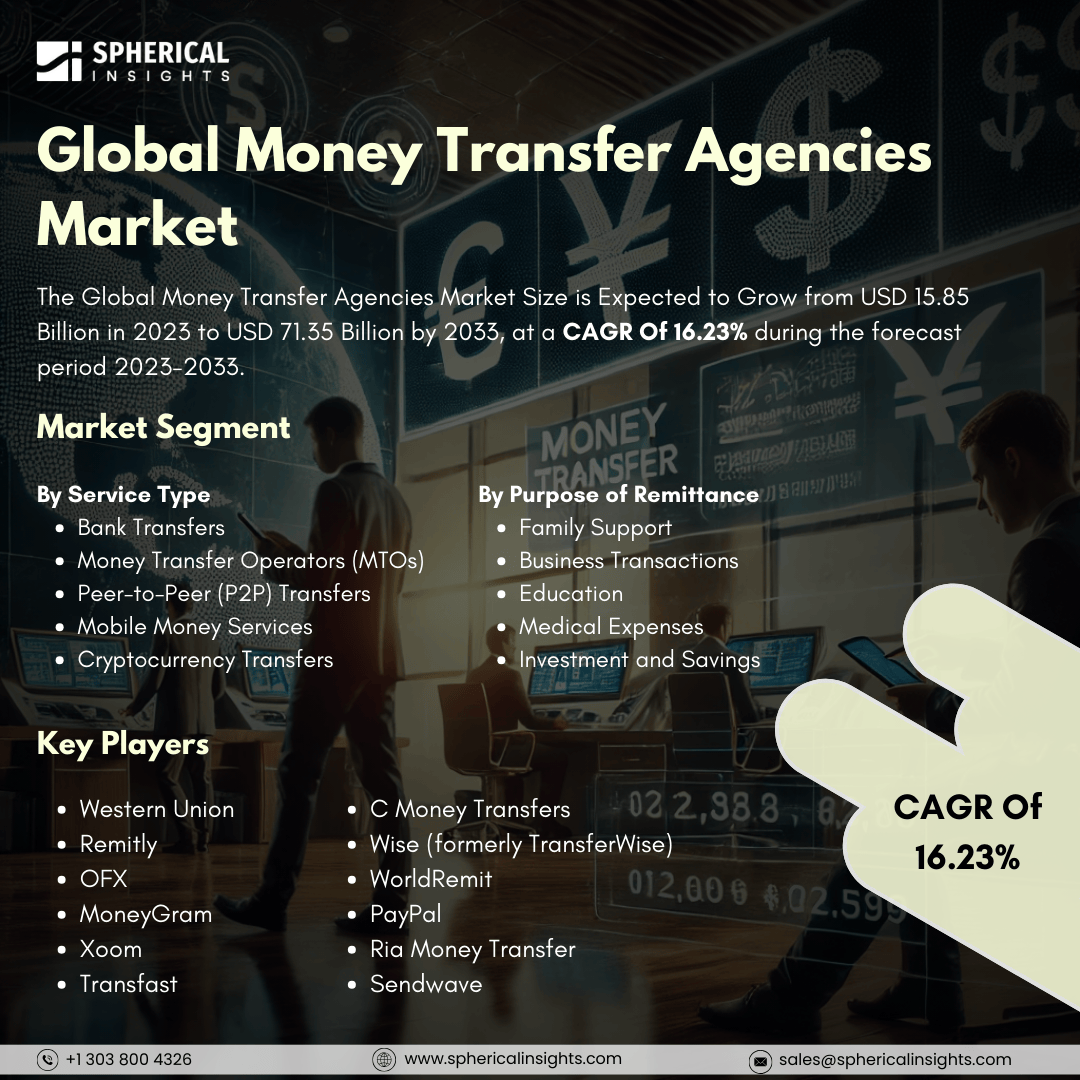

Global Money Transfer Agencies Market Size to worth USD 71.35 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Money Transfer Agencies Market Size is Expected to Grow from USD 15.85 Billion in 2023 to USD 71.35 Billion by 2033, at a CAGR 16.23% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Money Transfer Agencies Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Bank Transfers, Money Transfer Operators (MTOs), Peer-to-Peer (P2P) Transfers, Mobile Money Services, and Cryptocurrency Transfers), By Purpose of Remittance (Family Support, Business Transactions, Education, Medical Expenses, and Investment and Savings), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A money transfer agency, also known as a money service business (MSB) or money transmitter, is a company or individual that facilitates the transfer of funds between consumers or entities. These services can be local or international and typically involve receiving funds from a customer and sending them to a designated recipient. The money transfer agency market is influenced by several factors. The rise of digital and mobile platforms has made it easier and faster to transfer money. Additionally, the need for money transfers has increased as more people relocate to new countries for work or study. Fintech companies also contribute to this growth by offering faster transactions and lower fees, which has prompted traditional money transfer agencies to innovate. However, the money transfer agency market faces several challenges that hamper its growth and efficiency. Key obstacles include regulatory compliance, as varying laws and regulations in different countries can complicate operations and drive up costs. Furthermore, security concerns related to fraud and cyber threats undermine consumer trust, making potential users hesitant to utilize these services. High transaction fees and unfavorable exchange rates can also deter customers, especially in regions with lower income levels.

The bank transfers segment is predicted to hold the largest market share through the forecast period.

Based on the service type, the money transfer agencies market is classified into bank transfers, money transfer operators (MTOs), peer-to-peer (P2P) transfers, mobile money services, and cryptocurrency transfers. Among these, the bank transfers segment is predicted to hold the largest market share through the forecast period. The growing preference for secure and reliable financial transactions among consumers and businesses is driven by several factors. Traditional banking institutions are enhancing their digital platforms to offer users convenient and efficient methods for transferring funds. Additionally, the integration of advanced technologies such as blockchain and real-time payment systems is further increasing the appeal of bank transfers, making them a preferred option for both domestic and international transactions.

The family support segment is anticipated to hold the highest market share during the projected timeframe.

Based on the purpose of remittance, the money transfer agencies market is divided into family support, business transactions, education, medical expenses, and investment and savings. Among these, the family support segment is anticipated to hold the highest market share during the projected timeframe. This trend is primarily driven by the increasing remittances sent by migrant workers to their families back home. As globalization facilitates workforce mobility, individuals are becoming more reliant on money transfer services to provide financial support to their relatives. This reliance is amplified by the rise of digital payment platforms that offer lower fees and faster transaction times, which make it easier for families to maintain financial connections across borders.

North America is estimated to hold the largest share of the money transfer agencies market over the forecast period.

North America is estimated to hold the largest share of the money transfer agencies market over the forecast period. The region's well-established banking infrastructure and high adoption of advanced financial technologies contribute to its strong position in the money transfer market. It also benefits from a large population of expatriates and immigrants who frequently use money transfer services to send remittances to their home countries. Furthermore, regulatory support and a competitive landscape among financial service providers drive continuous innovation and improvement in money transfer solutions, enhancing customer experience and driving market growth.

Asia Pacific is expected to grow the fastest during the forecast period. This growth is also driven by rapid economic development and increasing internet penetration in the region. The rise of the middle class and a growing young population play significant roles in driving the demand for convenient and affordable money transfer solutions. Additionally, the proliferation of mobile payment platforms and fintech startups is transforming the financial landscape, making it easier for consumers to access these services. This dynamic environment positions the Asia Pacific region as a key player in the global money transfer market.

Company Profiling

Major key players in the money transfer agencies market includes Western Union, Remitly, OFX, MoneyGram, Xoom, Transfast, C Money Transfers, Wise (formally TransferWise), WorldRemit, PayPal, Ria Money Transfer, Sendwave, and Others.

Recent Development

- In October 2024, Worldline [Euronext: WLN], a leading provider of payment services worldwide, has announced the introduction of its new account-to-account payment solution, “Bank Transfer by Worldline.” This offering allows retailers to process payments and enhances the variety of payment options available to merchants. It also effectively caters to specific payment situations that traditional payment methods often struggle to handle, such as invoices and high-value transactions. The solution provides a smooth and secure payment experience for both customers and businesses across Europe.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the money transfer agencies market based on the below-mentioned segments:

Global Money Transfer Agencies Market, By Service Type

- Bank Transfers

- Money Transfer Operators (MTOs)

- Peer-to-Peer (P2P) Transfers

- Mobile Money Services

- Cryptocurrency Transfers

Global Money Transfer Agencies Market, By Purpose of Remittance

- Family Support

- Business Transactions

- Education

- Medical Expenses

- Investment and Savings

Global Money Transfer Agencies Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa