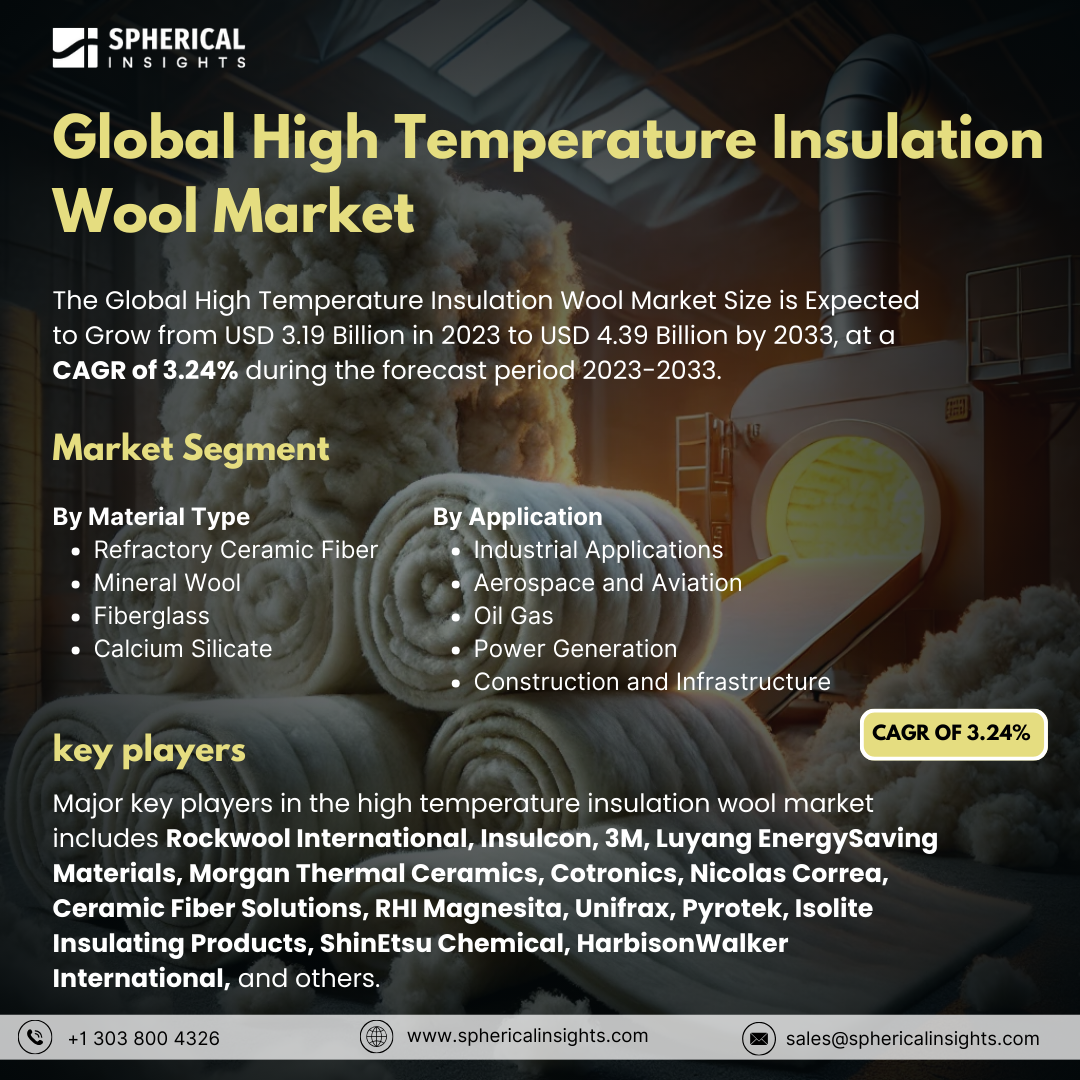

Global High Temperature Insulation Wool Market Size to worth USD 4.39 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global High Temperature Insulation Wool Market Size is Expected to Grow from USD 3.19 Billion in 2023 to USD 4.39 Billion by 2033, at a CAGR of 3.24% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global High Temperature Insulation Wool Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Refractory Ceramic Fiber, Mineral Wool, Fiberglass, and Calcium Silicate), By Application (Industrial Applications, Aerospace and Aviation, Oil Gas, Power Generation, and Construction and Infrastructure), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

High-temperature insulation wool (HTIW) is a synthetic material composed of mineral-based fibers that can endure extreme temperatures. It is utilized in various industrial applications, including furnaces, kilns, and aerospace components. The high-temperature insulation market is fueled by several factors, such as strict environmental regulations imposed by governments and increasing awareness among consumers and builders regarding the environmental benefits of sustainable materials. Rapid urbanization and ongoing construction projects, particularly in high-rise buildings, are driving the demand for high-temperature insulation. Additionally, both governments and businesses are investing in increasing production capacity in industries like glass, cement, iron and steel, and ceramics to meet this rising demand. However, there are factors that may hinder the growth of the high-temperature insulation wool market. The elongated dust particles found in high-temperature insulation wool can potentially lead to tumor development. Handling these products can also release fibrous dust, posing health risks. Moreover, advanced insulation materials can be expensive, making them less accessible to consumers and developers. In developing countries, where budgets are often limited, more affordable materials like fiberglass may be preferred.

The fiberglass segment is predicted to hold the largest market share through the forecast period.

Based on the material type, the high temperature insulation wool market is classified into refractory ceramic fiber, mineral wool, fiberglass, and calcium silicate. Among these, the fiberglass segment is predicted to hold the largest market share through the forecast period. This is due to its superior thermal insulation properties and versatility in various applications. Fiberglass insulation is lightweight, non-combustible, and resistant to moisture, making it an ideal choice for industries such as construction, automotive, and aerospace. Its ability to effectively reduce energy consumption and improve thermal efficiency drives its adoption, particularly in energy-efficient building designs and high-performance industrial processes. As sustainability becomes increasingly important, the demand for fiberglass insulation is expected to continue rising, solidifying its dominant position in the market.

The industrial applications segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the high temperature insulation wool market is divided into industrial applications, aerospace and aviation, oil gas, power generation, and construction and infrastructure. Among these, the industrial applications segment is anticipated to hold the highest market share during the projected timeframe. This is primarily driven by the increasing demand for high-temperature insulation in various industries, including manufacturing, chemical processing, and power generation. These sectors require reliable insulation materials to enhance energy efficiency, reduce operational costs, and ensure worker safety in high-heat environments. As industries focus on optimizing their processes and reducing heat loss, the adoption of advanced insulation solutions is expected to grow, positioning the industrial applications segment as a leader in the market.

North America is estimated to hold the largest share of the high temperature insulation wool market over the forecast period.

North America is estimated to hold the largest share of the high temperature insulation wool market over the forecast period. This is attributed to robust industrial activities and stringent regulations regarding energy efficiency and emissions. The region's established manufacturing base, particularly in sectors such as aerospace, automotive, and petrochemicals, drives the demand for high-performance insulation solutions. Additionally, ongoing investments in infrastructure and a shift towards sustainable practices further enhance the region's market position. The combination of technological advancements and regulatory support for energy-efficient solutions is expected to sustain North America's dominance in the high-temperature insulation wool market.

Asia Pacific is expected to grow the fastest during the forecast period, fueled by rapid industrialization and urbanization in emerging economies. Countries such as China and India are witnessing significant investments in infrastructure development, manufacturing, and energy sectors, which in turn boosts the demand for high-temperature insulation materials. The increasing focus on energy efficiency and sustainability, coupled with government initiatives promoting cleaner technologies, contributes to the region's accelerated growth. As the region continues to expand its industrial capabilities, the high-temperature insulation wool market is poised for substantial growth, outpacing other global markets.

Company Profiling

Major key players in the high temperature insulation wool market includes Rockwool International, Insulcon, 3M, Luyang EnergySaving Materials, Morgan Thermal Ceramics, Cotronics, Nicolas Correa, Ceramic Fiber Solutions, RHI Magnesita, Unifrax, Pyrotek, Isolite Insulating Products, ShinEtsu Chemical, HarbisonWalker International, and others.

Recent Developments

- In March 2024, with the 2024 AMPP Annual Conference + Expo about to begin, ROCKWOOL Technical Insulation is launching its ProRox PS 965, featuring CR-Tech technology for corrosion resistance. According to the company, this is the industry's first stone wool insulation that includes a built-in corrosion inhibitor.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the high temperature insulation wool market based on the below-mentioned segments:

Global High Temperature Insulation Wool Market, By Material Type

- Refractory Ceramic Fiber

- Mineral Wool

- Fiberglass

- Calcium Silicate

Global High Temperature Insulation Wool Market, By Application

- Industrial Applications

- Aerospace and Aviation

- Oil Gas

- Power Generation

- Construction and Infrastructure

Global High Temperature Insulation Wool Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa