Global Intelligent Virtual Assistant (IVA) Based Banking Market Size to worth USD 18.29 Billion by 2033

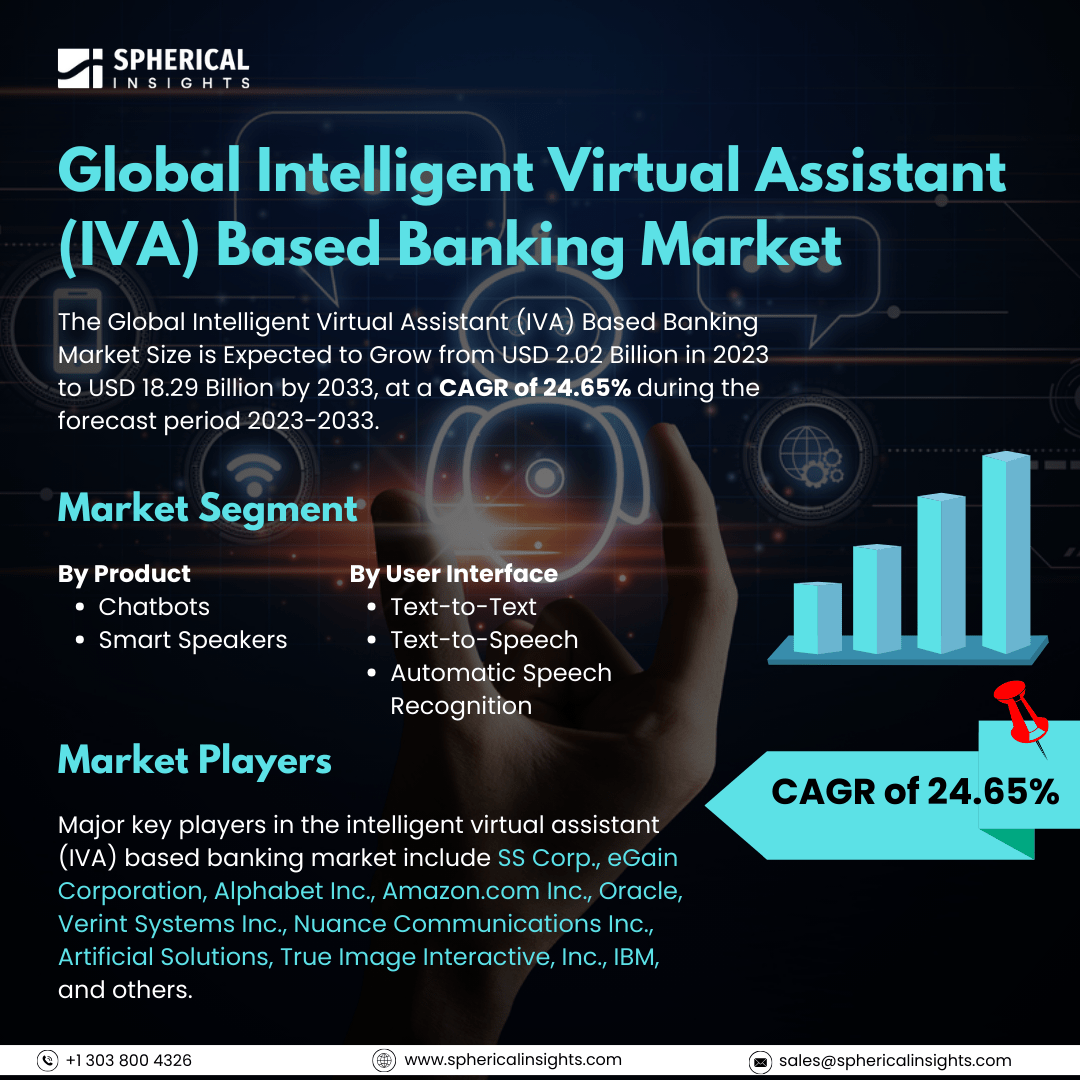

According to a research report published by Spherical Insights & Consulting, The Global Intelligent Virtual Assistant (IVA) Based Banking Market Size is Expected to Grow from USD 2.02 Billion in 2023 to USD 18.29 Billion by 2033, at a CAGR of 24.65% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Intelligent Virtual Assistant (IVA) Based Banking Market Size, Share, and COVID-19 Impact Analysis, By Product (Chatbots, Smart Speakers), By User Interface (Text-to-Text, Text-to-Speech, and Automatic Speech Recognition), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The market for Intelligent Virtual Assistants (IVAs) in banking refers to AI-powered software designed to interact with banking customers. IVAs can assist financial institutions by streamlining call center transactions and offering personalized customer service. Several key factors are driving the growth of the IVA-based banking market, including the rising customer demand for 24/7 access to personalized banking services, increased adoption of digital channels, advancements in Natural Language Processing (NLP) technology that facilitate more natural interactions, cost savings through the automation of routine tasks, improved customer experience, and a heightened need for enhanced security and fraud detection capabilities. These factors encourage banks to integrate IVAs to optimize operations and provide a more convenient customer experience. However, while IVA-based banking presents significant advantages, several challenges could hinder its market growth. These include concerns about data privacy and security, limitations in advanced natural language processing for handling complex inquiries, technical issues with speech recognition, integration difficulties with legacy banking systems, customer resistance to new technologies, and regulatory challenges related to AI implementation. These factors can all impact user trust and limit the full potential of IVA systems in the banking sector.

The smart speakers segment is predicted to hold the largest market share through the forecast period.

Based on the product, the intelligent virtual assistant (IVA) based banking market is classified into chatbots, and smart speakers. Among these, the smart speakers segment is predicted to hold the largest market share through the forecast period. The adoption of smart speakers with intelligent virtual assistants is increasing in both households and businesses. This growth can be attributed to advancements in voice recognition technology, improved user experiences, and the rising popularity of smart home ecosystems. As consumers seek convenience and connectivity, these smart speakers are becoming essential tools for managing daily tasks, controlling smart devices, and accessing information seamlessly.

The text-to-text segment is anticipated to hold the highest market share during the projected timeframe.

Based on the user interface, the intelligent virtual assistant (IVA) based banking market is divided into text-to-text, text-to-speech, and automatic speech recognition. Among these, the text-to-text segment is anticipated to hold the highest market share during the projected timeframe. Text-based AI technologies are gaining traction, mainly due to the growing demand for automation in content creation and customer interactions. Businesses are increasingly utilizing these technologies to improve productivity and efficiency through applications such as chatbots, automated email responses, and content generation. As organizations strive to enhance user engagement and streamline communication, the versatility and effectiveness of text-to-text solutions are expected to boost their prominence in the market.

North America is estimated to hold the largest share of the intelligent virtual assistant (IVA) based banking market over the forecast period.

North America is estimated to hold the largest share of the intelligent virtual assistant (IVA) based banking market over the forecast period. The rise of intelligent virtual assistants (IVAs) is largely driven by technological advancements and high digital adoption rates. Financial institutions in this region are increasingly integrating IVAs to enhance customer service, streamline operations, and offer personalized banking experiences. With a tech-savvy population and significant investments in innovation from banks and fintech companies, North America is positioned as a leader in this rapidly evolving sector.

Europe is expected to grow the fastest during the forecast period. The demand for IVAs is being fueled by a surge in digital transformation initiatives and a heightened emphasis on customer experience across various industries. The region's commitment to innovation, along with growing regulatory support for technology adoption, creates a favorable environment for the development of intelligent virtual assistants. As businesses across Europe seek to improve operational efficiency and engage customers more effectively, the demand for IVAs is expected to accelerate, positioning Europe as a key player in this market.

Company Profiling

Major key players in the intelligent virtual assistant (IVA) based banking market include SS Corp., eGain Corporation, Alphabet Inc., Amazon.com Inc., Oracle, Verint Systems Inc., Nuance Communications Inc., Artificial Solutions, True Image Interactive, Inc., IBM, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Kyndryl, the world’s largest IT infrastructure services provider, announced the launch of Kyndryl Interactive AI for the Service Desk. This dynamic IT support service combines artificial intelligence (AI) with human expertise to provide a hyper-personalized interactive IT support experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global intelligent virtual assistant (IVA) based banking market based on the below-mentioned segments:

Global Intelligent Virtual Assistant (IVA) Based Banking Market, By Product

Global Intelligent Virtual Assistant (IVA) Based Banking Market, By User Interface

- Text-to-Text

- Text-to-Speech

- Automatic Speech Recognition

Global Intelligent Virtual Assistant (IVA) Based Banking Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa