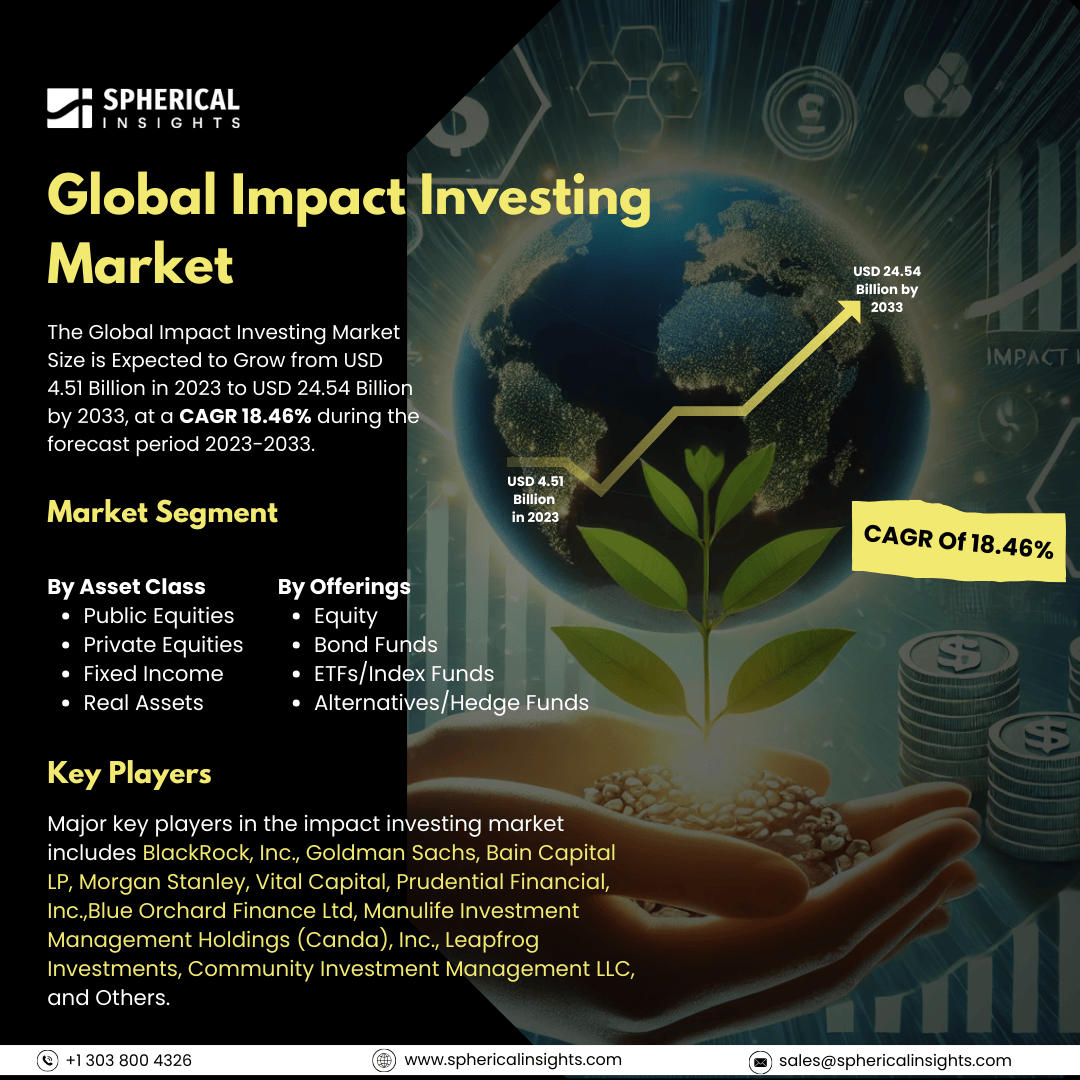

Global Impact Investing Market Size to worth USD 24.54 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Impact Investing Market Size is Expected to Grow from USD 4.51 Billion in 2023 to USD 24.54 Billion by 2033, at a CAGR 18.46% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Impact Investing Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Equities, Private Equities, Fixed Income, and Real Assets), By Offering (Equity, Bond Funds, ETFs/Index Funds, and Alternatives/Hedge Funds), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The impact investing market is a rapidly growing sector focused on generating financial returns while creating a positive social or environmental impact. Impact investing involves allocating capital to companies, organizations, and funds with the goal of achieving measurable benefits in social or environmental areas. Several key factors are driving the growth of impact investing. There is increasing awareness of social and environmental issues, a shift in consumer preferences toward sustainability, and a rising demand for responsible investment options. Investors are increasingly looking to align their financial goals with their values, resulting in more capital being directed toward businesses that offer positive social or environmental outcomes alongside financial returns. However, the impact investing market faces challenges that can hinder its growth and effectiveness. One significant issue is the lack of standardized metrics and frameworks for measuring social and environmental impact, which can lead to confusion and inconsistency among investors. Additionally, some investors perceive impact investments as yielding lower financial returns compared to traditional investments, which can deter risk-averse individuals.

The public equities segment is predicted to hold the largest market share through the forecast period.

Based on the asset class, the impact investing market is classified into public equities, private equities, fixed income, and real assets. Among these, the public equities segment is predicted to hold the largest market share through the forecast period. Public equities are gaining popularity due to their strong liquidity, accessibility, and increasing interest from institutional and retail investors. Factors such as favourable regulatory environments, the growth of investment platforms, and a rising trend toward sustainable investing are likely to enhance investor confidence and participation in this sector. Additionally, the performance of major stock indices and the potential for capital appreciation make public equities an attractive investment option, ensuring their continued prominence in the market.

The equity segment is anticipated to hold the highest market share during the projected timeframe.

Based on the offering, the impact investing market is divided into equity, bond funds, ETFs/index funds, and alternatives/hedge funds. Among these, the equity segment is anticipated to hold the highest market share during the projected timeframe. Equities are appealing for their potential for high returns and diversification benefits. As investors seek to improve their portfolios with equities, driven by favourable economic conditions and corporate earnings growth, this segment is expected to attract significant capital inflows. Furthermore, the rise of equity-based investment strategies, such as exchange-traded funds (ETFs) and index funds, further supports the dominance of equities in the market.

North America is estimated to hold the largest share of the impact investing market over the forecast period.

North America is estimated to hold the largest share of the impact investing market over the forecast period. Impact investing is growing largely due to a strong financial infrastructure and the presence of many influential investors and organizations committed to social and environmental goals. The heightened awareness of sustainability issues and the demand for responsible investment options are prompting a shift toward impact investing.

Europe is expected to grow the fastest during the forecast period, driven by an increasing focus on sustainable finance and responsible investment practices. The region's regulatory landscape is becoming more supportive of green and impact investments, encouraging both institutional and retail investors to direct their funds toward initiatives that address social and environmental challenges. The growing number of impact-focused funds and investment vehicles, along with heightened public awareness of climate change and social equity issues, is propelling Europe to the forefront of the impact investing market.

Company Profiling

Major key players in the impact investing market includes BlackRock, Inc., Goldman Sachs, Bain Capital LP, Morgan Stanley, Vital Capital, Prudential Financial, Inc., Blue Orchard Finance Ltd, Manulife Investment Management Holdings (Canda), Inc., Leapfrog Investments, Community Investment Management LLC, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Elevance Health Foundation, the philanthropic arm of Elevance Health, has announced a $10 million commitment to launch a new impact investing program. This initiative aims to create a positive social impact through investment opportunities, complementing its existing grant portfolio. The program will provide loans to small businesses, social enterprises, and entrepreneurs dedicated to promoting health equity in under-resourced communities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the impact investing market based on the below-mentioned segments:

Global Impact Investing Market, By Asset Class

- Public Equities

- Private Equities

- Fixed Income

- Real Assets

Global Impact Investing Market, By Offerings

- Equity

- Bond Funds

- ETFs/Index Funds

- Alternatives/Hedge Funds

Global Impact Investing Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa