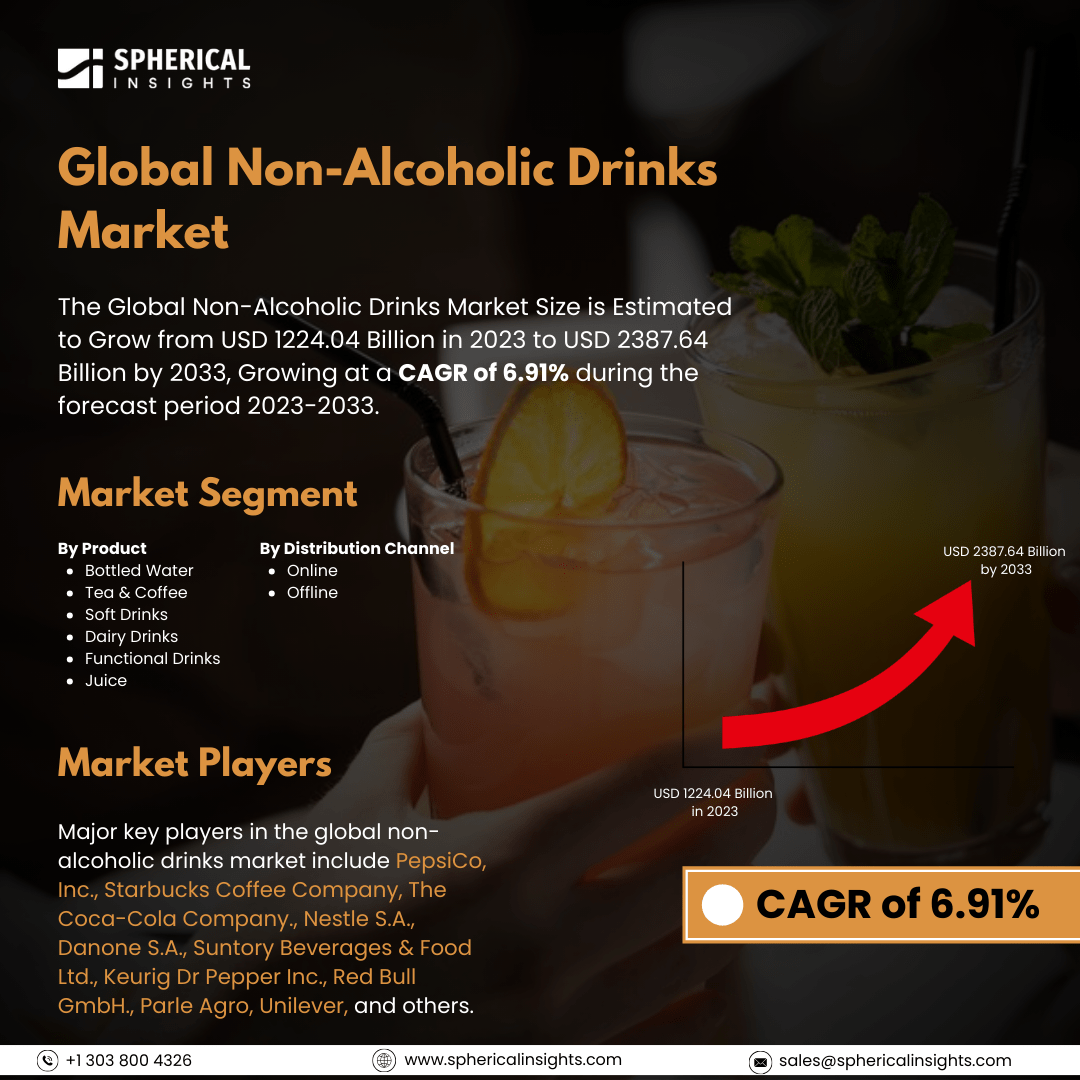

Global Non-Alcoholic Drinks Market Size to Worth USD 2387.64 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Non-Alcoholic Drinks Market Size is Estimated to Grow from USD 1224.04 Billion in 2023 to USD 2387.64 Billion by 2033, Growing at a CAGR of 6.91% during the forecast period 2023-2033.

Browse key industry insights spread across 215 pages with 110 Market data tables and figures & charts from the report on the Global Non-Alcoholic Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product (Bottled Water, Tea & Coffee, Soft Drinks, Dairy Drinks, Functional Drinks, and Juice), By Distribution Channel (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The industry that manufactures and markets beverages without alcohol is known as the global non-alcoholic drinks market. The growing concentration on wellness and consumers' inclination for healthier, nutrient-rich beverages are the main drivers of the market's expansion. This tendency is also influenced by growing health consciousness and worries about the negative consequences of alcohol use. Effective marketing techniques that prioritize flavor and quality, as well as creative product development that accommodates changing consumer preferences, especially among millennials, are also essential. Furthermore, the expansion of worldwide manufacturing is encouraged by the relaxation of trade barriers, and online sales are increased by the growing popularity of portable, handy beverage options and the quick development of e-commerce platforms. A minimum legal age for alcohol purchases has also been set in several nations, and alcohol taxes and prices have been increased to deter consumption. The public's awareness of alcohol has also lessened as a result of some governments banning alcohol advertising, which has increased demand for non-alcoholic drinks. However, the market's capacity to produce is anticipated to be hampered by the disruptions in natural resource availability caused by indirect greenhouse gas emissions, decreased water supplies, and rising pollution.

The soft drinks segment held the largest share of 22.81% in 2023 and is expected to grow at a CAGR of 4.52% throughout the projection period.

Based on the product, the global non-alcoholic drinks market is categorized into bottled water, tea & coffee, soft drinks, dairy drinks, functional drinks, and juice. Among these, the soft drinks segment held the largest share of 22.81% in 2023 and is expected to grow at a CAGR of 4.52% throughout the projection period. The global non-alcoholic market is attributable to ongoing flavour and packaging innovation. Additionally, there is a growing trend for premium and craft soft drinks since consumers are prepared to spend more for goods that are healthful and of superior quality. The market for soft drinks is also expanding as a result of several developments, including macroeconomic considerations. In addition, the industry has grown as a result of rising disposable incomes and economic development in emerging nations, which have raised consumer spending on soft drinks.

The offline segment accounted for the largest market share of 78.25% in 2023 and is estimated to grow at a CAGR of 5.19% throughout the projection period.

Based on the distribution channel, the global non-alcoholic drinks market is divided into online and offline. Among these, the offline segment accounted for the largest market share of 78.25% in 2023 and is estimated to grow at a CAGR of 5.19% throughout the projection period. This category encompasses supermarkets, hypermarkets, online merchants, and more outlets. Supermarkets and hypermarkets improve convenience by offering a wide range of brands and goods to customers in one location. In these retail settings, price-conscious customers are also drawn to special offers and discounts. Additionally, the social component of in-person purchasing encourages impulsive purchases, especially at convenience stores. In addition, expanding food service establishments, including cafes and restaurants, boost offline sales by providing non-alcoholic drinks in communal settings.

North America is expected to hold the largest share of the global non-alcoholic drinks market through the forecast period.

North America is expected to hold the largest share of the global non-alcoholic drinks market through the forecast period. North America is renowned for having one of the biggest soft drink markets. Fruit juices, energy drinks, bottled water, carbonated soft drinks (CSDs), and other soft drink options are available in this area. Although traditional CSD consumption remains mostly constant, there has been an apparent shift in favour of healthier substitutes. Many carbonated soft drink companies, including PepsiCo and The Coca-Cola Company, are based in the United States. In addition, the industry is experiencing a rise in demand for packaged foods and beverages, and young people have a strong desire for carbonated soft drinks. Growing concerns about wellness and health have led to a rise in the popularity of low-sugar choices, flavoured water, and functional beverages. As a result, the strong market demand for non-alcoholic drinks was impacted by the consumption pattern and ongoing increase.

Asia Pacific is predicted to grow at the fastest CAGR of the global non-alcoholic drinks market over the forecast period. A rapidly growing population and rising disposable incomes are the primary drivers of this growth, as they encourage consumer spending on a wide variety of beverage options. Convenient, portable drinks are in high demand as a result of lifestyle shifts brought about by urbanization trends. In addition, customers are being encouraged to choose better options, such as functional beverages, by growing health consciousness. The region's cultural diversity fosters innovation by enabling companies to customize goods to suit regional tastes and preferences, which consequently promotes market expansion.

Company Profiling

Major key players in the global non-alcoholic drinks market include PepsiCo, Inc., Starbucks Coffee Company, The Coca-Cola Company., Nestle S.A., Danone S.A., Suntory Beverages & Food Ltd., Keurig Dr Pepper Inc., Red Bull GmbH., Parle Agro, Unilever, and others.

Recent Developments

- In June 2024, Coca-Cola India introduced a new range of reasonably priced effervescent drinks in bottles made 100% of recycled PET (rPET). Reducing plastic waste and promoting sustainability are the goals of this campaign. Owing to its smaller size, the new package will be easier for customers to reach. This action is consistent with Coca-Cola's worldwide pledge to use sustainable materials and advance the beverage industry's circular economy.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global non-alcoholic drinks market based on the below-mentioned segments:

Global Non-Alcoholic Drinks Market, By Product

- Bottled Water

- Tea & Coffee

- Soft Drinks

- Dairy Drinks

- Functional Drinks

- Juice

Global Non-Alcoholic Drinks Market, By Distribution Channel

Global Non-Alcoholic Drinks Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa