Global Micro Lending Market Size to worth USD 306.09 Billion by 2033

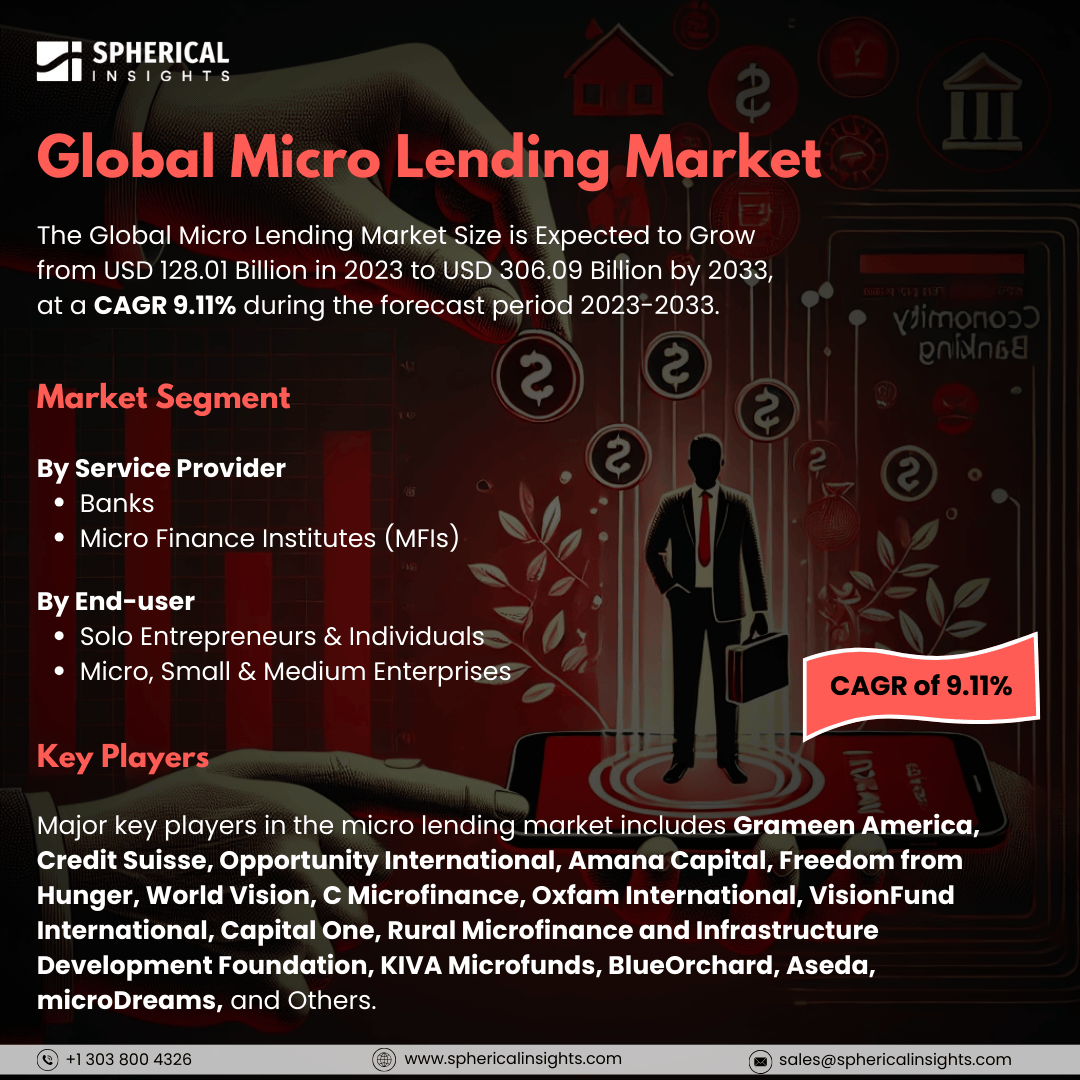

According to a research report published by Spherical Insights & Consulting, The Global Micro Lending Market Size is Expected to Grow from USD 128.01 Billion in 2023 to USD 306.09 Billion by 2033, at a CAGR 9.11% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Micro Lending Market Size, Share, and COVID-19 Impact Analysis, By Service Provider (Banks, Micro Finance Institutes (MFIs), By End-user (Solo Entrepreneurs & Individuals, Micro, Small & Medium Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Microlending, also known as microfinance, is the practice of providing small loans to individuals and businesses that cannot access traditional banking services. The primary objective of microlending is to assist people in starting or expanding their businesses, alleviate poverty, and promote financial inclusion. The microlending market is largely driven by the growing demand for financial inclusion, especially in developing regions where traditional banking options are limited. Advances in digital technology and mobile banking have made it easier for people to access microloans, allowing borrowers to obtain funds quickly and conveniently. Additionally, there is an increasing awareness of entrepreneurship among low-income individuals, which has heightened the demand for small loans to initiate or grow businesses. However, the market also faces challenges, including high default rates that can discourage lenders, as well as varying regulatory challenges across different regions. Furthermore, economic instability and a lack of financial literacy among borrowers can negatively impact repayment rates, creating risks for micro-lenders.

The banks segment is predicted to hold the largest market share through the forecast period.

Based on the service provider, the micro lending market is classified into banks, micro finance institutes (MFIs). Among these, the banks segment is predicted to hold the largest market share through the forecast period. This is primarily due to their established infrastructure, regulatory advantages, and extensive customer bases. They have the capacity to offer a wide range of financial products and services, including microloans, which cater to diverse customer needs. Their ability to leverage technology for efficient operations and customer engagement further strengthens their market position. Additionally, banks possess greater resources for risk assessment and management, enabling them to offer competitive rates and attract a larger clientele.

The micro, small & medium enterprises segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end-user, the micro lending market is divided into solo entrepreneurs & individuals, micro, small & medium enterprises. Among these, the micro, small & medium enterprises segment is anticipated to hold the highest market share during the projected timeframe. There is a growing recognition of micro, small, and medium enterprises (MSMEs) as vital contributors to economic growth and employment. Governments and financial institutions are increasingly focused on providing tailored financial solutions to this segment, acknowledging their potential for innovation and job creation. The rise of entrepreneurship, along with the demand for accessible financing options, drives the need for microloans and other financial products. As MSMEs continue to grow, their market share is expected to increase significantly.

North America is estimated to hold the largest share of the micro lending market over the forecast period.

North America is estimated to hold the largest share of the micro lending market over the forecast period. The micro-lending sector is thriving, supported by a well-developed financial ecosystem and increasing awareness of alternative lending options. The region has a robust network of financial institutions, including banks, credit unions, and fintech companies, that provide diverse lending solutions for individuals and businesses. Supportive regulatory frameworks and government initiatives aimed at fostering entrepreneurship and small business growth contribute to the expansion of micro-lending. As more consumers and businesses seek flexible financing solutions, North America is well-positioned to maintain its leadership in the micro-lending space.

Asia Pacific is expected to grow the fastest during the forecast period. This is driven by rapid economic development, a burgeoning middle class, and the increasing digitalization of financial services. The diverse populations and varying economic landscapes of these regions create significant demand for microloans and innovative lending solutions tailored to local needs. Additionally, the rise of fintech companies and mobile banking platforms has made access to credit easier for underserved populations, further driving growth.

Company Profiling

Major key players in the micro lending market includes Grameen America, Credit Suisse, Opportunity International, Amana Capital, Freedom from Hunger, World Vision, C Microfinance, Oxfam International, VisionFund International, Capital One, Rural Microfinance and Infrastructure Development Foundation, KIVA Microfunds, BlueOrchard, Aseda, microDreams, and Others.

Recent Development

- In November 2024, Muthoot Microfin, a microfinance institution located in Kochi, has begun disbursing loans through its new co-lending partnership with the State Bank of India (SBI). This initiative aims to provide affordable credit to rural entrepreneurs, particularly focusing on empowering women and supporting small businesses. As part of this collaboration, SBI has sanctioned a limit of RS 500 crore, which will be distributed in tranches of RS 100 crore each.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the micro lending market based on the below-mentioned segments:

Global Micro Lending Market, By Service Provider

- Banks

- Micro Finance Institutes (MFIs)

Global Micro Lending Market, By End-user

- Solo Entrepreneurs & Individuals

- Micro, Small & Medium Enterprises

Global Micro Lending Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa