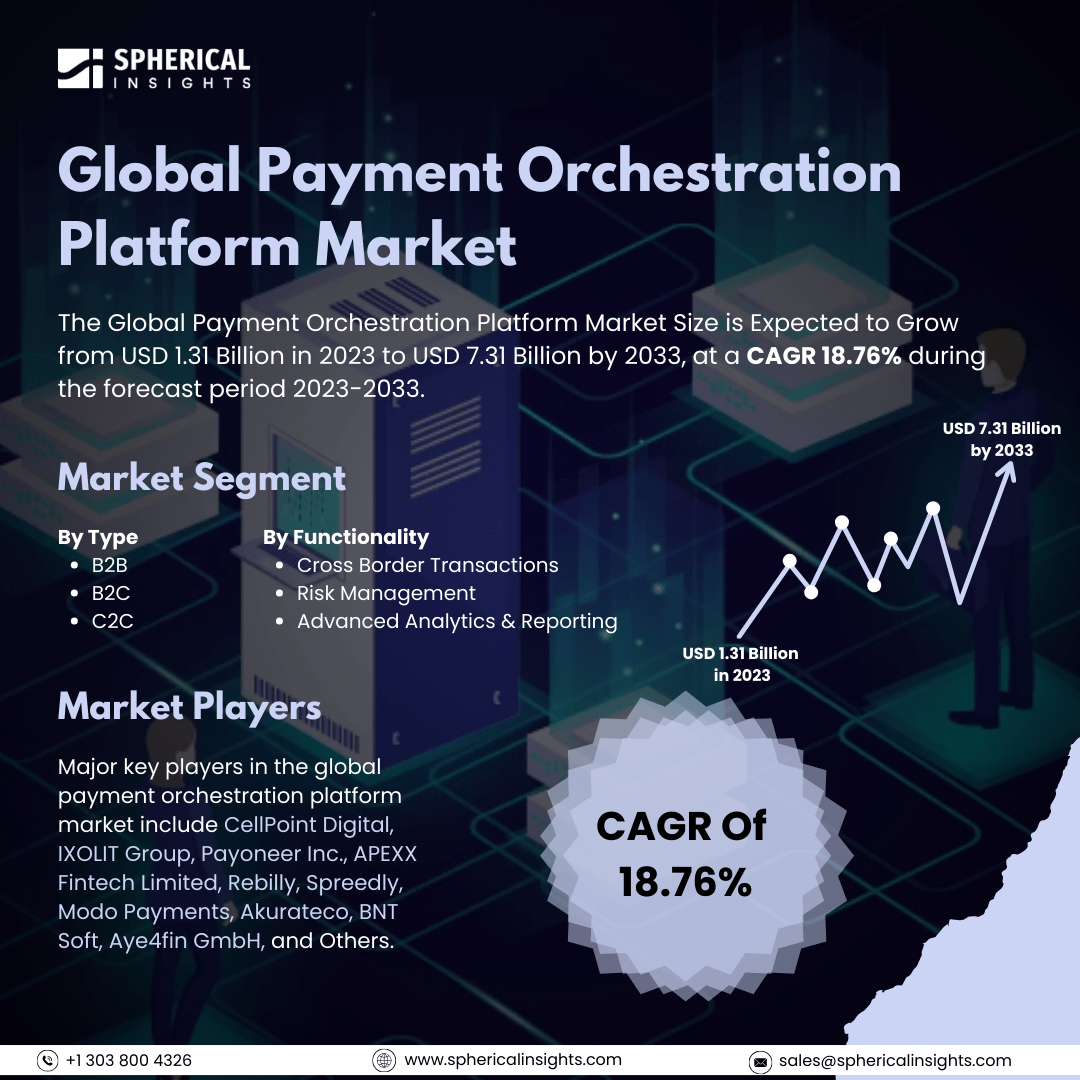

Global Payment Orchestration Platform Market size to worth USD 7.31 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Payment Orchestration Platform Market Size is Expected to Grow from USD 1.31 Billion in 2023 to USD 7.31 Billion by 2033, at a CAGR 18.76% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Payment Orchestration Platform Market Size, Share, and COVID-19 Impact Analysis, By Type (B2B, B2C, and C2C), By functionality (Cross Border Transactions, Risk Management, and Advanced Analytics & Reporting), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The payment orchestration platform market refers to the software that centralizes payment services into a single platform. This software enables businesses to effectively manage their payment processes, including transaction initiation, processing, and reconciliation. Several factors drive growth in the payment orchestration platform market. These include the rise of e-commerce, an increasing demand for seamless digital payments, the growth of cross-border transactions, a need for flexible payment options, and the desire for streamlined payment processing across multiple providers and regions. As a result, businesses are seeking platforms that can manage diverse payment methods, ensure compliance with various regulations, and provide a smooth customer experience. This centralized approach makes it easier for businesses to operate internationally with a unified payment solution. However, there are key challenges in the payment orchestration platform market. These include high implementation costs, complex integration with existing systems, concerns about data security and compliance, potential vendor management difficulties, scalability issues for growing businesses, and the need to navigate diverse regional regulations when operating internationally. The technical complexity and costs associated with adopting a payment orchestration platform can deter businesses, especially smaller ones, from fully harnessing its benefits.

The B2B segment is predicted to hold the largest market share through the forecast period.

Based on the type, the payment orchestration platform market is classified into B2B, B2C, and C2C. Among these, the B2B segment is predicted to hold the largest market share through the forecast period. The increasing digitization of business processes and the growing demand for efficient payment solutions among enterprises are driving the adoption of payment orchestration platforms specifically designed for B2B transactions. As companies strive to streamline their operations and enhance transaction efficiency, these platforms are becoming more prevalent. This trend is further fueled by the need for improved cash flow management, better reconciliation processes, and the ability to handle multiple payment methods seamlessly, making B2B transactions more reliable and cost-effective.

The cross-border transactions segment is anticipated to hold the highest market share during the projected timeframe.

Based on the functionality, the payment orchestration platform market is divided into cross-border transactions, risk management, and advanced analytics & reporting. Among these, the cross-border transactions segment is anticipated to hold the highest market share during the projected timeframe. The globalization of trade and the rising number of international business interactions are contributing to this growth. As companies expand their operations into new markets, the demand for robust payment solutions that facilitate seamless cross-border transactions is increasing. Payment orchestration platforms are increasingly utilized to navigate complex regulatory environments, reduce currency conversion fees, and enhance transaction speed, helping businesses overcome the challenges associated with international payments.

North America is estimated to hold the largest share of the payment orchestration platform market over the forecast period.

North America is estimated to hold the largest share of the payment orchestration platform market over the forecast period. The market is thriving due to the region's advanced technological infrastructure and high adoption rate of digital payment solutions. The presence of numerous leading payment service providers and fintech companies accelerates innovation and competition, resulting in the development of more sophisticated payment orchestration platforms. Moreover, the increasing focus on enhancing customer experiences and the need for streamlined payment processes among businesses are significant factors driving market growth in this region.

Asia Pacific is expected to grow the fastest during the forecast period. Rapid digital transformation and increasing smartphone penetration are fueling market expansion. The rising number of e-commerce transactions and the growing middle class are driving demand for efficient payment solutions, prompting businesses to adopt payment orchestration platforms to optimize their operations. Furthermore, supportive government initiatives aimed at promoting digital payments and financial inclusion contribute to the dynamic growth landscape, solidifying Asia Pacific’s position as a key player in the payment orchestration market.

Company Profiling

Major key players in the global payment orchestration platform market include CellPoint Digital, IXOLIT Group, Payoneer Inc., APEXX Fintech Limited, Rebilly, Spreedly, Modo Payments, Akurateco, BNT Soft, Aye4fin GmbH, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, CellPoint Digital, a UK-based payment technology company, secured a $30 million investment from Toscafund, a London-based asset management firm, and its private equity division, Penta Capital. This new investment reinforces the ongoing partnership between CellPoint Digital and Toscafund, which manages assets worth $4.5 billion. Toscafund has previously supported Playtech with multiple investments, including a $25 million round completed in 2022.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global payment orchestration platform market based on the below-mentioned segments:

Global Payment Orchestration Platform Market, By Type

Global Payment Orchestration Platform Market, By Functionality

- Cross Border Transactions

- Risk Management

- Advanced Analytics & Reporting

Global Payment Orchestration Platform Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa