Global High-Frequency Trading (HFT) Market Size to worth USD 1139.63 Million by 2033

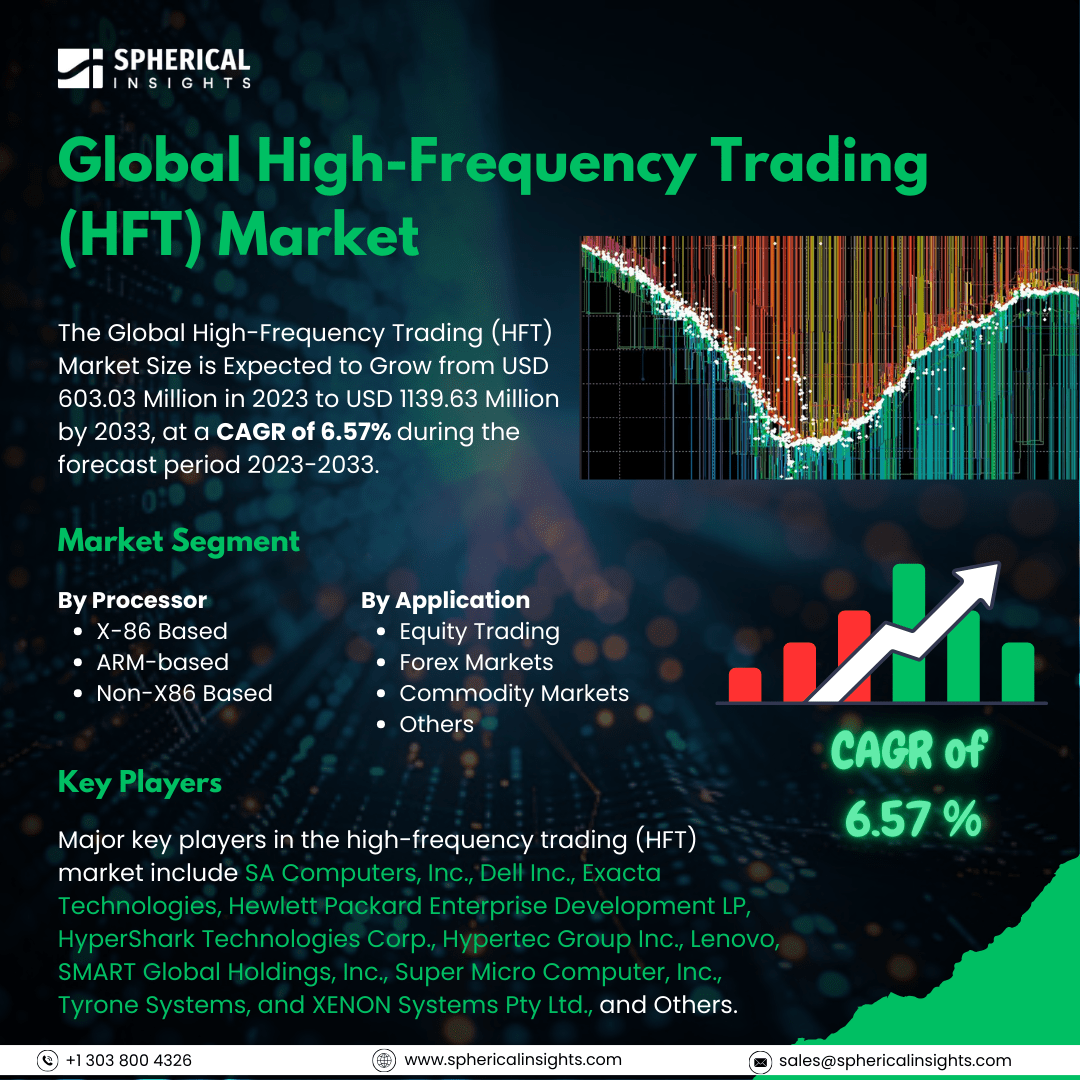

According to a research report published by Spherical Insights & Consulting, The Global High-Frequency Trading (HFT) Market Size is Expected to Grow from USD 603.03 Million in 2023 to USD 1139.63 Million by 2033, at a CAGR of 6.57% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global High-Frequency Trading (HFT) Market Size, Share, and COVID-19 Impact Analysis, By Processor (X-86, ARM-based, and Non-X86 Based), By Application (Equity Trading, Forex Markets, Commodity Markets, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The global high-frequency trading (HFT) market refers to the arena of computers and networks that facilitate high-speed trading. HFT is a form of algorithmic trading that employs powerful computers to execute a large number of trades within a very short timeframe. This market is primarily driven by the rapid advancement of technology, which allows for extremely fast trade execution through sophisticated algorithms, low-latency networks, and powerful computing capabilities. These advancements enable traders to take advantage of tiny price discrepancies and market inefficiencies, ultimately leading to increased market liquidity and heightened competition among financial institutions seeking a competitive edge. However, the global HFT market also faces significant challenges. Increasing competition among HFT firms has led to diminishing profit margins. Additionally, high operational costs associated with maintaining advanced technology infrastructure pose a challenge. Strict regulations can limit trading strategies, and there is a risk of market instability arising from rapid algorithmic trading. Concerns about potential market manipulation and the complexities of navigating diverse market structures across different exchanges further complicate the landscape. All these factors require substantial investment in technology to remain competitive in the market.

The X-86-based segment is predicted to hold the largest market share through the forecast period.

Based on processor, the high-frequency trading (HFT) market is classified into X-86-based, ARM-based, and non-X86-based. Among these, the X-86 based) segment is predicted to hold the largest market share through the forecast period. This is due to its widespread adoption in personal computers, servers, and enterprise systems, the X86 architecture has become the preferred choice for many consumers and businesses. Its compatibility with a vast range of software applications, along with its performance efficiency and cost-effectiveness, makes it highly attractive. As organizations continue to invest in digital transformation and cloud-based solutions, the demand for X86-based systems is expected to increase, solidifying its market leadership throughout the forecast period.

The equity trading segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the high-frequency trading (HFT) market is divided into equity trading, forex markets, commodity markets, and others. Among these, the equity trading segment is anticipated to hold the highest market share during the projected timeframe. This growth is also driven by the increasing popularity of stock markets and a rise in both retail and institutional investors. Enhanced trading platforms, coupled with advancements in technology such as algorithmic trading and real-time data analytics, have made equity trading more accessible and efficient. As investors seek higher returns and greater market participation, the equity trading segment is poised for significant growth, outpacing other financial instruments in the market.

North America is estimated to hold the largest share of the high-frequency trading (HFT) market over the forecast period.

North America is estimated to hold the largest share of the high-frequency trading (HFT) market over the forecast period. This growth is primarily due to its established financial infrastructure and the presence of key market players. The region boasts advanced technological capabilities, including high-speed internet and sophisticated trading algorithms that facilitate rapid transaction execution. Additionally, the regulatory environment in North America is conducive to high-frequency trading (HFT) operations, attracting both domestic and international firms to establish their trading activities there, further enhancing their market dominance.

Europe is expected to grow the fastest during the forecast period. The market is fueled by the increasing adoption of advanced trading technologies and regulatory reforms that promote market efficiency. There is a surge in institutional investment and a shift towards more automated trading strategies, driving demand for HFT services. Furthermore, the expansion of electronic trading platforms and the integration of artificial intelligence in trading processes contribute to Europe's rapid growth, positioning it as a significant player in the global HFT landscape.

Company Profiling

Major key players in the high-frequency trading (HFT) market include SA Computers, Inc., Dell Inc., Exacta Technologies, Hewlett Packard Enterprise Development LP, HyperShark Technologies Corp., Hypertec Group Inc., Lenovo, SMART Global Holdings, Inc., Super Micro Computer, Inc., Tyrone Systems, and XENON Systems Pty Ltd., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Orderly Network, a Web3 liquidity layer, is excited to announce its partnership with FUNL.AI, an automated DeFi trading agent that operates via Telegram. This partnership aims to revolutionize decentralized finance (DeFi) by introducing autonomous AI agents that automate and simplify trading for users through Telegram, utilizing Orderly's robust omnichannel infrastructure.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the high-frequency trading (HFT) market based on the below-mentioned segments:

Global High-Frequency Trading (HFT) Market, By Processor

- X-86 Based

- ARM-based

- Non-X86 Based

Global High-Frequency Trading (HFT) Market, By Application

- Equity Trading

- Forex Markets

- Commodity Markets

- Others

Global High-Frequency Trading (HFT) Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa