Global Metal Additive Manufacturing Market Size to worth USD 19.34 Billion by 2033

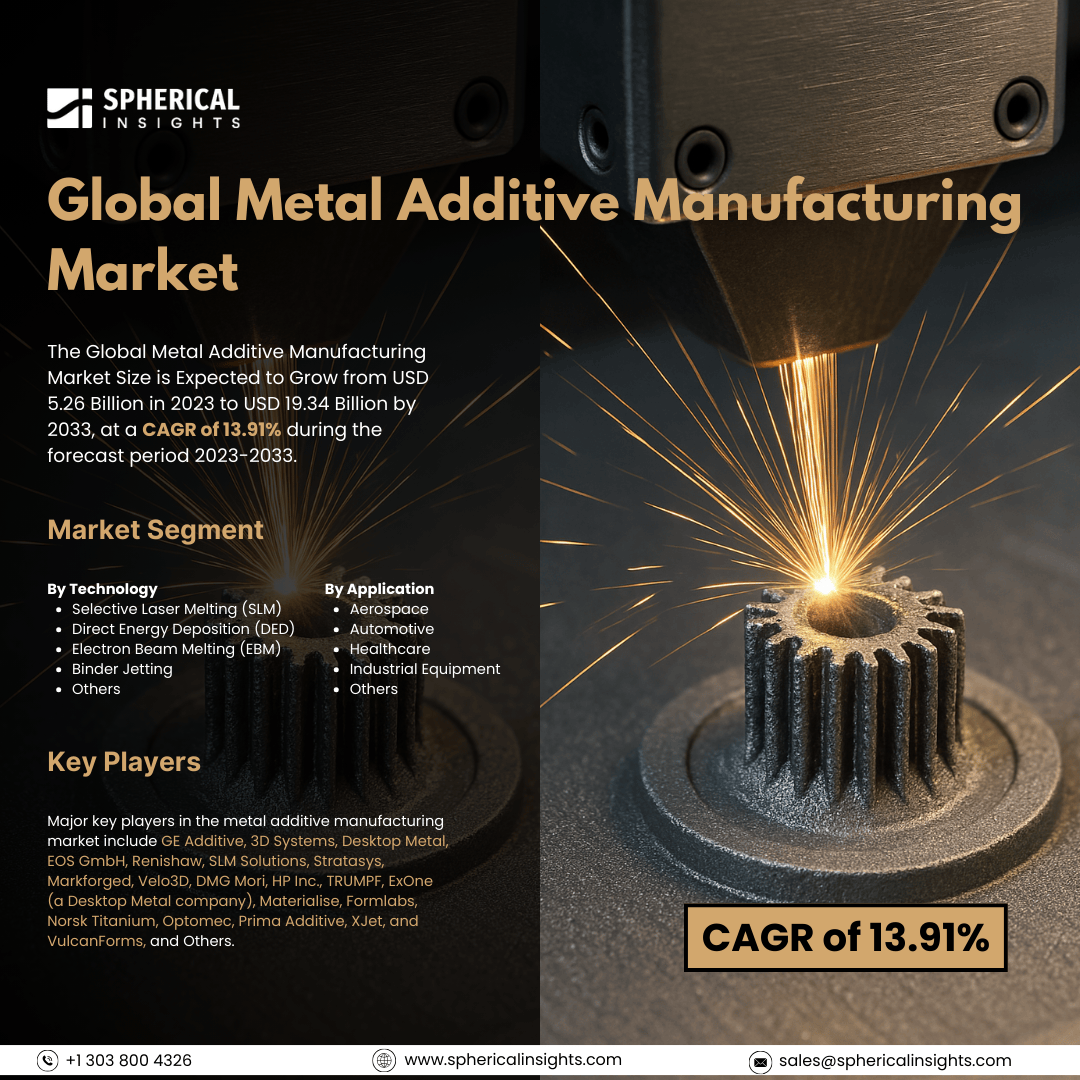

According to a research report published by Spherical Insights & Consulting, The Global Metal Additive Manufacturing Market Size is Expected to Grow from USD 5.26 Billion in 2023 to USD 19.34 Billion by 2033, at a CAGR of 13.91% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Metal Additive Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Technology (Selective Laser Melting (SLM), Direct Energy Deposition (DED), Electron Beam Melting (EBM), Binder Jetting, and Others), By Application (Aerospace, Automotive, Healthcare, Industrial Equipment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The metal additive manufacturing market utilizes 3D printing and additive manufacturing technologies like laser powder bed fusion, directed energy deposition, and binder jetting to create complex metal parts with intricate internal features, optimized lattices, and lightweight designs, which are challenging or impossible to achieve with traditional methods. The automobile industry's growing need for complicated parts made with additive manufacturing and falling production costs are driving the expansion of the global metal additive manufacturing market. Demand may also be increased by using 3D printing for quick prototyping and putting more emphasis on individualized treatment. Opportunities for market expansion shortly may arise from ongoing research and development efforts to broaden the application breadth and the capacity to manufacture complex design components that are not achievable with traditional approaches. Various government initiatives drive the market of the metal additive manufacturing market. For instance, the Indian Ministry of Electronics and Information Technology (MeitY) released the National Strategy for Additive Manufacturing (NSAM) in 2022, aiming to utilize additive manufacturing for industrial growth, innovation, and inclusive development. The strategy encourages public-private partnerships to develop additive manufacturing grade materials, 3D printer machines, and indigenous products for various sectors. However, high capital investment in metal additive manufacturing hinders market growth, preventing smaller manufacturers from adopting the technology. Shared services and pay-per-use arrangements aim to reduce upfront costs.

The selective laser melting (SLM) segment accounted for 28.88% of the market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the metal additive manufacturing market is classified into selective laser melting (SLM), direct energy deposition (DED), electron beam melting (EBM), binder jetting, and others. Among these, the selective laser melting (SLM) segment accounted for 28.88% of the market share in 2023 and is expected to grow at a significant CAGR during the forecast period. Selective laser melting (SLM) is the dominant process in metal additive manufacturing due to its precision in producing complex parts. It enables manufacturers to 3D print metal components layer by layer from digital models, providing design flexibility and creating complex geometries that are nearly impossible to manufacture through conventional methods.

The aerospace segment held 33.68% of the market share in 2023 and is estimated to grow at a CAGR of 17.75% during the forecast period.

Based on the application, the metal additive manufacturing market is divided into aerospace, automotive, healthcare, industrial equipment, and others. Among these, the aerospace segment held 33.68% of the market share in 2023 and is estimated to grow at a CAGR of 17.75% during the forecast period. The aerospace sector is gaining significant attention for metal additive manufacturing due to regulatory acceptance and design optimization opportunities. Metal 3D printing enables the creation of net-shape components and complex interior geometries, resulting in lighter aircraft structures, improved fuel efficiency, and longer ranges. Regulatory bodies like the FAA and EASA have approved selective laser-melting printed parts for commercial passenger transportation.

North America is estimated to hold the largest share of the metal additive manufacturing market over the forecast period.

North America is estimated to hold the largest share of the metal additive manufacturing market over the forecast period. The U.S., with significant R&D budgets and manufacturing infrastructure, is home to major aerospace and defense firms like Boeing, Lockheed Martin, and GE Aviation, who have invested heavily in metal 3D printing for complex product development, making the U.S. the largest global producer of such parts.

Asia Pacific is predicted to have the fastest CAGR growth in the metal additive manufacturing market over the forecast period. China aims to become a global leader in advanced manufacturing through initiatives like 'Made in China 2025'. The government provides funding and tax incentives, and state-run research institutes collaborate with global players to develop high-volume production systems. Local manufacturers gain expertise in 3D printing equipment and metal powders.

Company Profiling

Major key players in the metal additive manufacturing market include GE Additive, 3D Systems, Desktop Metal, EOS GmbH, Renishaw, SLM Solutions, Stratasys, Markforged, Velo3D, DMG Mori, HP Inc., TRUMPF, ExOne (a Desktop Metal company), Materialise, Formlabs, Norsk Titanium, Optomec, Prima Additive, XJet, and VulcanForms, and Others.

Recent Development

- In September 2024, at RAPID + TCT, Additive Industries, a prominent additive manufacturing business based in the Netherlands, unveiled the most recent version of its trademark MetalFab 3D printing technology. With its revolutionary on-demand build platform size, which is reportedly an industry first, the new MetalFab 300 Flex model sets a new standard in the 3D printing sector and offers manufacturers previously unheard-of flexibility.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the metal additive manufacturing market based on the below-mentioned segments:

Global Metal Additive Manufacturing Market, By Technology

- Selective Laser Melting (SLM)

- Direct Energy Deposition (DED)

- Electron Beam Melting (EBM)

- Binder Jetting

- Others

Global Metal Additive Manufacturing Market, By Application

- Aerospace

- Automotive

- Healthcare

- Industrial Equipment

- Others

Global Metal Additive Manufacturing Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa