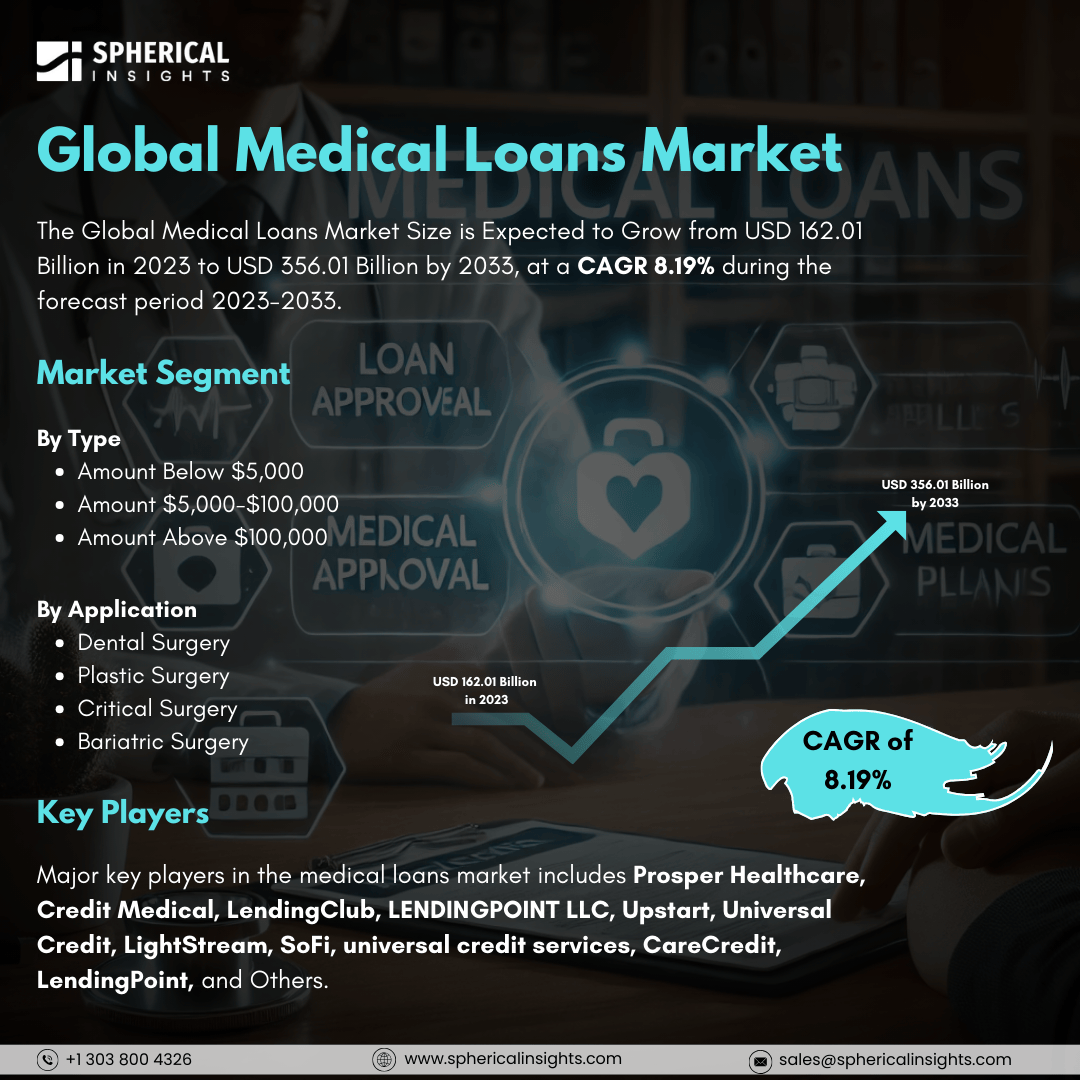

Global Medical Loans Market Size to worth USD 356.01 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Medical Loans Market Size is Expected to Grow from USD 162.01 Billion in 2023 to USD 356.01 Billion by 2033, at a CAGR 8.19% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Medical Loans Market Size, Share, and COVID-19 Impact Analysis, By Type (Amount Below $5,000, Amount $5,000-$100,000, and Amount Above $100,000), By Application (Dental Surgery, Plastic Surgery, Critical Surgery, and Bariatric Surgery), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A medical loan is a specific type of personal loan designed to help individuals cover medical expenses, such as hospital bills, surgeries, and prescription costs. Unlike regular personal loans, medical loans cater specifically to those facing unexpected healthcare costs, allowing them to avoid depleting their savings or relying heavily on credit cards. Several key factors drive the medical loans market. Rising healthcare costs, an increasing demand for elective procedures, and a growing awareness of financial options among consumers all play a substantial role. As medical expenses continue to rise, many consumers seek financial assistance to cover out-of-pocket costs, especially for treatments not fully covered by insurance. Furthermore, the expanding range of available services, including cosmetic surgery and advanced medical technologies, has increased patient interest in financing their healthcare needs. However, the medical loans market also faces several challenges that may hinder its growth. High-interest rates, strict lending criteria, and a lack of consumer awareness are significant obstacles. Many financial institutions charge substantial interest rates on medical loans, which can deter patients from seeking financing due to concerns about affordability and repayment burdens. Additionally, the rigorous eligibility requirements often associated with these loans can exclude a considerable number of potential borrowers, particularly those with lower credit scores or unstable incomes.

The amount below $5,000 segment is predicted to hold the largest market share through the forecast period.

Based on the type, the medical loans market is classified into amount below $5,000, amount $5,000-$100,000, and amount above $100,000. Among these, the amount below $5,000 segment is predicted to hold the largest market share through the forecast period. The demand for medical loans is increasing due to their accessibility and affordability for a wide range of patients. Many individuals seeking medical care, especially for elective procedures or minor surgeries, are more inclined to request smaller loan amounts. This trend is driven by a growing awareness of the financial options available for healthcare costs, as well as an increasing number of healthcare providers offering flexible payment plans. As a result, the demand for low-value loans is expected to rise, solidifying this segment's position as a leader in the market.

The dental surgery segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the medical loans market is divided into dental surgery, plastic surgery, critical surgery, and bariatric surgery. Among these, the dental surgery segment is anticipated to hold the highest market share during the projected timeframe. In the dental sector, there is a notable increase in demand for financing options, reflecting the rising prevalence of dental issues and growing awareness of oral health. More consumers are prioritizing dental care, including cosmetic procedures such as implants and orthodontics. Moreover, advancements in dental technology and treatment methods are making these surgeries more accessible, further driving market growth. This combination of heightened patient demand and evolving healthcare financing solutions positions the dental surgery segment as a key leader in the medical loans market.

North America is estimated to hold the largest share of the medical loans market over the forecast period.

North America is estimated to hold the largest share of the medical loans market over the forecast period. North America’s dominance in the medical loans market can be attributed to several factors, including high healthcare costs, widespread insurance coverage, and a robust healthcare infrastructure. The region's population considerably relies on medical financing solutions to manage out-of-pocket expenses for various treatments and procedures. Additionally, there are numerous financial institutions offering tailored loan products, and growing awareness of medical financing options among consumers reinforces North America's leading position in the market.

Asia Pacific is expected to grow the fastest during the forecast period. The growth of medical loans is driven by a rapidly expanding middle class, increasing healthcare expenditures, and greater access to medical services. As economic development continues in these regions, more individuals are seeking medical loans to cover expenses associated with both elective and necessary medical procedures. Furthermore, the rise of digital financial services and growing acceptance of medical financing options are facilitating this growth. The unique demographic trends and evolving healthcare landscape make this region a burgeoning market for medical loans.

Company Profiling

Major key players in the medical loans market includes Prosper Healthcare, Credit Medical, LendingClub, LENDINGPOINT LLC, Upstart, Universal Credit, LightStream, SoFi, universal credit services, CareCredit, LendingPoint, and Others.

Recent Developments

- In April 2024, Ashneer Grover, co-founder and former Managing Director of BharatPe, is set to launch a new app called 'ZeroPe,' which aims to provide loans for healthcare. According to the app’s listing on the Google Play Store, ZeroPe is currently in the testing phase and has been developed by Third Unicorn, a company Grover founded after leaving BharatPe. The app will offer instant pre-approved medical loans of up to Rs 5 lakh to help users cover their medical expenses.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the medical loans market based on the below-mentioned segments:

Global Medical Loans Market, By Type

- Amount Below $5,000

- Amount $5,000-$100,000

- Amount Above $100,000

Global Medical Loans Market, By Application

- Dental Surgery

- Plastic Surgery

- Critical Surgery

- Bariatric Surgery

Global Medical Loans Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa