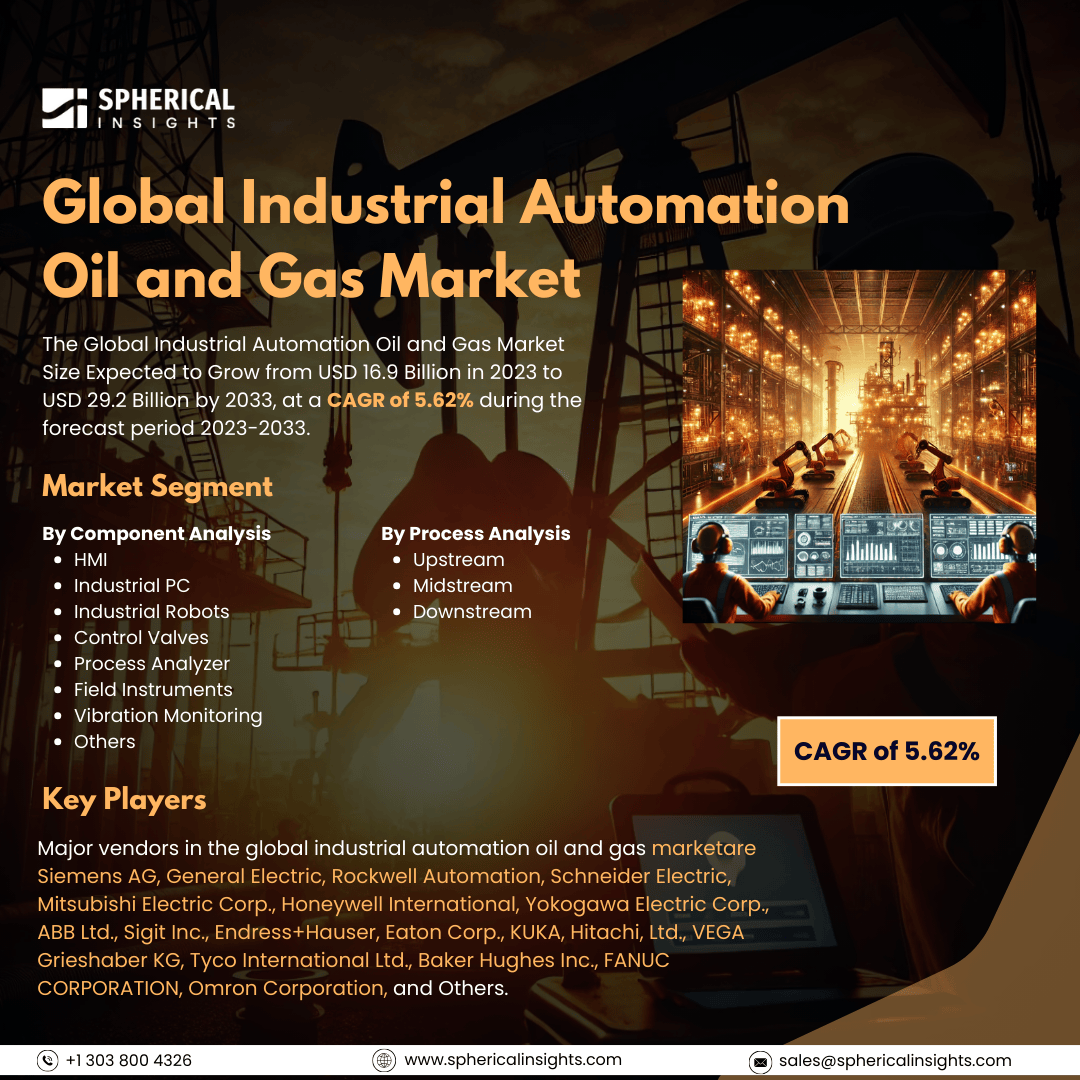

Global Industrial Automation Oil and Gas Market Size to Exceed USD 29.2 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Industrial Automation Oil and Gas Market Size Expected to Grow from USD 16.9 Billion in 2023 to USD 29.2 Billion by 2033, at a CAGR of 5.62% during the forecast period 2023-2033.

Browse 220 market data Tables and 50 Figures spread through 190 Pages and in-depth TOC on the Global Industrial Automation Oil and Gas Market Size, Share, and COVID-19 Impact Analysis, By Component (HMI, Industrial PC, Industrial Robots, Control Valves, Process Analyzer, Field Instruments, Vibration Monitoring, Others), By Process (Upstream, Midstream, Downstream), By Solution (MES, PLC, DCS, PAM, SCADA, Functional Safety, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industrial automation for oil and gas, or oilfield automation, refers to a growing range of procedures that use digital technologies to assist oil and gas firms in becoming more competitive in global marketplaces. Internet of Things (IoT) sensors, autonomous and predictive technologies to increase production, and expert networks and artificial intelligence (AI) to overcome the challenges brought on by a lack of experienced workers are all commonly employed in oil and gas automation. Numerous business benefits, such as reduced expenses, a more integrated company, and enhanced production and efficiency, are provided by oil and gas automation. The many issues confronting the oil and gas sector are rising production costs, deteriorating infrastructure, and environmental concerns. Consequently, there is an increasing need for automation solutions that can enhance environmental performance, safety, and efficiency. Efficiency can be increased through automation in a variety of ways. However, infrastructure investments are impacted by lower oil and gas prices, and the market for oil and gas automation and instrumentation is severely constrained by the growing trend toward renewable energy sources. It is anticipated that the expansion of the conventional energy industry will create opportunities for market participants because of the rising energy demand in the developing economies of Asia-Pacific and Latin America.

The control valves segment is anticipating the market with the largest revenue share over the estimated period.

Based on the components, the global industrial automation oil & gas market is segmented into the HMI, industrial PC, industrial robots, control valves, process analyzers, field instruments, vibration monitoring, and others. Among these, the control valves segment is anticipating the market with the largest revenue share over the estimated period. Control valves are used in the oil and gas sector to adjust a fluid's flow or pressure. They are required because of their vital role in ensuring operational effectiveness and safety at almost every stage of oil and gas operations. Depending on the specific needs, a variety of control valve types are used, including butterfly, ball, and gate valves. The procedures of distribution, transportation, and refinement all depend on their use.

The downstream segment is projected to hold the largest share of the global industrial automation oil and gas market during the estimated period.

Based on the process, the global industrial automation oil & gas market is segmented into upstream, midstream, and downstream. Among these, the downstream segment is projected to hold the largest share of the global industrial automation oil and gas market during the estimated period. Its dominance is a result of the intricacy of refining operations, the sheer volume of refineries worldwide, and the high capital and operating expenses associated with petrochemical and refining output. To ensure effective and secure operations in this sector, advanced automation technologies such as process control systems, sensors, and advanced analytics are essential. Among other things, automation aids in the downstream segment's demand forecasting, inventory management, quality assurance, and process optimization.

The DCS segment accounted for the largest revenue share of more than 35.7% over the predicted timeframe.

Based on the solution, the global industrial automation oil & gas market is segmented into MES, PLC, DCS, PAM, SCADA, functional safety, and others. Among these, the DCS segment is segment accounted for the largest revenue share of more than 35.7% over the predicted timeframe. DCS systems are now crucial for managing complex processes in large facilities, which makes them invaluable in sectors like gas processing and oil refining that involve intricate operations. It integrates the automation, monitoring, and control of several devices and systems. In the oil and gas sector, DCS oversees pipelines, controls refining procedures, and plans intricate processes including batch processing and blending. By enabling centralized monitoring of dispersed activities, they facilitate the management of large operations, optimize throughput, and uphold safety regulations.

North America anticipates the market with the largest market share over the estimated period.

North America is anticipating the market with more than 38.7% market share over the estimated period. North America has a substantial oil and gas industry, primarily in the United States and Canada, with a significant shift toward unconventional energy sources such as shale gas and oil reserves. Automation has been essential in improving shale extraction technologies. Furthermore, severe safety and environmental requirements encourage the use of automation technology to ensure conformity and decrease liabilities. North America is well-known in the oil and gas business for its use of advanced automation technologies such as artificial intelligence, machine learning, and data analytics.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The growing production and exploration efforts in developing nations such as China and India. Growing industrial development in the region necessitates increased energy consumption, which drives investments in oil and gas automation systems. Countries with enormous populations and expanding energy demands, such as India and China, are driving the need for improved oil and gas production. As the region's emerging nations expand, there will be a larger demand for energy systems and refining capacity, pushing demand for increasingly automated solutions. Automation technologies are critical to ensuring safe and efficient operations in potentially hazardous offshore locations.

Company Profiling

Major vendors in the global industrial automation oil and gas market are Siemens AG, General Electric, Rockwell Automation, Schneider Electric, Mitsubishi Electric Corp., Honeywell International, Yokogawa Electric Corp., ABB Ltd., Sigit Inc., Endress+Hauser, Eaton Corp., KUKA, Hitachi, Ltd., VEGA Grieshaber KG, Tyco International Ltd., Baker Hughes Inc., FANUC CORPORATION, Omron Corporation, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In March 2023, Honeywell announced a partnership with Microsoft to develop a cloud-based platform for automating oil and gas production processes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global industrial automation oil and gas market based on the below-mentioned segments:

Global Industrial Automation Oil and Gas Market, By Component Analysis

- HMI

- Industrial PC

- Industrial Robots

- Control Valves

- Process Analyzer

- Field Instruments

- Vibration Monitoring

- Others

Global Industrial Automation Oil and Gas Market, By Process Analysis

- Upstream

- Midstream

- Downstream

Global Industrial Automation Oil & Gas Market, Solution Analysis

- MES (Manufacturing Execution System)

- PLC (Programmable Logic Controller)

- DCS (Distribution Control System)

- PAM (Process Automation Management)

- SCADA (Supervisory Control and Data Acquisition)

- Functional Safety

- Others

Global Industrial Automation Oil and Gas Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa