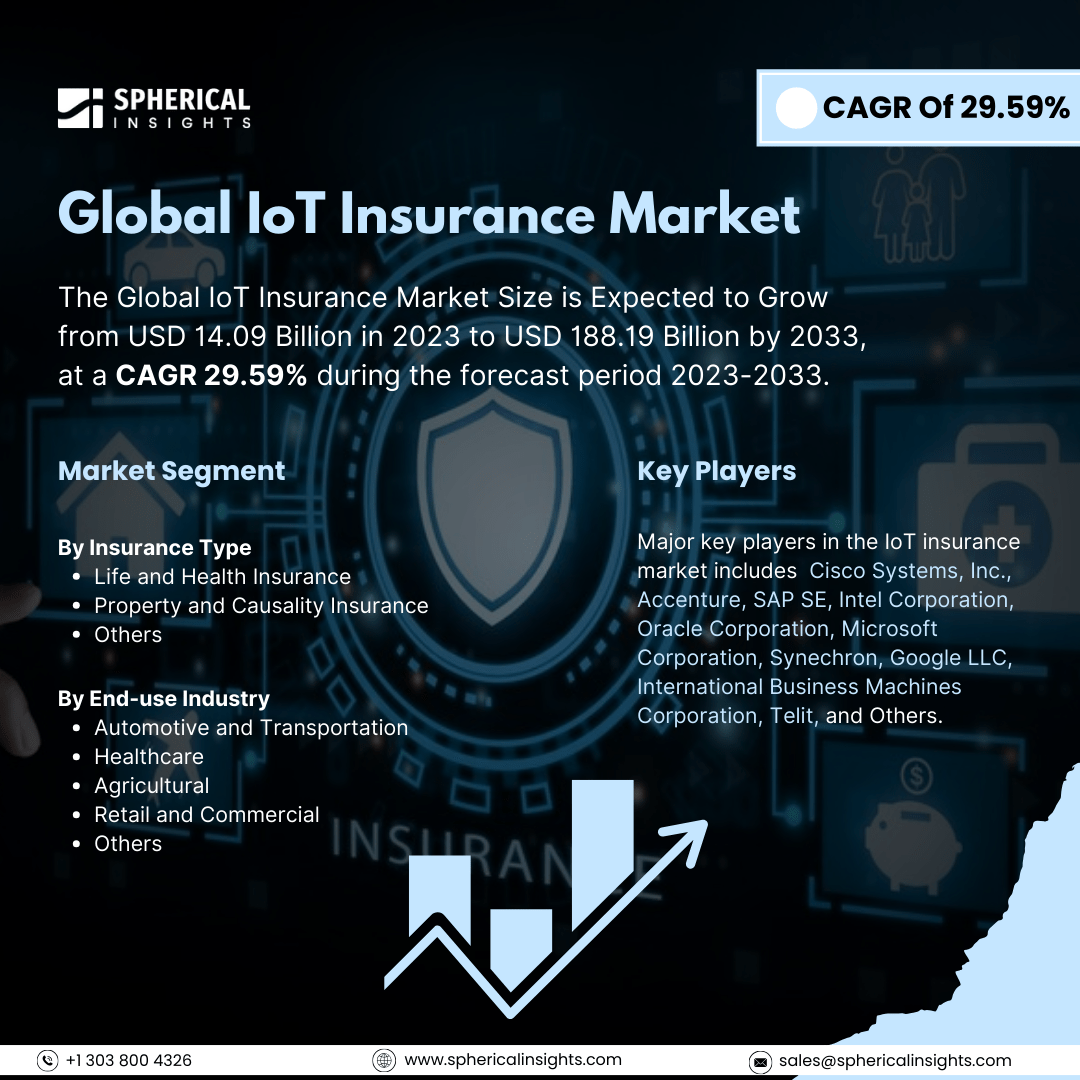

Global IoT Insurance Market Size to worth USD 188.19 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global IoT Insurance Market Size is Expected to Grow from USD 14.09 Billion in 2023 to USD 188.19 Billion by 2033, at a CAGR 29.59% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global IoT Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Life and Health Insurance, Property and Causality Insurance, and Others), By End-use Industry (Automotive and Transportation, Healthcare, Agricultural, Retail and Commercial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The Internet of Things (IoT) insurance market refers to the sector that offers insurance products and services utilizing IoT devices and technologies. IoT devices are physical objects, such as vehicles and buildings, equipped with sensors, software, and connectivity to collect and exchange data. Moreover, several key factors are driving the growth of the IoT insurance market, including the increasing adoption of IoT devices across various sectors, the ability to gather real-time data for more accurate risk assessment, reduced premiums through proactive risk management, personalized insurance offerings made possible by data analysis, and investments by insurance companies aimed at enhancing operational efficiency through IoT technology. Together, these elements contribute to a more data-driven and customer-centric insurance experience. However, there are also significant challenges facing the IoT insurance market. These include concerns about data security and privacy, a lack of standardized regulations, customer hesitation to share personal information with insurers, the potential for complex data management issues, and insufficient technical expertise within the insurance industry to fully utilize IoT capabilities.

The life and health insurance segment is predicted to hold the largest market share through the forecast period.

Based on the insurance type, the IoT insurance market is classified into life and health insurance, property and causality insurance, and others. Among these, the life and health insurance segment is predicted to hold the largest market share through the forecast period. There is an increasing awareness of health management and a rising prevalence of chronic diseases. As consumers prioritize financial security and well-being, the demand for life insurance policies and health coverage is growing. Additionally, advancements in telemedicine and wellness programs are driving innovations in the insurance sector, making products more appealing and accessible. This combination of factors is likely to reinforce the dominant position of the life and health insurance segment throughout the forecast period.

The automotive and transportation segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end-use industry, the IoT insurance market is divided into automotive and transportation, healthcare, agricultural, retail and commercial, and others. Among these, the automotive and transportation segment is anticipated to hold the highest market share during the projected timeframe. The insurance industry is also experiencing rapid technological evolution, particularly with the rise of connected vehicles and autonomous driving systems. As vehicles become increasingly integrated with Internet of Things (IoT) technologies, the demand for insurance products catering to these innovations is expected to surge. Moreover, the growing emphasis on safety and risk management in transportation is increasing the need for specialized insurance solutions, ensuring this segment's prominence during the projected timeframe.

North America is estimated to hold the largest share of the IoT insurance market over the forecast period.

North America is estimated to hold the largest share of the IoT insurance market over the forecast period. The growth is driven by the region's advanced technological infrastructure and high adoption rates of IoT devices. The presence of major insurance companies and startups focused on integrating IoT solutions into their offerings further enhances market growth. Additionally, regulatory support and increased consumer awareness regarding data-driven insurance models facilitate the development of tailored policies, allowing the North American market to lead in innovation and market share in IoT insurance.

Europe is expected to grow the fastest during the forecast period. The growth is driven by a strong regulatory environment and a proactive approach toward digital transformation within the insurance sector. The region is witnessing rapid advancements in technology adoption, including the integration of artificial intelligence and IoT, which enhance operational efficiency and customer engagement. Furthermore, the growing consumer demand for personalized insurance products and services, along with a focus on sustainability, encourages insurers to innovate and expand their offerings, thereby further propelling growth in the European market.

Company Profiling

Major key players in the IoT insurance market includes Cisco Systems, Inc., Accenture, SAP SE, Intel Corporation, Oracle Corporation, Microsoft Corporation, Synechron, Google LLC, International Business Machines Corporation, Telit, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Accenture (NYSE: ACN) has acquired ON Service GROUP, a prominent provider of business process services specializing in insurance operations. The terms of the transaction have not been disclosed. This acquisition enhances Accenture’s capabilities in insurance operations and expands the range of services available to clients in Germany, particularly for insurance business processes such as sales and policy administration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the IoT insurance market based on the below-mentioned segments:

Global IoT Insurance Market, By Insurance Type

- Life and Health Insurance

- Property and Causality Insurance

- Others

Global IoT Insurance Market, By End-use Industry

- Automotive and Transportation

- Healthcare

- Agricultural

- Retail and Commercial

- Others

Global IoT Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa