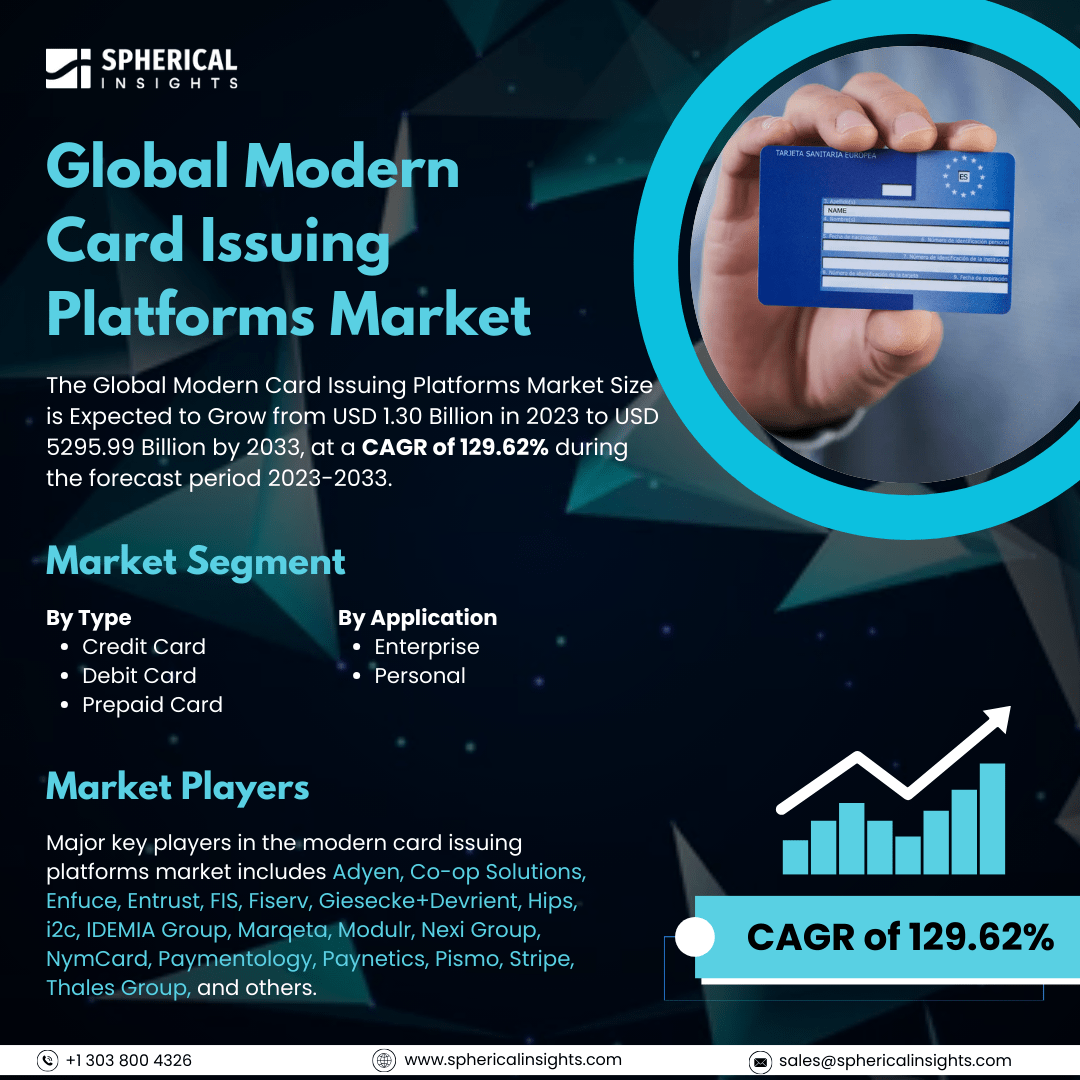

Global Modern Card Issuing Platforms Market Size to worth USD 5295.99 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Modern Card Issuing Platforms Market Size is Expected to Grow from USD 1.30 Billion in 2023 to USD 5295.99 Billion by 2033, at a CAGR of 129.62% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Modern Card Issuing Platforms Market Size, Share, and COVID-19 Impact Analysis, By Type (Credit Card, Debit Card, and Prepaid Card), By Application (Enterprise, Personal), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The modern card issuing platforms market consists of card management systems that utilize APIs to assist businesses in issuing and managing cards. These platforms are designed with a digital-first approach and enable businesses to offer various payment options, including both virtual and physical cards. This market is primarily driven by several factors, including the growing demand for digital-first payment solutions, the increasing adoption of mobile wallets, the need for faster card issuance, the desire for enhanced customer experiences through personalization, cost optimization through automation, and the rise of innovative fintech companies advocating for more flexible and customizable card offerings. These trends are particularly prevalent in virtual cards and real-time transaction monitoring, all facilitated by the API-driven architecture of modern platforms. However, while modern card-issuing platforms present significant advantages, there are potential challenges. These include high initial investment costs for traditional institutions to upgrade, complex integration with existing systems, concerns regarding data security and privacy, regulatory hurdles related to adapting to new features, a lack of understanding among consumers about advanced functionalities, and possible resistance from established market players who may be hesitant to adopt new technologies rapidly.

The prepaid card segment is predicted to hold the largest market share through the forecast period.

Based on the type, the modern card issuing platforms market is classified into credit card, debit card, and prepaid cards. Among these, the prepaid card segment is predicted to hold the largest market share through the forecast period. The increasing acceptance of prepaid cards among consumers and businesses is due to their convenience, security, and control over spending. These cards are particularly appealing to budget-conscious users and individuals without traditional bank accounts. Moreover, the growth of digital payments and e-commerce has boosted the demand for prepaid solutions, as they provide a straightforward way to conduct online transactions while reducing the risk of overspending.

The enterprise segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the modern card issuing platforms market is divided into enterprise, personal. Among these, the enterprise segment is anticipated to hold the highest market share during the projected timeframe. Businesses are increasingly relying on digital payment solutions to streamline their financial operations. Many enterprises have started adopting modern card-issuing platforms to improve their payment processes, enhance expense management, and offer employees more efficient payment methods. This transition is driven by the need for better financial control, improved reporting capabilities, and the desire to integrate payment solutions into existing financial systems, thereby fostering growth in this segment.

North America is estimated to hold the largest share of the modern card issuing platforms market over the forecast period.

North America is estimated to hold the largest share of the modern card issuing platforms market over the forecast period. The demand for modern payment solutions is rising, largely due to the region's advanced technological infrastructure and high consumer adoption rates of digital payment methods. The presence of established financial institutions and fintech companies, combined with a robust regulatory framework, has facilitated the development and deployment of innovative card issuing platforms. Additionally, the growing trend of e-commerce and online transactions in North America is further propelling this demand.

Europe is expected to grow the fastest during the forecast period. The market for modern card issuing platforms is being driven by a strong emphasis on digital transformation and innovation within the financial sector. There is a noticeable rise in contactless payments and mobile wallet adoption, contributing to this demand. Furthermore, regulatory initiatives aimed at enhancing consumer protection and promoting competition in the payment industry are creating favorable conditions for market expansion, positioning Europe as a dynamic player in the card issuing landscape.

Company Profiling

Major key players in the modern card issuing platforms market includes Adyen, Co-op Solutions, Enfuce, Entrust, FIS, Fiserv, Giesecke+Devrient, Hips, i2c, IDEMIA Group, Marqeta, Modulr, Nexi Group, NymCard, Paymentology, Paynetics, Pismo, Stripe, Thales Group, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, CARD91 proudly announced the launch of its 3-in-1 card platform at the prestigious Global Fintech Fest 2024. This innovative solution combines the functionalities of an ID card, access card, and prepaid card, including the National Common Mobility Card (NCMC), into one streamlined product. It is tailored to meet the modern needs of corporate employees and students alike. In addition to these primary uses, this card can be utilized in various scenarios, such as effectively managing large-scale events, in medical institutions, shopping malls, and many more.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the modern card issuing platforms market based on the below-mentioned segments:

Global Modern Card Issuing Platforms Market, By Type

- Credit Card

- Debit Card

- Prepaid Card

Global Modern Card Issuing Platforms Market, By Application

Global Modern Card Issuing Platforms Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa