Global Letter of Credit Confirmation Market Size to worth USD 6.72 Billion by 2033

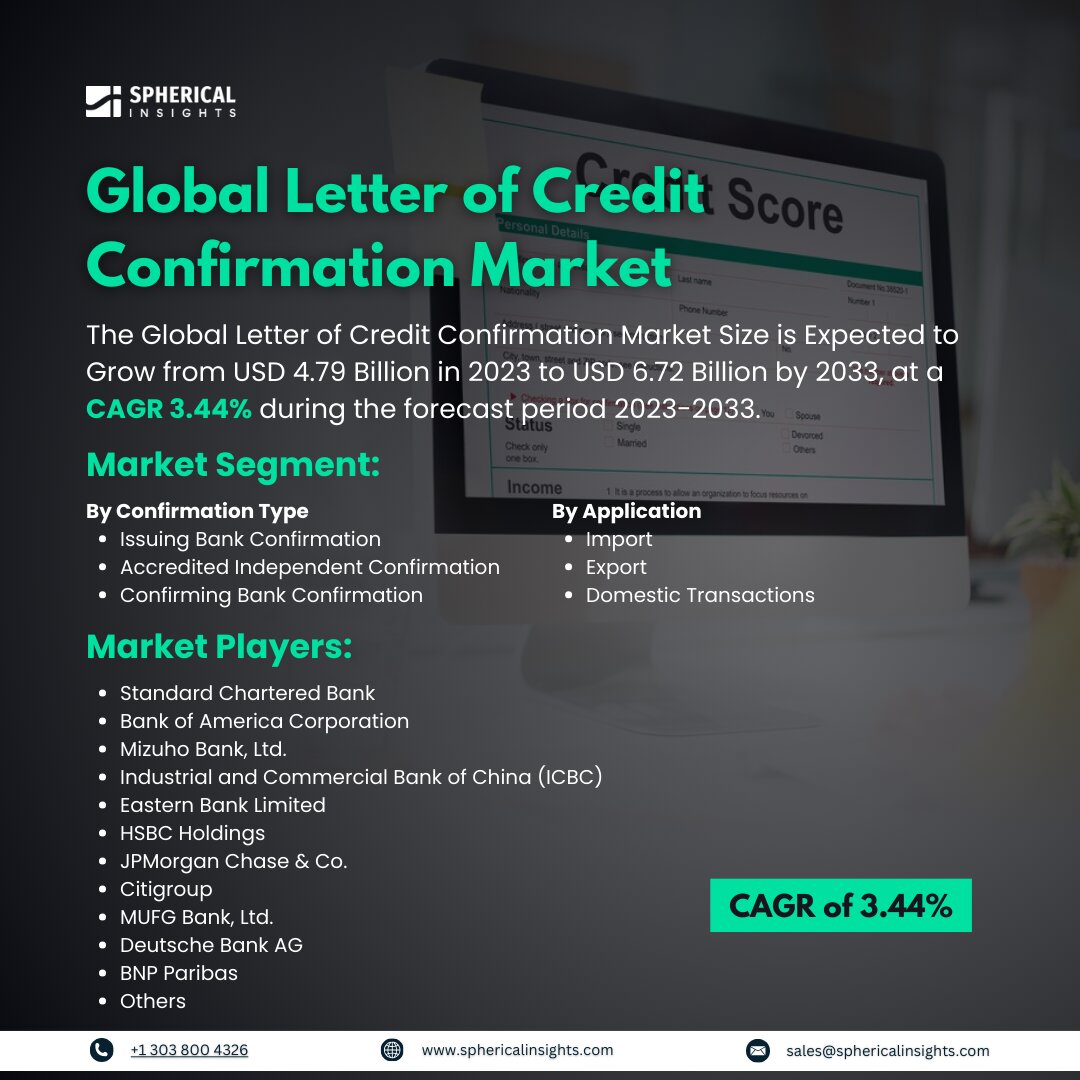

According to a research report published by Spherical Insights & Consulting, the Global Letter of Credit Confirmation Market Size is Expected to Grow from USD 4.79 Billion in 2023 to USD 6.72 Billion by 2033, at a CAGR 3.44% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Letter of Credit Confirmation Market Size, Share, and COVID-19 Impact Analysis, By confirmation type (Issuing Bank Confirmation, Accredited Independent Confirmation, and Confirming Bank Confirmation), By application (Import, Export, and Domestic Transactions), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A letter of credit (L/C) confirmation is a guarantee from a second bank that it will pay the seller if the terms and conditions of the original L/C are met. This provides an additional layer of security for the seller and helps mitigate risks for both the buyer and seller. The market for letter of credit confirmations is influenced by various factors, as these confirmations are primarily used to minimize the risk of default for the seller in international trade. There are several types of letters of credit, including sight L/Cs, usance L/Cs, standby L/Cs, revolving L/Cs, and confirmed LCs. These letters of credit serve as a safety net for the seller, ensuring payment if the buyer defaults. Furthermore, some letters of credit are open-ended, allowing for multiple transactions and making them a convenient option for businesses involved in recurring transactions. Importantly, these letters cannot be amended or canceled without the consent of all parties involved, providing greater security for the seller. However, the letter of credit confirmation market also faces several challenges. Online transactions for letter of credit confirmations often involve multiple intermediaries, which can lead to vulnerabilities such as cyberattacks on the network. These attacks may result in data breaches, loss of trade information, and significant financial losses. Additionally, exporters and importers may present fraudulent underlying documents, which can hamper the growth of the letter of credit confirmation market.

The issuing bank confirmation segment is predicted to hold the largest market share through the forecast period.

Based on the confirmation type, the letter of credit confirmation market is classified into issuing bank confirmation, accredited independent confirmation, and confirming bank confirmation. Among these, the issuing bank confirmation segment is predicted to hold the largest market share through the forecast period. This is due to its critical role in facilitating secure and reliable international trade transactions, the demand for issuing bank confirmations is expected to rise. This segment provides assurance to exporters that they will receive payment, thereby reducing the risks associated with foreign transactions. As global trade continues to expand, more businesses are seeking to mitigate risks and enhance their credibility in international markets.

The export segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the letter of credit confirmation market is divided into import, export, and domestic transactions. Among these, the export segment is anticipated to hold the highest market share during the projected timeframe. The need for export letters of credit is primarily driven by the growing globalization of trade and the increasing number of companies engaging in international commerce. As businesses seek to broaden their market reach, the demand for letters of credit, which offer payment security and trade finance, is surging. This trend is further supported by regulatory frameworks and trade agreements that encourage exporters to utilize letters of credit, ensuring protection against payment defaults and enhancing their competitive advantage.

North America is estimated to hold the largest share of the letter of credit confirmation market over the forecast period.

North America is estimated to hold the largest share of the letter of credit confirmation market over the forecast period. This demand is also driven by a robust financial infrastructure and a high volume of international trade activities. The presence of major banks and financial institutions in the region enhances the availability and reliability of letter of credit services. Additionally, a strong regulatory environment and established trade relationships with various countries contribute to the region's dominance, as businesses increasingly rely on letters of credit to mitigate risks and secure transactions in cross-border trade.

Asia Pacific is expected to grow the fastest during the forecast period. The surge in demand is further driven by rapid economic development and an increase in trade activities among emerging markets. A growing manufacturing base, coupled with rising consumer demand, has led to an increase in exports, necessitating the use of letters of credit for secure transactions. Moreover, the growing adoption of digital banking solutions and improvements in trade finance infrastructure are facilitating faster and more efficient processing of letters of credit, making the Asia-Pacific market increasingly attractive for businesses engaged in international trade.

Competitive Analysis

Major key players in the letter of credit confirmation market includes Standard Chartered Bank, Bank of America Corporation, Mizuho Bank, Ltd., Industrial and Commercial Bank of China, ICBC, Eastern Bank Limited, First Abu Dhabi Bank PJSC, Sumitomo Mitsui Banking Corporation, HSBC Holdings, JPMorgan Chase Co, Citigroup, MUFG Bank, Ltd, Deutsche Bank AG, BNP Paribas, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Trade Finance Global (TFG) and BAFT (the Bankers Association for Finance and Trade) have announced the release of a joint guide on Letters of Credit. Titled “Everything You Need to Know about Letters of Credit: A Comprehensive Guide to Documentary Credits,” the guide was launched at the BAFT International Trade and Payments Conference in Washington, D.C.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the letter of credit confirmation market based on the below-mentioned segments:

Global Letter of Credit Confirmation Market, By Confirmation Type

- Issuing Bank Confirmation

- Accredited Independent Confirmation

- Confirming Bank Confirmation

Global Letter of Credit Confirmation Market, By Application

- Import

- Export

- Domestic Transactions

Global Letter of Credit Confirmation Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa