Global Invoice Factoring Market Size to worth USD 10.82 Billion by 2033

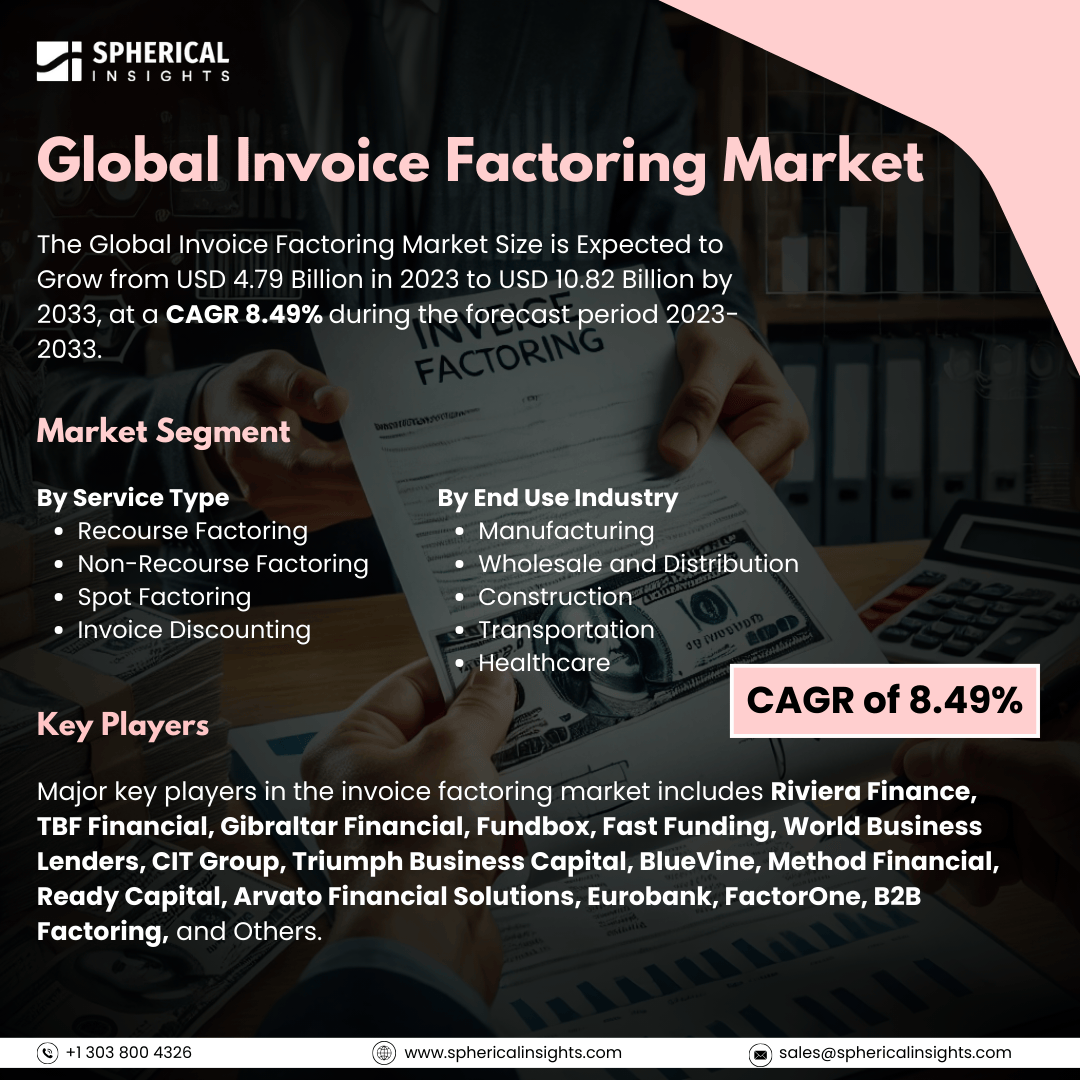

According to a research report published by Spherical Insights & Consulting, The Global Invoice Factoring Market Size is Expected to Grow from USD 4.79 Billion in 2023 to USD 10.82 Billion by 2033, at a CAGR 8.49% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Invoice Factoring Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Recourse Factoring, Non-Recourse Factoring, Spot Factoring, and Invoice Discounting), By End Use Industry (Manufacturing, Wholesale and Distribution, Construction, Transportation, and Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Invoice factoring is a financial transaction in which a business sells some or all of its unpaid invoices to a third party, known as a factor, in exchange for a cash advance. The factor then collects payment from the business's customers and pays the business the remaining balance, minus a fee. The invoice factoring market is influenced by various factors. Economic growth can lead to an increase in the number of invoices available for factoring, while economic downturns often result in higher demand for factoring services to enhance liquidity. Certain industries, such as manufacturing, wholesale trade, and transportation, are more likely to utilize factoring services. Small and medium-sized enterprises (SMEs) are increasingly turning to invoice factoring as a way to access immediate funds without taking on long-term debt. However, the invoice factoring market also faces several challenges. Invoice factoring can be costly, with fees typically ranging from 1% to 5% of the invoice value. When these fees are converted to an annual percentage rate (APR), the overall cost can be even higher. Additionally, the creditworthiness of the customer plays a significant role in determining the terms and approval of the invoice factoring process. If a customer is deemed high-risk, the factoring company may impose higher fees. Lastly, factoring companies often interact directly with customers to recover unpaid invoices, which can lead to startups losing some control over their customer relationships.

The recourse factoring segment is predicted to hold the largest market share through the forecast period.

Based on the service type, the invoice factoring market is classified into recourse factoring, non-recourse factoring, spot factoring, and invoice discounting. Among these, the recourse factoring segment is predicted to hold the largest market share through the forecast period. Due to its flexible repayment structure, recourse factoring enables businesses to manage cash flow more effectively. In this arrangement, the seller retains the risk of non-payment from debtors, making it a cost-effective option for companies that have strong credit relationships with their customers. This segment is particularly appealing to businesses seeking immediate liquidity while minimizing costs associated with factoring services. As more firms recognize the benefits of recourse factoring in enhancing financial stability and operational efficiency, its market share is projected to grow significantly throughout the forecast period.

The manufacturing segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end use industry, the invoice factoring market is divided into manufacturing, wholesale and distribution, construction, transportation, and healthcare. Among these, the manufacturing segment is anticipated to hold the highest market share during the projected timeframe. Manufacturers, in particular, face challenges related to cash flow because of long payment terms from customers. The need for consistent cash flow to support production cycles and manage operational expenses drives the use of invoice factoring. This financial solution provides an immediate influx of capital by converting receivables into cash, allowing manufacturers to invest in raw materials, pay suppliers promptly, and sustain production levels. As the manufacturing sector continues to expand and evolve, the reliance on factoring services is expected to increase, solidifying its position as the leading segment in the market.

North America is estimated to hold the largest share of the invoice factoring market over the forecast period.

North America is estimated to hold the largest share of the invoice factoring market over the forecast period. The North American market for invoice factoring is driven by a robust economy and a high concentration of businesses that utilize these services. The region's well-established financial infrastructure, along with a growing number of small and medium-sized enterprises (SMEs) seeking flexible financing options, supports strong demand for invoice factoring. Additionally, North American companies are increasingly recognizing the strategic advantages of maintaining liquidity through factoring, which enhances their operational efficiency and competitive edge. These factors position North America as a dominant player in the invoice factoring landscape.

Europe is expected to grow the fastest during the forecast period. The invoice factoring market is fueled by a surge in small business activity and a supportive regulatory environment. This region is characterized by a growing number of startups and SMEs that require immediate access to working capital to navigate economic uncertainties. Moreover, advancements in technology and digital platforms are making factoring services more accessible and efficient for businesses across Europe. As companies in this region continue to adopt innovative financing solutions to optimize cash flow and support growth, the invoice factoring market is expected to expand rapidly.

Company Profiling

Major key players in the invoice factoring market includes Riviera Finance, TBF Financial, Gibraltar Financial, Fundbox, Fast Funding, World Business Lenders, CIT Group, Triumph Business Capital, BlueVine, Method Financial, Ready Capital, Arvato Financial Solutions, Eurobank, FactorOne, B2B Factoring, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, FundThrough, a financial technology platform that addresses cash flow challenges for growing businesses by providing fast invoice payments, has announced the acquisition of the invoice factoring business from BlueVine, another financial technology company. This acquisition accelerates FundThrough's strategic focus on embedded finance and supports its expansion efforts in the U.S. market, effectively doubling the number of U.S. clients who will utilize FundThrough to convert unpaid invoices into working capital. All employees from BlueVine's invoice funding division will join FundThrough as part of this transaction.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the invoice factoring market based on the below-mentioned segments:

Global Invoice Factoring Market, By Service Type

- Recourse Factoring

- Non-Recourse Factoring

- Spot Factoring

- Invoice Discounting

Global Invoice Factoring Market, By End Use Industry

- Manufacturing

- Wholesale and Distribution

- Construction

- Transportation

- Healthcare

Global Invoice Factoring Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa