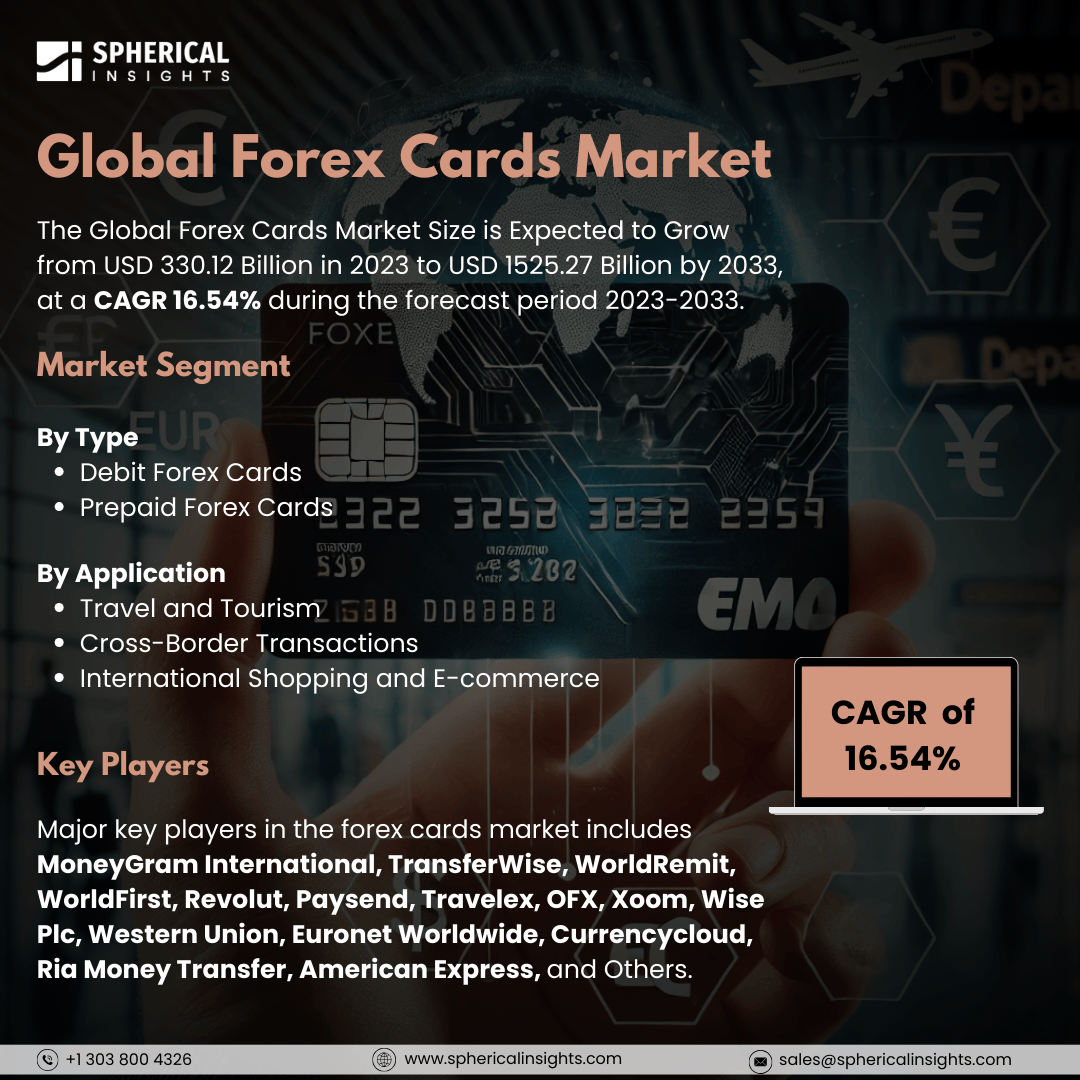

Global Forex Cards Market Size to worth USD 1525.27 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Forex Cards Market Size is Expected to Grow from USD 330.12 Billion in 2023 to USD 1525.27 Billion by 2033, at a CAGR 16.54% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Forex Cards Market Size, Share, and COVID-19 Impact Analysis, By Type (Debit Forex Cards, Prepaid Forex Cards), By Application (Travel and Tourism, Cross-Border Transactions, and International Shopping and E-commerce), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A forex card is a prepaid card that allows users to hold foreign currency and make transactions while traveling abroad. The market for forex cards is influenced by several factors. As more people engage in international travel and trade, the demand for convenient and secure payment methods rises. Additionally, the growing popularity of e-commerce contributes to the expansion of the forex card market. Forex cards protect users from the risks associated with fluctuating currency exchange rates by enabling them to preload a specific amount of foreign currency onto the card. Users can load multiple currencies onto a forex card, allowing them to utilize the local currency of the country they are visiting. However, the forex card market also faces several challenges that can hamper its growth and adoption. One key issue is regulatory challenges, as different countries impose various restrictions on foreign exchange transactions, creating compliance complexities for providers. Additionally, fluctuating exchange rates may deter potential users, as they could incur losses when converting currencies. Security concerns related to online transactions, fraud, and data breaches also contribute to consumer apprehension.

The debit forex cards segment is predicted to hold the largest market share through the forecast period.

Based on the type, the forex cards market is classified into debit forex cards, prepaid forex cards. Among these, the debit forex cards segment is predicted to hold the largest market share through the forecast period. The increasing adoption of debit forex cards among travellers and expatriates is largely driven by their convenience for international transactions. These cards allow users to preload multiple currencies, which helps minimize exchange rate fluctuations and transaction fees appealing to budget-conscious consumers. Furthermore, the rise in online shopping and digital payments has enhanced the attractiveness of debit forex cards as a secure and efficient way to manage expenses abroad.

The travel and tourism segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the forex cards market is divided into travel and tourism, cross-border transactions, and international shopping and e-commerce. Among these, the travel and tourism segment is anticipated to hold the highest market share during the projected timeframe. This trend is driven by resurgence in global travel post-pandemic, along with the growing trend of experiential tourism. As more people seek international experiences, the demand for financial products that facilitate seamless cross-border transactions rises. Forex cards specifically address this need by providing travellers with a reliable and cost-effective means of handling foreign currencies, thereby enhancing the overall travel experience.

North America is estimated to hold the largest share of the forex cards market over the forecast period.

North America is estimated to hold the largest share of the forex cards market over the forecast period. North America regions with robust economies and high levels of international travel, the demand for forex cards continues to grow. The presence of a diverse population, including expatriates and frequent travellers, drives the need for these convenient financial tools. Additionally, advancements in technology and the increasing availability of digital banking solutions contribute to the popularity of forex cards among consumers who seek flexibility and security in currency management while traveling.

Europe is expected to grow the fastest during the forecast period. This is driven by an increase in cross-border travel and a strong tourism sector. The diverse range of currencies and travel destinations in the region creates a high demand for forex cards, which enable users to manage multiple currencies with competitive exchange rates efficiently. As digital and contactless payment options become more prevalent, coupled with consumer preferences for secure and convenient payment methods while traveling, Europe emerges as a key market for the growth of forex cards.

Company Profiling

Major key players in the forex cards market includes MoneyGram International, TransferWise, WorldRemit, WorldFirst, Revolut, Paysend, Travelex, OFX, Xoom, Wise Plc, Western Union, Euronet Worldwide, Currencycloud, Ria Money Transfer, American Express, and Others.

Recent Development

- In January 2025, Travel services provider Thomas Cook (India) has partnered with the National Payments Corporation of India (NPCI) to launch its first RuPay prepaid forex card specifically designed for Indian travelers visiting the UAE. This collaboration will begin with the UAE as a pilot location, followed by a phased global rollout.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the forex cards market based on the below-mentioned segments:

Global Forex Cards Market, By Type

- Debit Forex Cards

- Prepaid Forex Cards

Global Forex Cards Market, By Application

- Travel and Tourism

- Cross-Border Transactions

- International Shopping and E-commerce

Global Forex Cards Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa