inc., Sesotec GmbH, TOMRA Systems ASA, Visys NV.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In February 2024, BRAIN-it's software control system-in artificial intelligence (AI)-which has been integrated into its top-model optical sorters. This system was introduced by Cimbria, a company based in Denmark. It is easily the most complicated recipe creation for optical sorting.

- In April 2023, National Recovery Technologies (NRT) a company based in the United States launched the SpydIR®-HS, which is an NIR optical sorter having multiple improvements. This has about 10 times the detection resolution.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global food sorting machine market based on the below-mentioned segments:

Global Food Sorting Machine Market, By Product

- Weight/Gravity Sorter

- Optical Sorter

- Others

Global Food Sorting Machine Market, By End Use

- Mining

- Food & Beverage

- Pharmaceutical

- Waste Recycling

- Others

Global Food Sorting Machine Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa