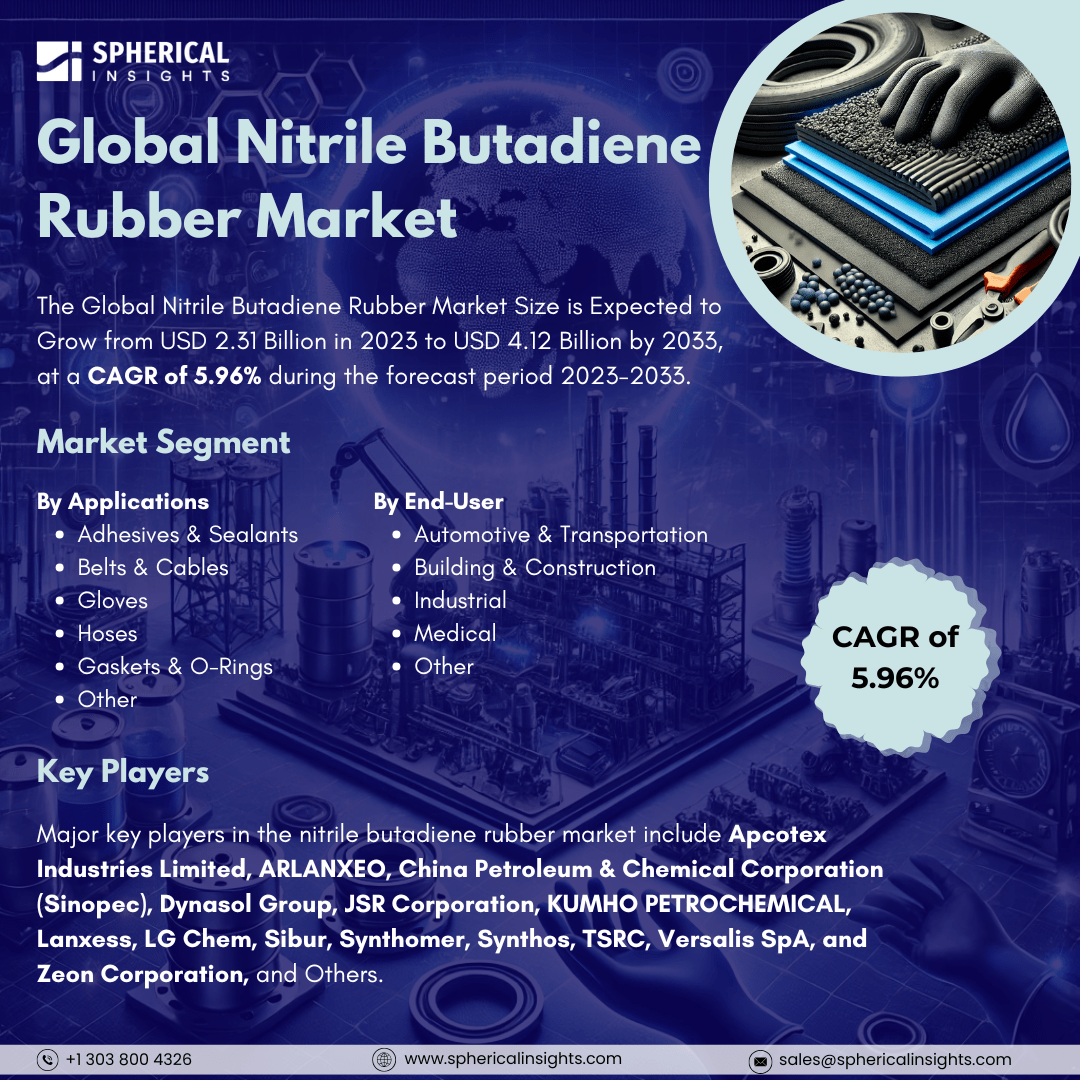

Global Nitrile Butadiene Rubber Market Size to worth USD 4.12 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Nitrile Butadiene Rubber Market Size is Expected to Grow from USD 2.31 Billion in 2023 to USD 4.12 Billion by 2033, at a CAGR of 5.96% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Nitrile Butadiene Rubber Market Size, Share, and COVID-19 Impact Analysis, By Applications (Adhesives & Sealants, Belts & Cables, Gloves, Hoses, Gaskets & O-Rings, and Other), By End-User (Automotive & Transportation, Building & Construction, Industrial, Medical, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Nitrile butadiene rubber (NBR) is an oil-resistant synthetic rubber used in fuel hoses, gaskets, and other oil-resistant goods. The automotive end-use segment is expected to have the most significant market penetration. The growing use of NBR products in seals, O-rings, hoses, belts, molded products, and cables fuels the automotive sector's expansion. The trend towards electric vehicles and driverless automobiles will further drive the growth of the automotive industry, increasing demand for NBR. The market for NBR (Nitrile Butadiene Rubber) is expected to grow due to its high abrasion resistance, tensile strength, and oil resistance properties. The rising industrialization and urbanization trends, particularly in developing nations, contribute to the demand for construction and manufacturing. Research and development efforts are also expected to boost market growth. NBR is increasingly used in automotive applications due to its heat abrasion resistance, oil and gas resistance, and permeability. It's also used in vibration isolation mounts, indicating a substantial demand for NBR. However, the market growth of NBR is expected to be restrained due to the availability of alternative products like polyurethane and fluctuating raw material prices.

The gaskets and O-rings segment is predicted to hold the largest market share through the forecast period.

Based on the applications, the nitrile butadiene rubber market is classified into adhesives & sealants, belts & cables, gloves, hoses, gaskets & O-rings, and others. Among these, the gaskets and O-rings segment is predicted to hold the largest market share through the forecast period. This is due to the increasing use of seals and O-rings in pressure-sensitive applications, as well as in automobile components like doors, engines, power steering systems, braking systems, and batteries, resulting in a higher demand for these components.

The automotive and transportation segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the end-user, the nitrile butadiene rubber market is divided into automotive & transportation, building & construction, industrial, medical, and other. Among these, the automotive and transportation segment is anticipated to hold the greatest market share during the projected timeframe. The transportation and automotive industries are among the main end-use sectors for nitrile butadiene rubber. In the automotive and aerospace industries, NBR is utilized to make fuel and oil handling hoses, seals, grommets, and self-sealing fuel tanks because normal rubbers cannot be used.

Asia Pacific is estimated to hold the largest share of the nitrile butadiene rubber market over the forecast period.

Asia Pacific is estimated to hold the largest share of the nitrile butadiene rubber market over the forecast period. Significant product demand from a range of end-use sectors and the existence of several advantageous FDI standards by regional government agencies are credited with the region's dominance. Since the area serves as a production center for several industries, such as the oil and gas and automotive sectors, the need for NBR has increased dramatically over time.

Europe is predicted to have the fastest CAGR growth in the nitrile butadiene rubber market over the forecast period. Rising nitrile rubber usage across a range of applications and growing advancements in NBR technology, such as the creation of novel procedures and product compositions, are driving this rise. Furthermore, the necessity for NBR is growing quickly due to the region's transportation sector improvements and the growing sales or acceptance of electric vehicles.

Company Profiling

Major key players in the nitrile butadiene rubber market include Apcotex Industries Limited, ARLANXEO, China Petroleum & Chemical Corporation (Sinopec), Dynasol Group, JSR Corporation, KUMHO PETROCHEMICAL, Lanxess, LG Chem, Sibur, Synthomer, Synthos, TSRC, Versalis SpA, and Zeon Corporation, and Others.

Recent Development

- In April 2024, SKF declared the creation of its first spherical roller bearings specifically for the food and beverage sector. The newly created bearing is protected from water, pollutants, and detergents by a high-performance nitrile butadiene rubber that has FDA and EC approval.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the nitrile butadiene rubber market based on the below-mentioned segments:

Global Nitrile Butadiene Rubber Market, By Applications

- Adhesives & Sealants

- Belts & Cables

- Gloves

- Hoses

- Gaskets & O-Rings

- Other

Global Nitrile Butadiene Rubber Market, By End-User

- Automotive & Transportation

- Building & Construction

- Industrial

- Medical

- Other

Global Nitrile Butadiene Rubber Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa