Global Marine Cargo Insurance Market Size to worth USD 19.20 Billion by 2033

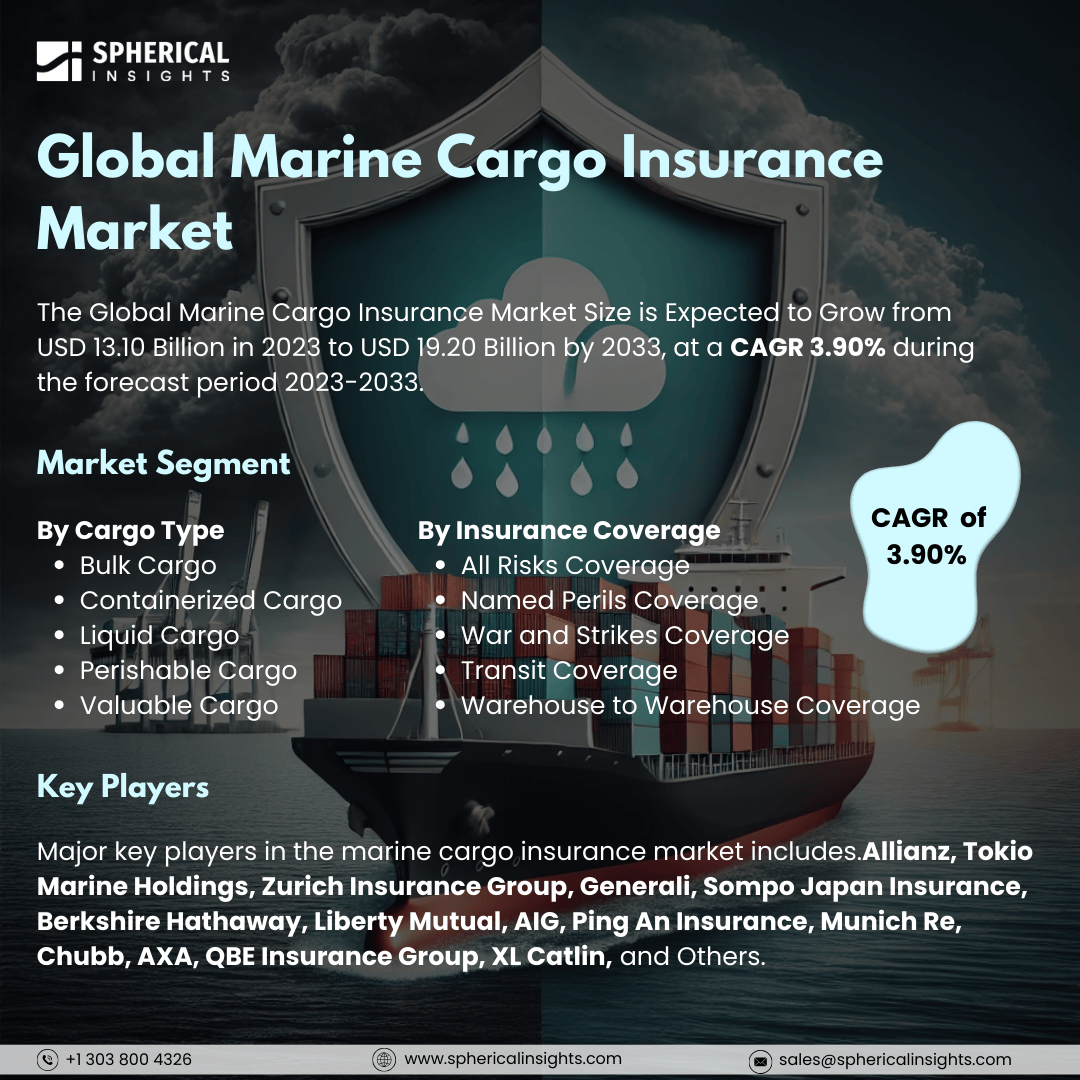

According to a research report published by Spherical Insights & Consulting, The Global Marine Cargo Insurance Market Size is Expected to Grow from USD 13.10 Billion in 2023 to USD 19.20 Billion by 2033, at a CAGR 3.90% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Marine Cargo Insurance Market Size, Share, and COVID-19 Impact Analysis, By Cargo Type (Bulk Cargo, Containerized Cargo, Liquid Cargo, Perishable Cargo, and Valuable Cargo), By insurance coverage (All Risks Coverage, Named Perils Coverage, War and Strikes Coverage, Transit Coverage, and Warehouse to Warehouse Coverage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Marine cargo insurance is a type of property insurance that protects against the loss or damage of goods being transported by sea, air, or land. This insurance covers risks during transit, including theft, piracy, natural disasters, and damage that may occur during loading and unloading. The marine cargo insurance market is influenced by several factors. As global trade volumes increase, so does the demand for marine cargo insurance, especially in emerging markets like China, India, and Brazil, which have experienced significant economic growth. Additionally, the shipping industry faces increasingly strict regulatory requirements, prompting companies to seek insurance policies that comply with these standards. The rise of online marketplaces and digital platforms has also led to a higher demand for marine cargo insurance to safeguard goods transported through these channels. However, the marine cargo insurance market is affected by various factors that can complicate the assessment and pricing of premiums. Political instability, trade disputes, weather conditions, and economic fluctuations can raise the risk of losses, complicating the pricing of premiums. The route taken by a ship can influence the premium costs. For instance, transporting fresh produce through regions prone to weather disruptions or port delays may lead to higher premiums. Similarly, the type of goods being shipped can impact premium rates; shipping hazardous materials, fuel, or perishable items often results in increased costs.

The containerized cargo segment is predicted to hold the largest market share through the forecast period.

Based on the cargo type, the marine cargo insurance market is classified into bulk cargo, containerized cargo, liquid cargo, perishable cargo, and valuable cargo. Among these, the containerized cargo segment is predicted to hold the largest market share through the forecast period. The increasing reliance on global trade and the efficiency offered by container shipping are driving a surge in demand for containerized transport. As businesses optimize their supply chains and seek cost-effective shipping solutions, the need for reliable container shipping continues to rise. This trend is further reinforced by advancements in container technology, improved logistics management, and a heightened focus on ensuring the secure transport of goods, which emphasizes the importance of comprehensive insurance coverage for these shipments.

The all risks coverage segment is anticipated to hold the highest market share during the projected timeframe.

Based on the insurance coverage, the marine cargo insurance market is divided into all risks coverage, named perils coverage, war and strikes coverage, transit coverage, and warehouse to warehouse coverage. Among these, the all risks coverage segment is anticipated to hold the highest market share during the projected timeframe. As businesses recognize the significance of all-encompassing insurance policies that protect against a wide range of potential losses, the demand for such coverage is expected to grow. Comprehensive insurance provides peace of mind for shippers and cargo owners by safeguarding against various risks, including theft, damage, and natural disasters. With a growing awareness of these risks and the desire to mitigate financial losses, the demand for all-risk coverage is anticipated to rise considerably.

North America is estimated to hold the largest share of the marine cargo insurance market over the forecast period.

North America is estimated to hold the largest share of the marine cargo insurance market over the forecast period. The strong economy and extensive trade networks contribute to a high volume of imports and exports, which drives the demand for insurance solutions to protect valuable cargo. The presence of major shipping companies and advanced logistics infrastructure in the region further supports the growth of marine cargo insurance, as businesses prioritize effective risk management.

Asia Pacific is expected to grow the fastest during the forecast period. Rapid industrialization, increasing trade activities, and a surge in e-commerce are significant factors contributing to the rising demand for marine cargo insurance. As countries expand their manufacturing capabilities and engage in international trade, businesses are becoming more aware of risk management practices. Additionally, government initiatives to enhance maritime logistics will further propel the adoption of marine cargo insurance in this region.

Company Profiling

Major key players in the marine cargo insurance market includes. Allianz, Tokio Marine Holdings, Zurich Insurance Group, Generali, Sompo Japan Insurance, Berkshire Hathaway, Liberty Mutual, AIG, Ping An Insurance, Munich Re, Chubb, AXA, QBE Insurance Group, XL Catlin, and Others.

Recent Development

- In May 2024, Allianz Commercial and Rokstone, a global reinsurance managing general agent (MGA) under the Aventum Group, have collaborated to launch a US$10 million facility specifically for the marine cargo sector.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the marine cargo insurance market based on the below-mentioned segments:

Global Marine Cargo Insurance Market, By Cargo Type

- Bulk Cargo

- Containerized Cargo

- Liquid Cargo

- Perishable Cargo

- Valuable Cargo

Global Marine Cargo Insurance Market, By Insurance Coverage

- All Risks Coverage

- Named Perils Coverage

- War and Strikes Coverage

- Transit Coverage

- Warehouse to Warehouse Coverage

Global Marine Cargo Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa