Global P&C Insurance Software Market Size to worth USD 27.75 Billion by 2033

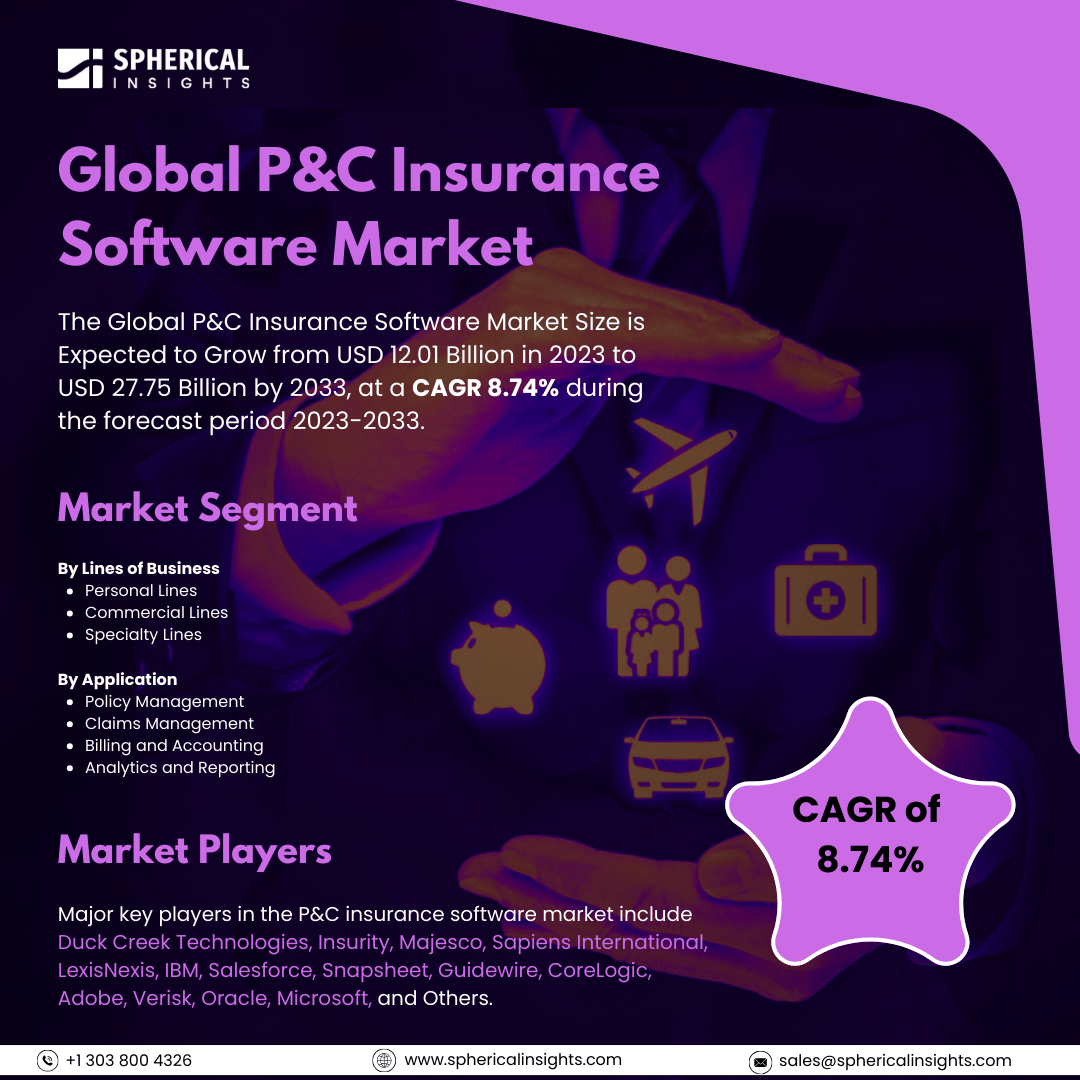

According to a research report published by Spherical Insights & Consulting, The Global P&C Insurance Software Market Size is Expected to Grow from USD 12.01 Billion in 2023 to USD 27.75 Billion by 2033, at a CAGR 8.74% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global P&C Insurance Software Market Size, Share, and COVID-19 Impact Analysis, By Lines of Business (Personal Lines, Commercial Lines, and Specialty Lines), By Application (Policy Management, Claims Management, Billing and Accounting, and Analytics and Reporting), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The P&C (Property and Casualty) insurance software market comprises software solutions designed to assist P&C insurance companies in managing their operations. This software streamlines and automates various processes within the insurance industry, ranging from underwriting to claims processing. Several factors drive the growth of the P&C insurance software market, including the increasing adoption of digital solutions such as cloud computing, IoT devices, and data analytics tools. Additionally, there is a rising demand for software that enables insurers to comply with evolving regulations and reporting requirements, enhances the customer experience, and improves underwriting and risk management. The incorporation of new technologies, such as AI and machine learning, is also contributing to market growth. Furthermore, there is a need for scalable, flexible, and cost-effective IT infrastructure. However, the P&C insurance software market also faces significant challenges. A major hindrance is the prevalent use of legacy systems within insurance companies, which complicates the transition to newer, cloud-based solutions. Concerns related to data integration, cybersecurity, and the cost and complexity of system upgrades lead to resistance among insurers to adopt modern software technologies.

The personal lines segment is predicted to hold the largest market share through the forecast period.

Based on the lines of business, the P&C insurance software market is classified into personal lines, commercial lines, and specialty lines. Among these, the personal lines segment is predicted to hold the largest market share through the forecast period. Increasing consumer demand for tailored insurance solutions that address individual needs is driving growth in the insurance market. Factors such as the rising number of insured individuals enhanced digital channels for purchasing insurance, and growing awareness of risk management among consumers are contributing to this trend. Moreover, innovations in technology and customer service are making personal insurance lines more accessible and appealing, further solidifying their dominance in the market.

The policy management segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the P&C insurance software market is divided into policy management, claims management, billing and accounting, and analytics and reporting. Among these, the policy management segment is anticipated to hold the highest market share during the projected timeframe. The growth of robust policy management systems is primarily due to the increasing complexity of insurance products and the need for efficient administration. As insurance companies face mounting regulatory demands and aim to enhance operational efficiency, these systems become essential for streamlining processes, ensuring compliance, and improving customer satisfaction. Additionally, advancements in automation and analytics enable insurers to manage their policies more effectively throughout the lifecycle, leading to improved profitability and customer retention, which ultimately boosts the segment's market share.

North America is estimated to hold the largest share of the P&C insurance software market over the forecast period.

North America is estimated to hold the largest share of the P&C insurance software market over the forecast period. The North American insurance market is thriving due to a well-established sector, ongoing technological advancements, and the presence of major insurance companies. The region’s strong regulatory framework and high consumer awareness foster a competitive landscape that encourages innovation in insurance technology. Furthermore, the ongoing digital transformation and integration of advanced analytics and artificial intelligence in underwriting and claims management are accelerating growth, positioning North America as a key player in the property and casualty (P&C) insurance software market.

Asia Pacific is expected to grow the fastest during the forecast period. Rapid economic development, increasing disposable incomes, and a growing middle class more inclined to purchase insurance products are fueling market expansion. The region's underserved insurance market offers significant growth opportunities—particularly in countries like India and China, where awareness of insurance importance is rising. Additionally, government initiatives aimed at promoting insurance penetration and the digitalization of insurance services are improving accessibility and customer engagement, making Asia Pacific a dynamic and fast-growing market in the global insurance landscape.

Company Profiling

Major key players in the P&C insurance software market include Duck Creek Technologies, Insurity, Majesco, Sapiens International, LexisNexis, IBM, Salesforce, Snapsheet, Guidewire, CoreLogic, Adobe, Verisk, Oracle, Microsoft, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Oyster launched an innovative suite of digital products designed to transform the property and casualty (P&C) insurance experience for small and medium-sized businesses (SMBs). By utilizing advanced AI and large language models (LLMs), this suite empowers business owners to manage their insurance needs more effectively and take control of their risk management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the P&C insurance software market based on the below-mentioned segments:

Global P&C Insurance Software Market, By Lines of Business

- Personal Lines

- Commercial Lines

- Specialty Lines

Global P&C Insurance Software Market, By Application

- Policy Management

- Claims Management

- Billing and Accounting

- Analytics and Reporting

Global P&C Insurance Software Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa